loans

Discover the Creditas payroll loan

With this loan, you can access low interest rates and have up to 5 years to pay off a loan with fixed installments so you don't have to worry about paying off every month. Learn more about this credit here.

Advertisement

Access the best rates and get approved even if you have a negative rating

If you are a salaried employee at a company affiliated with Creditas Benefícios, you can have access to credit with better payment conditions and low interest rates.

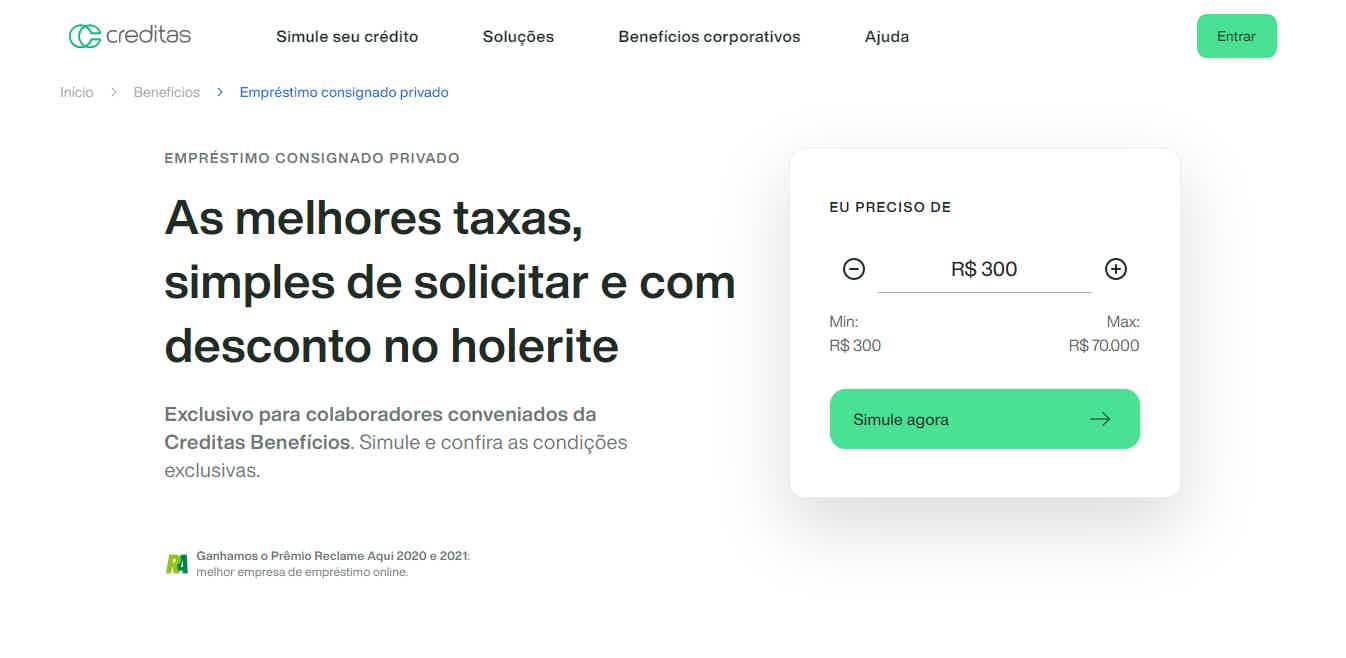

This is the Creditas payroll loan that allows you to have access to up to R$$ 70 thousand in credit that you can pay in fixed installments in up to 60 months.

| Minimum Income | not informed |

| Interest rate | Starting at 1,49% am |

| Deadline to pay | Up to 60 months |

| release period | Within 5 business days |

| loan amount | Up to R$ 70 thousand |

| Do you accept negatives? | Yes |

| Benefits | Online 100% application fixed installments |

How to apply for a Creditas payroll loan

Request via the app, phone and website in a very quick and easy way!

With this option, you have even more convenience, since you won't have to pay another bill every month. Thus, with the loan, the value of the installments is automatically deducted from your salary, preventing you from defaulting on your payments!

Therefore, in this post you will learn more about the Creditas payroll loan and see how this option can be interesting for your financial life!

How does the Creditas payroll loan work?

First of all, it is important to understand how a Creditas payroll loan works in practice!

Therefore, this type of credit was created especially for those who work as CLT employees and whose company is accredited by the financial institution.

In this way, from this loan, these people can request a certain amount of credit.

Therefore, after formalizing the transaction, the value of the installments will be automatically deducted from the paycheck, salary slip or benefit that the person receives.

Furthermore, as the Creditas payroll loan is made for people with a fixed income, it is possible to access better interest and term conditions, since the person's salary is used as payment guarantee.

And here you don't need to worry that the value of the installments won't consume your entire salary! According to Law No. 10,820, payroll loans can only have installments worth up to 35% of the applicant's salary.

This way, you know that only a small portion of your income is compromised and that you will still be able to use your salary for your other financial responsibilities.

What is the loan limit?

Namely, the credit limit that the Creditas payroll loan offers to the public is R$70,000, while the minimum that can be borrowed is R$300.00.

However, the release of this amount will depend solely on the credit analysis that the financial institution will carry out on your profile.

Who is the loan for?

Initially, payroll loans were made especially for retirees, INSS pensioners and salaried workers. However, Creditas has a special criterion for this.

Therefore, to apply for a Creditas payroll loan, your company must be affiliated with the Creditas Benefits program so that the credit can be released.

Is a Creditas payroll loan worth it?

At first, after learning a little more about the Creditas payroll loan, it is common to have doubts about whether this is really the best option.

After all, the loan has attractive payment terms and can offer low interest rates. But is it really a good idea to apply for it?

Therefore, to find out, it is necessary to know the main positive and negative points of this solution!

Benefits

Initially, the Creditas payroll loan can surprise you and offers an interesting range of benefits, such as:

- Fixed installments that consume up to 35% of the salary;

- Fully online application;

- Approves credit for those with bad credit;

- It has a low interest rate;

- Allows you to pay in up to 5 years.

In addition to all this, when you take out a Creditas payroll loan, you also access Creditas Benefícios, which is an application designed for you to manage all the benefits you receive from your company, from health insurance to VR!

Disadvantages

As much as the Creditas payroll loan has great positive points, we cannot forget that it also has some disadvantages.

Firstly, there is the fact that the loan is only available to those who work in a company that has an agreement with Creditas Benefícios.

Therefore, if your company does not have it, it will be necessary to go through this additional process of convincing the company's management to implement this solution, which can make the request more bureaucratic.

Furthermore, Creditas does not offer any grace period to start paying the first installment, an item that we can find in other payroll loan options.

How to get a Creditas payroll loan?

Namely, you can simulate taking out credit through several different channels that the financial institution makes available.

But, to find out in detail how to apply for a Creditas payroll loan, just check out the post below which shows a complete step-by-step guide.

How to apply for a Creditas payroll loan

Apply online for 100% to access the best credit conditions!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Natura Pay digital account

Check out in this post the main advantages of being a Natura Pay account, how to get paid for your sales safely.

Keep Reading

Conscious Fashion: 7 cheap tips to renew the closet

Learn 7 cheap tips to renovate your closet and learn everything about conscious fashion in a simple and creative way! Check out!

Keep Reading

Neon Card Review 2021

In this review of the Neon card, learn about the exclusive benefits, such as the annuity exemption and the Vai de Visa program, in addition to the product's characteristics.

Keep ReadingYou may also like

6 biggest doubts on the Access card

The Acesso card is ideal for those who are negative and it even offers an international Mastercard flag! If you have any questions about how it works, this post is for you! Read and check!

Keep Reading

Discover the Simple Loan

Get to know the Simplic loan with installments between 3 and 12 months and amounts of up to R$3,500 reais.

Keep Reading

Finmatch loan: what is it and how does it work?

Learn a little more about this new company that came with the aim of not only helping, but also supporting micro-entrepreneurs to invest in their own business.

Keep Reading