loans

Discover the NoVerde loan

The NoVerde loan is a great option for those who are in a hurry, but want to access advantages and take out a completely secure and online loan. Check here the conditions and benefits it can provide you.

Advertisement

Money in your account in a few hours

Taking out a personal loan can be the best solution for many Brazilians who want to make a purchase or even pay off other debts. In this sense, knowing the credit offered at NoVerde can be a good idea.

This technology startup works by offering a personal loan that allows you to receive the money in your account within 1 business day. Therefore, if you are in an emergency, NoVerde can help you solve it faster.

| Minimum Income | not informed |

| Interest rate | From 7.9% to 18.9% per month |

| Deadline to pay | From 3 to 18 months |

| release period | 1 business day |

| loan amount | Up to R$ 8 thousand |

| Do you accept negatives? | Uninformed |

| Benefits | Money falls within 24 working hours Completely online application process Offers discount for early installments |

How to apply for the NoVerde loan

Check here how easy and fast it is to apply for a NoVerde personal loan.

In addition, the loan has a good payment term and offers a great discount when anticipating installments. Want to know more about him? So just continue this post!

How does the NoVerde personal loan work?

Firstly, knowing how the NoVerde loan works is essential before taking out the loan.

Therefore, the loan works very easily. First, you register on the platform to facilitate credit analysis.

Soon after, you can now do the loan simulation, where you will fill in how much you need to borrow and how many installments you can pay. With this, NoVerde will be able to show the value of the installments and interest applied.

If everything is fine and you want to proceed with the loan, just take a photo of your document and a selfie to guarantee the security of the operation.

So, after accepting the credit offer and signing the contract, you just have to wait a few hours and the money will already fall into your account.

What is the NoVerde personal loan limit?

In summary, when taking out a loan, it is important to know if he will be able to lend you the amount necessary to carry out your projects.

Therefore, the NoVerde loan can release to the public a loan of up to R$ 8 thousand that can be paid in up to 18 months.

That way, you can borrow an interesting amount to carry out your plans and you don't have to spend many years paying off a debt.

NoVerde Advantages

Certainly, the main advantage of the NoVerde loan is the fact that the money falls into your account very quickly. But this is not the only benefit of credit.

At NoVerde, you have the possibility to anticipate your loan installments and also get a discount on them! Thus, the total amount of interest on the loan may decrease as you anticipate the installments.

In addition, loans made at NoVerde are completely safe. The company asks for a security check where the user needs to take a selfie and a photo of his document to prove that he is the one who is hiring.

Finally, taking out the loan takes place completely online. So, you don't even have to leave the house to have the money in your account.

Main features of NoVerde

Before taking out a loan, it is interesting to learn more about the company that is offering it.

Therefore, NoVerde is a startup that emerged in 2016 in order to offer more inclusive financial products. Its purpose was to make credit more accessible to people.

For this, they created a fully digital platform that allows people to borrow without much bureaucracy and, still, be able to quickly access the credit amount.

Who the loan is for

In summary, NoVerde's personal loan is suitable for all individuals who wish to take out a loan quickly.

Therefore, if you need to clear your name of a debt or intend to make a purchase and urgently need the amount, taking out the loan at NoVerde can be a good financial option, as the amount drops quickly in the account.

How to get a NoVerde personal loan?

NoVerde's personal loan is an interesting option for those who are in a hurry but want to access credit safely and without bureaucracy.

Therefore, if you liked this option and want to take out a loan from NoVerde, just keep checking the content below that shows you step by step how to apply for credit.

How to apply for the NoVerde loan

Check here how easy and fast it is to apply for a NoVerde personal loan.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

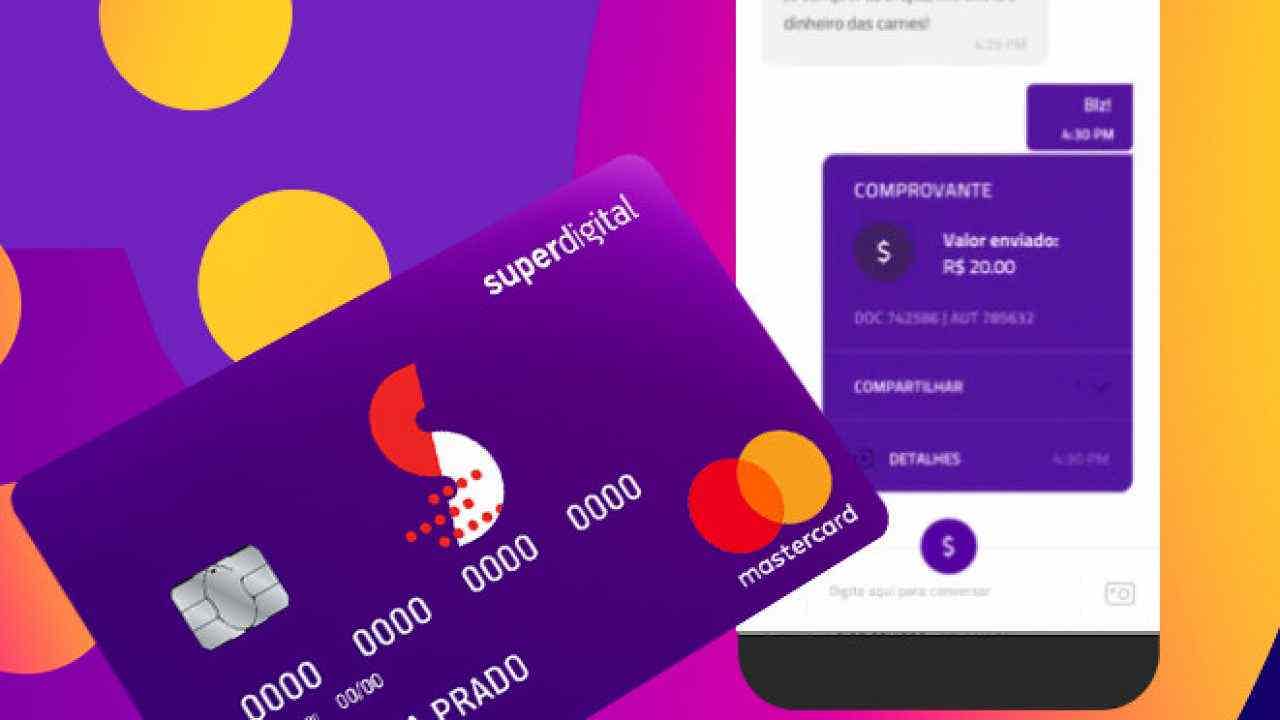

Bradesco Neo Card or Superdigital Card: which one is better?

Be it the Bradesco Neo card or the Superdigital card, both have international coverage and offer several advantages. Check out!

Keep Reading

Indeed: how to find job vacancies with the app?

Discover how the Indeed app can be your ally in your job search. Find out more about its features and how to use it.

Keep Reading

Santander SX Card or Original Card: which one to choose?

The Santander SX card or Original card are credit card options for those looking for exclusive benefits. Learn more about them here!

Keep ReadingYou may also like

How to be rich in 2021

Do you want to become rich? Here are some tips you should follow to reach your goal. Continue reading and find out what they are.

Keep Reading

18 Websites for you to earn money online

If you want to earn money online, you need to know the sites listed below. Start 2021 off right and make an extra income.

Keep Reading

How to apply for the Banco Invest card

Banco Invest's credit card is an excellent alternative to give you more purchasing power and also help you organize your finances! Interested? So, see how to order yours right now!

Keep Reading