Cards

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Advertisement

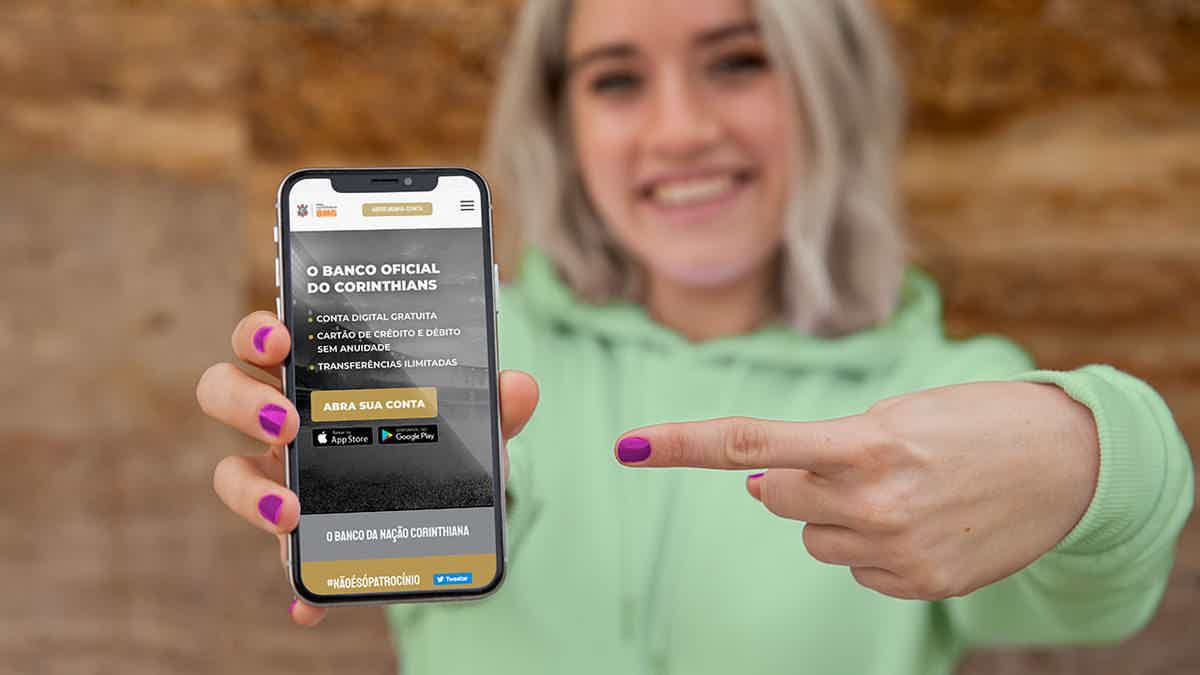

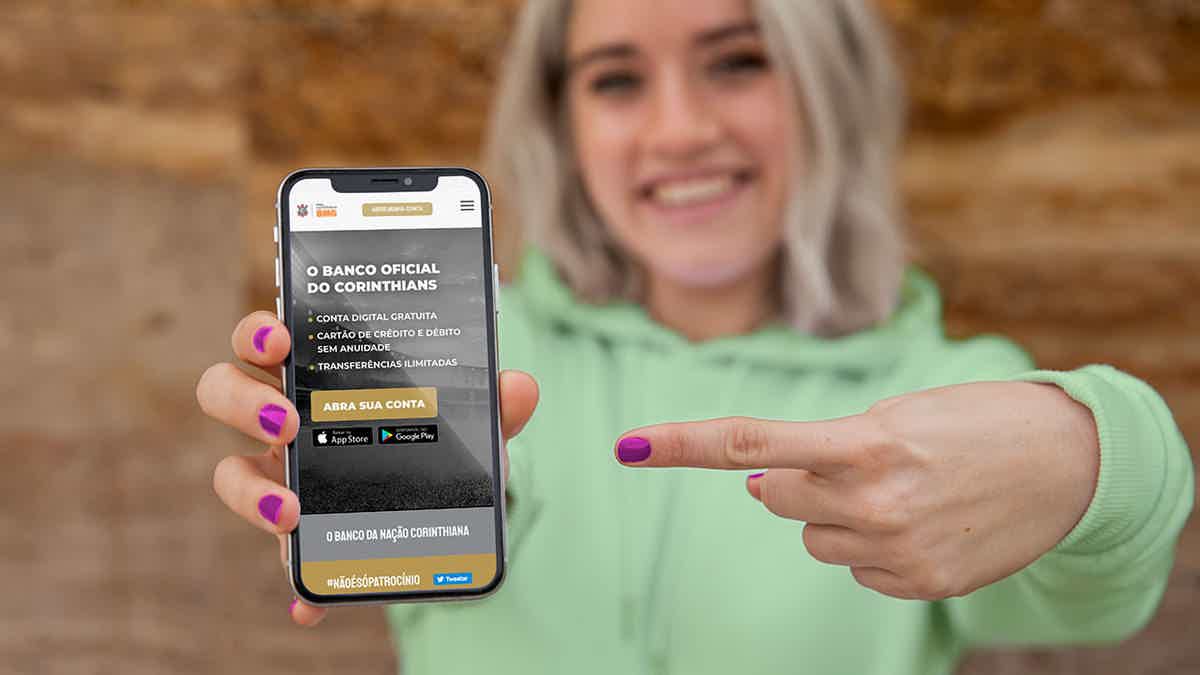

Corinthians BMG credit card

So, the Corinthias BMG credit card is a card issued by the BMG bank in partnership with the Mastercard brand and the Corinthias Club, bringing comfort, practicality and several advantages such as international coverage, absence of consultation with the SPC and SERASA and, a digital account 100% free!

So read on to find out what this card has to offer! Check out!

How to apply for Corinthias BMG card

Do you want to learn how to apply for the Corinthians BMG card with international coverage, cashback program and exclusive digital account? So read on to learn.

How does the Corinthias BMG credit card work?

Well, the Corinthians digital account is a complete digital account that gives you access to various services such as the Mastercard brand, that is, you guarantee access to all the benefits of the Mastercard brand, such as the Mastercard Surpreenda program.

In addition, the credit card has international coverage, so you can make purchases in stores in Brazil and abroad, as well as credit withdrawals at Banco 24 Horas cashiers.

It also has no annuity, mobile top-ups, free transfers and bill payment at any time of the day, as well as expense control via the app and credit life insurance!

Another advantage is that the bank does not consult the SPC and SERASA, that is, even with the dirty name you can have access to the card and still have a cashback program in both credit and debit! Too much isn't it?

What is the Corinthias BMG credit card limit?

So, the Corinthians BMG credit card limit will depend on the analysis made by the BMG bank!

Is the Corinthias BMG credit card worth it?

Well let's know the advantages and disadvantages of this card! So check it out!

Benefits

And the first great advantage of the Corinthians BMG card is the absence of an annuity, because you have a free 100% digital account that does not carry out credit analysis in credit agencies such as SPC and SERASA. That is, even with the dirty name, you can make your request!

And in addition, it has a very interesting cashback program in both credit and debit, Mastercard brand with various benefits and international coverage and several other exclusive benefits that we mentioned earlier!

Disadvantages

So, one of the biggest disadvantages of the card is the fact that you need to register for a digital account to access the credit card! But, it's worth it when you think about all the other perks!

How to make a Corinthias BMG credit card?

So, to make the card is very simple! That's because, just access the MG bank website with the documents in hand. Then follow the steps requested to open the BMG digital account! In this, you will have access to a fast, safe and full of exclusive advantages for customers!

How to apply for Corinthias BMG card

Do you want to learn how to apply for the Corinthians BMG card with international coverage, cashback program and exclusive digital account? So read on to learn.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Leader card invoice: how to consult?

Do you have a Leader store credit card, but don't know how to issue an invoice? Learn here how to check your Leader card bill.

Keep Reading

App for watching soap operas: discover ViX’s options

Explore a world of Latin emotions with ViX - the definitive app for watching passionate soap operas. Download now and dive into the stories!

Keep Reading

Smiling Brazil: check if your city is part of the program

The Brasil Sorridente Program is benefiting thousands of people throughout Brazil through the SUS. Learn more about the program here!

Keep ReadingYou may also like

Get to know the Millennium BCP Mortgage Loan

Check out everything about the Millennium BCP Mortgage Loan with a 40-year repayment term and simple contracting. Want to know more? Then continue reading this exclusive content.

Keep Reading

Discover the Ame Digital loan

Taking out a loan can help those who dream of buying a car, for example. In this sense, Ame digital has several options available for all purposes. Come meet!

Keep Reading

Discover the Santander Elite Visa card

Want to travel and save at the same time? The Santander Elite Visa card can be a great alternative for your finances. Learn more in the text below!

Keep Reading