Cards

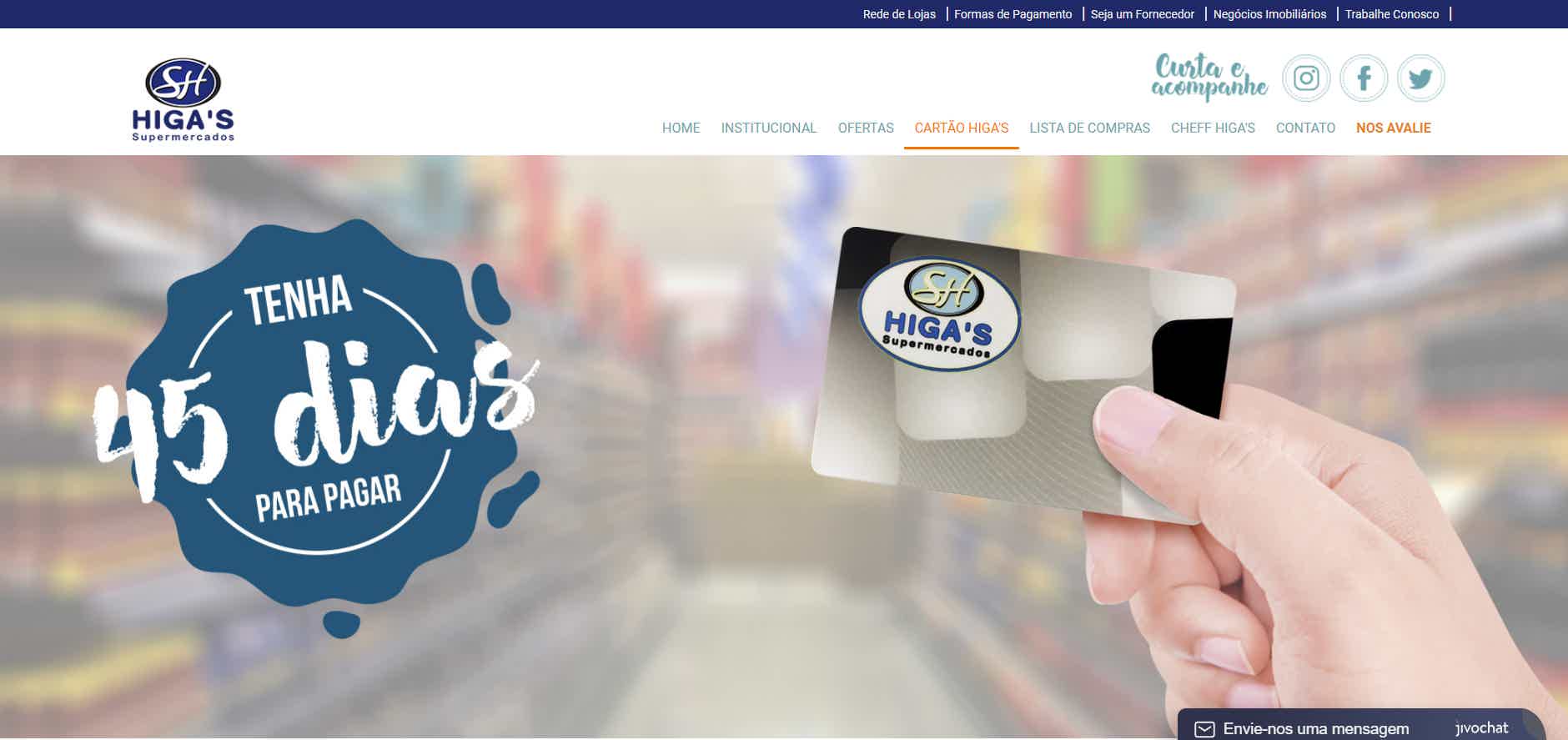

Discover the Higa's credit card

Find out how to use your Higa's credit card at Higa's stores. It is easy to approve and you have access to special conditions on your purchases, such as special prices, annuity exemption when there is no invoice and up to 45 days to pay.

Advertisement

Higa's: up to 45 days to pay the invoice, simple application to check the balance and special prices

Learn all about how the Higa's credit card works and check out how it can be a great ally in your purchases at the Higa's chain of stores. This is because it facilitates customer access to differentiated prices, discounts, promotions, an application for consultation and a period of up to 45 days to pay the invoice. So read on, we'll tell you all about this card.

How to apply for the Higa's card

Learn how to apply for the Higa'card and access exclusive conditions for customers, such as a period of up to 45 days to pay for purchases.

How does the Higa's credit card work?

In 2014, DMCARD entered into a partnership with the Higa's supermarket so that together they could create the Higa's Private Label credit card, that is, for exclusive use in the Higa's chain stores.

Thus, for customers who usually buy online, it has become a good alternative, as it has an innovative proposal with discounts and differentiated prices on products, as well as a special payment term.

It is worth mentioning that it has a 12x annuity of R$ 12.90, but the amount is only charged when there is an invoice. So, if you are already a Higa's customer or know the chain, this card may be a good option, remembering that it cannot be used in other establishments.

What is the Higa's credit card limit?

So, the Higa's card limit is not informed by the network. But you can check this value at one of the stores at the time of credit analysis during the application process. It is worth noting that the network does not require a minimum income, so the limit will be defined based on your financial profile.

Is Higa's credit card worth it?

So, know the advantages and disadvantages of this card, below.

Benefits

Among the advantages of the Higa's card is the fact that you have up to 45 days to pay the first invoice, as well as the prices of all products in any of the stores in the Higa's chain will be differentiated for customers registered with the card.

And, in addition, applying for the card is also simple, fast and secure, and can be done at any of the stores in the network, just having your CPF and RG in hand. If approved, you will receive a provisional card and within 15 working days, you will receive the definitive card. In addition, invoices can be paid at network stores or at bank branches or lottery outlets.

Also, you can have access to everything that happens with your credit card in the DMCARD application responsible for issuing the card. Finally, there is also an exemption from the annuity when there is no outstanding invoice to pay.

Disadvantages

Despite having several advantages, the biggest disadvantage of this card is the fact that it can only be used at Higa's chain stores. Just like he charges annuity. So, if you are looking for a credit card to use in other establishments and that has fee exemption, this card is not the best alternative.

How to make a Higa's credit card?

So, to apply for the Higa's card you will need to go to one of the chain stores in person with your personal documents and the approval is immediate. So, to see the step by step of this process, click on the recommended content below.

How to apply for the Higa's card

Learn how to apply for the Higa's card and have access to unique conditions, such as an application to track expenses and differentiated prices.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

See how to earn 40% profit selling online

Find out what the Eudora reseller routine is, check out the step by step to register and earn money with resale.

Keep Reading

Discover the Caixa Grafite card

Understand how the Caixa Grafite card works, as well as learn about its advantages and main features. For that, read this post and check it out!

Keep Reading

How to apply for the Caixa Nacional card

Mr. Panda will show you in this post how simple it is to apply for your Caixa Nacional card and benefit from the various advantages it offers.

Keep ReadingYou may also like

Online C6 Bank card: no annual fee and CDB with zero brokerage

How to order the C6 Bank card online? What are the benefits? And the limit? If these are questions you often ask, be sure to check out the full review we've prepared for you. Continue reading and learn more.

Keep Reading

How to apply for the Pingo Doce card

Do you want a card that really gives you discounts when shopping at the Pingo Doce supermarket chain? So, see how to apply for the Poupa Mais card and get new discounts every week. Learn more right now!

Keep Reading

ActivoBank Personal Credit or BNI Puzzle Personal Credit: which is best?

Do you need a larger amount and want to pay it off in less time or do you prefer smaller amounts with an extended deadline? By answering this question, you will know which personal credit to choose: ActivoBank or Puzzle BNI. Next, we'll show you how to compare the two and choose yours, find out more!

Keep Reading