loans

Discover the personal loan Marisa

In today's article we will introduce you to the Marisa personal loan and its characteristics. With it, you can request credit to pay bills and the release is immediate! Want to know more? Come check out the post.

Advertisement

Marisa: find out about the quick release loan now

Among so many options on the market, it is increasingly difficult to choose the best loan option. So, in today's article, we're going to introduce you to the Marisa personal loan, with its own characteristics so you know if it's a good option!

How to apply for the loan Marisa

Learn how to apply for the Marisa loan and have excellent credit conditions that fit in your pocket.

Do you want to know more about him? Read on!

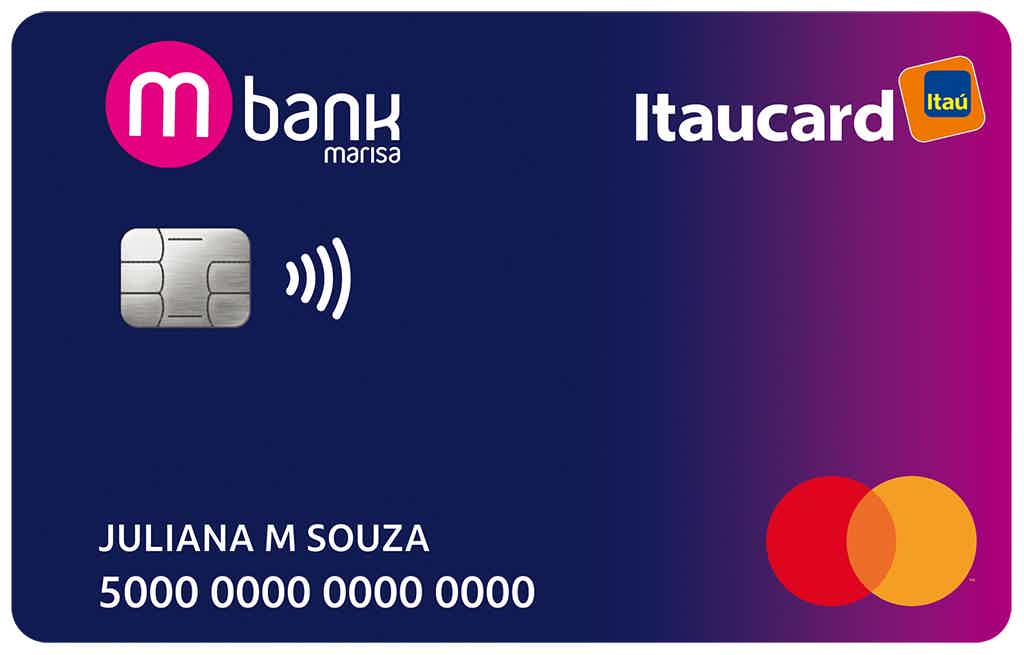

Discover the Marisa credit card

Check here how the Marisa card works and find out what are the advantages you can take advantage of when applying for it.

How does the Marisa personal loan work?

Firstly, the Marisa personal loan is a loan for store customers, because to be able to apply for the loan you need to have a store card.

Furthermore, it is also necessary to provide documents such as ID, CPF, proof of residence and income.

In fact, the credit analysis carried out by the institution and the release of the loan is usually very quick, it will depend on the analysis that takes into account your financial history. So, maintain a high credit score and a good payment ratio.

In this sense, if you are approved, you will be able to receive the money immediately, directly from the cashier or through a bank deposit.

Another interesting point is that at the time of hiring it is possible to sign up to the “Withdrawal is in your hand” insurance, which works as follows: in the event of dismissal from your job, you are protected in the payment of some installments that will be made by this insurance.

And best of all, you don't need to say the purpose of the money when applying for the loan.

What is the Marisa personal loan limit?

So, the Marisa personal loan limit is defined based on the customer's profile and history. Therefore, it is only possible to check the pre-approved limit on the Mbank app.

Is Marisa personal loan worth it?

Now that you know more about the characteristics of the Marisa personal loan, it's easier to know whether it's worth it or not. So, let's now know the advantages and disadvantages of a personal loan. Check out!

Benefits

Among the advantages, the response time for credit analysis and also for the release of loan amounts is usually very short, it will depend on your financial history and if approved, it can be withdrawn at the cashier or through a bank deposit.

And another super different advantage is the “Withdrawal is in hand” insurance, to protect you in situations, such as losing your job.

Disadvantages

Despite several advantages, the Marisa personal loan has disadvantages, such as the lack of information about credit conditions on the official website.

And, in addition, to apply for the loan, you need to have a store card.

How to get a personal loan Marisa?

To take out a Marisa personal loan, you need to have your Marisa store card in addition to documents such as ID, CPF, proof of residence and income.

So, do you want more details about the Marisa personal loan application process? We leave a link below with the step by step!

How to apply for the loan Marisa

Learn how to apply for the Marisa loan and have excellent credit conditions that fit in your pocket.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

ProUni Program: clear your doubts

With the ProUni program, it is possible to get 50% and 100% scholarships at private universities. Find out all the details in this article!

Keep Reading

Crefaz personal loan: what is Crefaz?

Do you already know the Crefaz loan? No? So keep reading because we are going to tell you all about this loan! Check out!

Keep Reading

How to apply for the Banco do Nordeste Clássico card

Do you want to know how to get your Banco do Nordeste Clássico card? So, see in this post the step by step for you to request yours.

Keep ReadingYou may also like

Banco CTT Personal Credit: what is it?

Do you want a loan without commissions and simple contracting? So, see the advantages of joining CTT Personal Credit. Learn more later.

Keep Reading

Discover the Credluz loan

With the Credluz personal loan, you have up to 24 months to pay and the amount is charged directly to your electricity bill! In addition, it is available for negatives. Read this post and learn more about it!

Keep Reading

Americanas Card or Zencard Card: which is better?

If you're looking for a credit card with exclusive benefits, such as discounts and rewards programs, and you don't know how to choose between the Americanas card or the Zencard card, this post was made for you! Click here and learn all about them.

Keep Reading