card machines

Discover the C6Pay card machine

The C6Pay card machine is a great way to receive payments through different channels and even access a complete portal to analyze your sales! Learn more about her here.

Advertisement

Have a machine without monthly costs

Did you know that the C6Pay card machine can facilitate the payments your business receives?

Namely, this card machine allows you to receive from your customers from the card, PIX and even through payment links.

| debit rate | Starting from 1,53% |

| upfront credit rate | From 2.9% |

| Installment credit rate | As of 3,61% |

| Additional per installment | Starting at 1,29% |

| Benefits | sales portal payment link Zero membership fee |

How to request the C6Pay machine?

Check out the full step-by-step to be able to use this little machine in your business!

In addition, with it you have access to a complete portal to analyze your sales.

But that is not all! In this post you will check everything that the C6Pay card machine can offer your business!

How does the C6Pay card machine work?

In summary, the C6Pay card machine allows you to pass payments for each sale you make in your business.

Namely, C6 offers the public two models of machines: the C6 Pay SuperMini and the C6 Pay Essencial. From them, you can accept payments from the main card brands.

In addition, it is also able to accept payments by approximation and also by PIX QR Code completely free of charge.

The two machines also allow you to get a free membership fee.

To do so, just invoice above R$ 3,500.00 at SuperMini or R$ 5,000 at Essencial.

That way, you get rid of the membership fee and can invest even more in your business.

Who is the card machine suitable for?

Namely, the C6Pay card machine can be used by three types of profile: legal entity, MEI (individual micro-entrepreneur) and individual.

For this, it is necessary to pay attention to the fees that the machine charges, since their value changes according to these three profiles.

But, on the official website of C6 Bank, you can check all the fees charged with complete transparency!

Is the C6Pay card machine worth it?

In summary, so far you have been able to get to know the main characteristics of the C6Pay card machine.

But is it really worth having this little machine in your business? That's what you'll find out when you check out the advantages and disadvantages of this solution!

Benefits

Firstly, one of the main advantages of the C6Pay card machine is the fact that it has a portal for you to analyze your sales up close. Thus, it is easier to create new strategies to increase your revenue.

And speaking of billing, you can receive a refund of the machine's membership fee when you reach C6's billing goals.

Namely, achieving these goals can become easier by having a machine that accepts the main flags. With the C6Pay card machine, you can spend purchases on brands such as:

- Visa;

- MasterCard;

- Hyper;

- Link;

- Hipercard;

- American Express.

In addition, you can still create payment links to receive for online sales.

Finally, having the C6Pay card machine, you can access the C6 bank digital account and credit card.

Disadvantages

On the other hand, the C6Pay card machine can also have some negative points.

Firstly, purchases that are credited can take from 2 business days to 31 calendar days for you to receive them.

In addition, in the first 12 months with the machine, you will have to pay its membership fee if you do not reach your billing targets.

Finally, to request your machine, you need to open an account at C6 Bank first and then access it. This may mean one more step to access the card machine.

How to order a C6Pay card machine?

In summary, despite the negative points, it might be a good idea for your business to have a C6Pay card machine.

So, if this little machine interests you, check out in the following post how her request works.

And spoiler: the process is done entirely over the internet! You receive your C6Pay card machine without leaving home. Read the content below and find out how to apply.

How to request the C6Pay machine?

You can request it through the website and app and still have a digital account with the best features!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

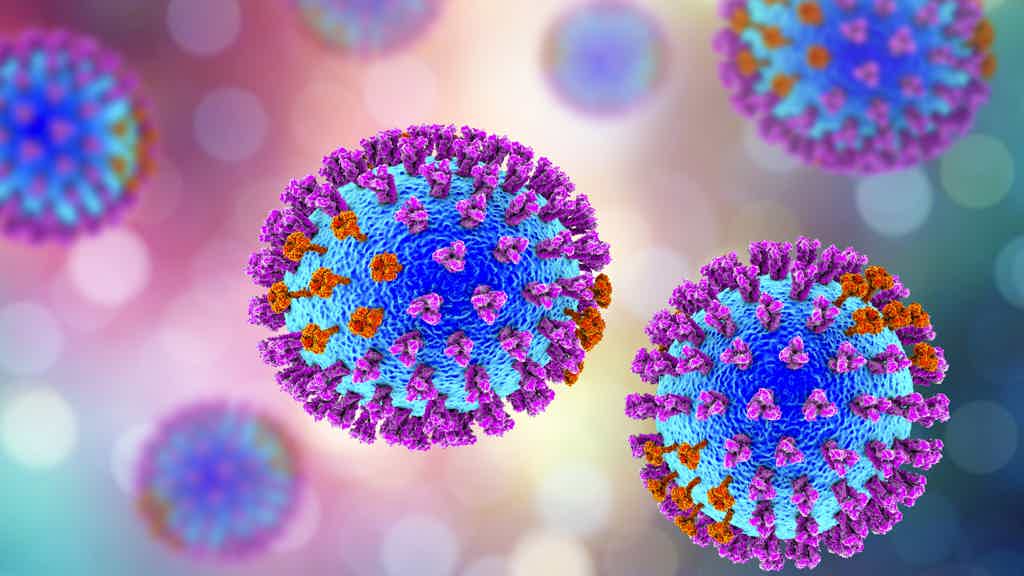

Biggest pandemics in the world: the 15 diseases that most marked history in number of deaths

With the current coronavirus pandemic, it is normal for people to be curious about similar cases from the past. Get to know the biggest pandemics in the world now.

Keep Reading

How to send resume to Magalu? Check it out here

Find out in this post how to send a resume to Magalu and learn about the main requirements you need to meet to be called!

Keep Reading

How to get points in Score Turbo Serasa?

Want to learn how to get points on Score Turbo Serasa? Check the text and increase your score faster to get credit approved!

Keep ReadingYou may also like

Discover the Torra Torra card

Torra torra is a chain of stores that sells clothes for the whole family and has a credit card that gives a 10% discount on the first purchase. Want to know more? Read on!

Keep Reading

BMG card or Nubank card: which one to choose?

BMG Card or Nubank Card? Which card to choose? Read our post and learn all about these two financial products.

Keep Reading

Discover the Will Bank Basic card

With the Will Bank Basic card, you are exempt from annuity and administrative fees, have access to the Mastercard benefits program and guarantee a free digital 100% account. See more here.

Keep Reading