loans

Find out about the Realiza Cred loan

The Realiza Cred is a loan without bureaucracy, which helps you pay off your debts. All this in a simple and fast way. Therefore, read on and find out all about the Realiza Cred loan.

Advertisement

Perform Cred Loan: credit without bureaucracy

Applying for a loan can be for several reasons. Whether for a trip or to settle a debt, the important thing is to get credit with good conditions. In addition, if you are negative, it is also important to find an institution that makes credits in this modality. So today we're going to introduce you to Realize Cred.

Read on to find out the details!

| Minimum Income | not informed |

| Interest rate | not informed |

| Deadline to pay | Uninformed |

| release period | after hiring |

| loan amount | It depends on your benefit |

| Do you accept negatives? | Yes |

| Benefits | Easy hiring Online service |

How does the Realiza Cred personal loan work?

In short, the Realiza Cred personal loan is a payroll loan. That is, it is an exclusive credit option for INSS retirees and pensioners, as well as public servants. Therefore, applying for your loan has much less bureaucracy and is also a super fast process.

What is the limit of the personal loan Realiza Cred?

For now, the institution still does not inform the maximum limit for loan. In this way, the value probably depends a lot on the credit analysis of each one. That is, after you deliver your documents to the institution, they can stipulate a value.

Advantages Perform Cred

In short, the main advantage of Realiza Cred is the fact that it is consigned. That way, even if you are negative or have a bad history, you can apply for your loan.

In addition, the loan is fast and can be applied for online. All this without bureaucracy and to help you settle your debts.

Furthermore, the credit installments are fixed, that is, you have no surprises along the way. As soon as you take out the loan, you will already know the value of all the installments.

Main features of Realiza Cred

In principle, the Realiza Cred personal loan is for three groups of people: INSS retirees and pensioners, as well as civil servants.

This is because the loan is payroll-deductible, that is, the deduction of the installments is directly from the salary. In this sense, you don't have to worry about the loan repayment date.

Also, the loan is great for you to sort out your finances. If you want to settle your debts, the loan is directly discounted from the payroll. In addition to an agile and practical process.

Who the loan is for

As already mentioned, the Realiza Cred loan is payroll-deductible. Thus, it is specific for INSS retirees and pensioners, as well as public servants.

That is, if you are in this group, a payroll loan is a great option. This is because this type of credit has special conditions. In this sense, interest rates are much lower and with longer payment terms.

How to make a personal loan Realize Cred?

Finally, if you want to apply for your Realiza Cred loan, just fill out a form on the website. In addition, the company also provides the number (11) 3895-7918 to contact.

In addition, in this other article we explain the complete step by step for you to request yours. Check out!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Credicard Zero card

With the Credicard Zero card, you don't pay an annuity and still participate in the Mastercard Surpreenda rewards program. See how to apply!

Keep Reading

Submarino Viagens app: learn how to buy cheap tickets and accommodation

Discover all the products available on the Submarino Viagens app. See the step by step to download it and if the company is reliable. Know more.

Keep Reading

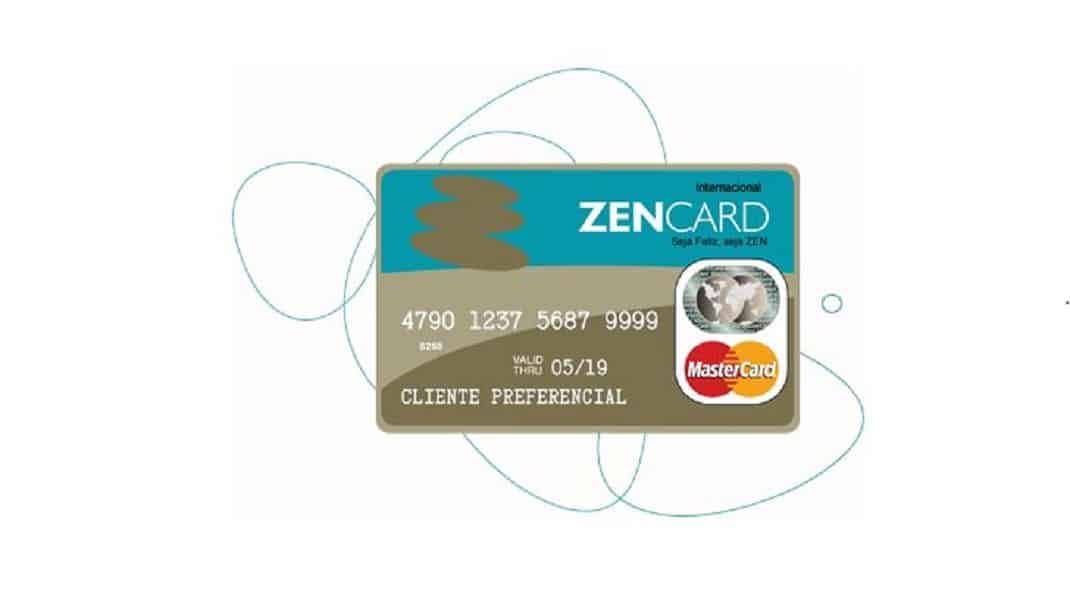

How to apply for the Zencard card

How about a good credit card to do your shopping and travel? Then see how to apply for the Zencard card right now

Keep ReadingYou may also like

How do I apply for the Crédit Agricole Mastercard World Elite card?

Applying for the Crédit Agricole Mastercard World Elite Credit Card opens the doors to an exclusive financial experience. Enjoy airport lounges, comprehensive insurance and elite benefits. Follow our simple guide and elevate your financial journey.

Keep Reading

Discover the City Furniture credit card

Have you ever thought about receiving discounts when shopping for decor and furniture for your home? So, find out below about the City Furniture credit card offered by Synchrony Bank in partnership with City Furniture.

Keep Reading

Brazilian Investor Overview

Find out more about the average profile of Brazilian investors, what their behavior is and what kind of investments they invest in.

Keep Reading