loans

Discover the Piki loan

The Piki personal loan accepts bad debts and has an innovative way of making payments. Because he debits the installments in the consumption account. Learn more about him in this post!

Advertisement

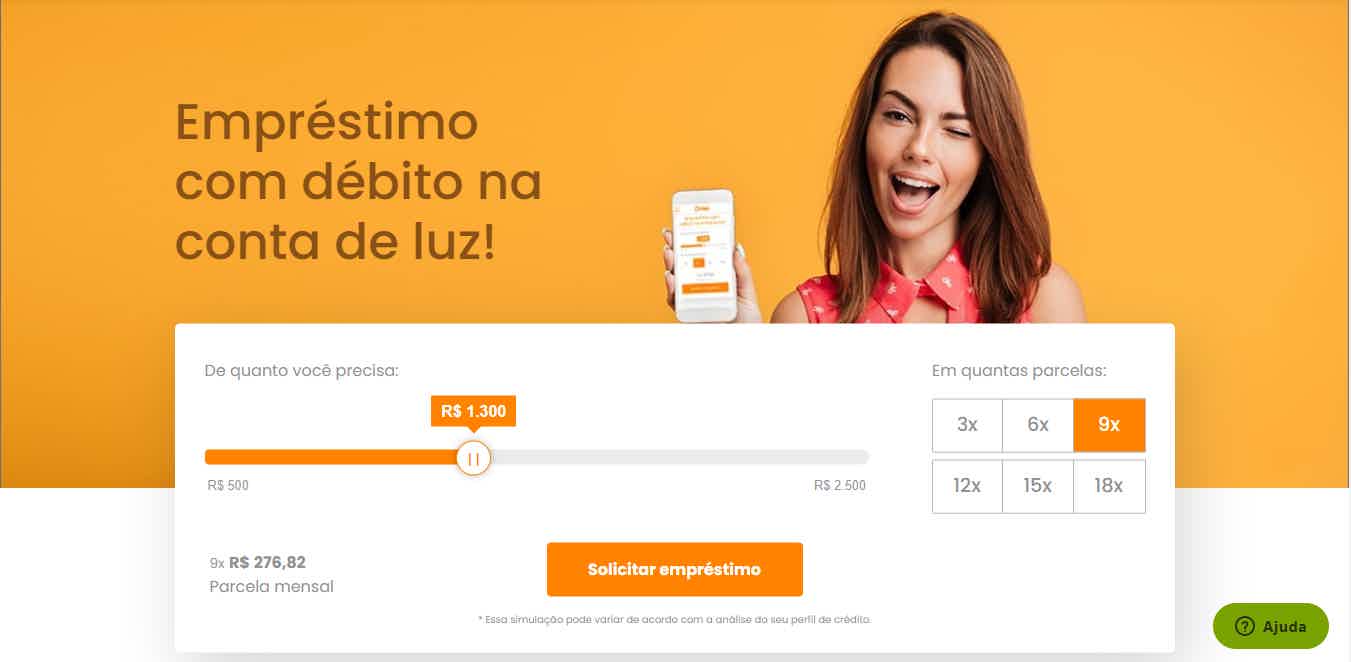

Discover the loan with debit on the electricity bill

In summary, the Piki personal loan is a very innovative type of credit. Basically, from it, users can make a loan in which the amount is debited from a consumption account.

That way, it's easier not to forget to pay and become a defaulter! In the table below, you can see its main features.

| Minimum Income | not informed |

| Interest rate | not informed |

| Deadline to pay | Up to 18 months |

| release period | 1 business day |

| loan amount | From R$500.00 to R$2,500.00 |

| Do you accept negatives? | Yes |

| Benefits | Immediate approval Charged to your electricity bill Process 100% online |

Therefore, continue reading to check out the post below for more information about this loan and how it works!

How does the Piki personal loan work?

In summary, the piki personal loan is a type of credit where the value of the installments is added to a consumption bill, such as electricity or water. That way, the risk of you forgetting to pay the debt and getting a dirty name is much smaller.

Basically, the Piki loan can only be taken out by those who live in Ceará, Goiás, São Paulo or Rio de Janeiro. Therefore, it is also necessary that the account be in the name of the user who will request the loan.

What is the Piki personal loan limit?

After all, the Piki loan can be requested for a minimum amount of R$500.00 and a maximum of R$2,500.00. This amount can be paid in up to 18 monthly installments.

Thus, due to the low loan amount, Piki does not require a high credit score to access the loan. Therefore, even those who are negative can request it.

Piki perks

The Piki personal loan offers several advantages for those who decide to apply for it. Among all of them, we highlight that he:

- immediately approves the loan request;

- collects the first payment within 30 days;

- deposit the money within 1 business day;

- It has rates that are competitive with the market.

Key features of Piki

Piki is basically an online 100% personal loan fintech. In this way, it is possible to apply for a loan without leaving home and immediately receive the money in your account.

In addition, it is one of the only financial institutions on the market that allows amounts to be debited from your consumption account. This guarantees that no parcel will be forgotten.

Who the loan is for

To use the Piki loan, it is important to pay attention to some limitations that it has on who can apply for it. Among its requirements, it is necessary that the person:

- do not have consumer bills in arrears;

- be between 21 and 79 years old;

- is the holder of the consumption account;

- resides in the states of Ceará, Goiás, São Paulo or Rio de Janeiro.

How to take out a Piki personal loan?

If you liked the proposal for this personal loan and want to make your own, you can start checking out the blog post below that shows you the complete step-by-step to apply for the loan in the main channels of Piki!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Nestlé vacancies: how to check the options?

Discover the main Nestlé vacancies available and check out the labor benefits that this great company offers its employees!

Keep Reading

Discover the C6 Rainbow credit card

Learn more about the C6 Rainbow international credit card with no annual fee, which supports the LGBTQIA+ community and prints the plastic with the social name.

Keep Reading

Discover the free Learncafe courses

Discover in this post how the free Learncafe courses work and check out what options there are on the platform for you to specialize!

Keep ReadingYou may also like

Check out how to buy national and international tickets up to 12 times through Booking

Booking is a travel platform that can help you find and buy your airline tickets comfortably and economically. Keep reading the article and check out everything about it!

Keep Reading

Discover the Avec digital account for beauty salons

Can you imagine having an exclusive digital account for the world of beauty, being able to control all your costs and expenses in an uncomplicated way? If so, get to know the Avec digital account!

Keep Reading

Does the BTG+ card have an annual fee? find out now

BTG+ cards offer several exclusive benefits to its customers. However, these advantages can directly impact the value of your annuity. Do you want to know how the differentiated monthly fee of the card works? So, read this post and find out!

Keep Reading