loans

Get to know the loan with Creditas car guarantee

The Creditas Car Secured Loan allows you to access up to R$ 150,000.00 of credit with interest from 1,49% per month and up to 60 months to pay. Learn more about him in this post!

Advertisement

Turn up to 90% of your car's value into credit

Creditas is a large Brazilian credit platform that works by offering various types of loans. Thus, one of the types of credit offered is the Creditas car loan.

Thus, from it, it is possible to access up to R$150,000.00 of credit that can be paid in up to 60 months with lower interest rates than other modalities.

| Minimum Income | not informed |

| Interest rate | Starting at 1,49% per month |

| Deadline to pay | Up to 60 months |

| release period | Uninformed |

| loan amount | From R$5,000.00 to R$150,000.00 |

| Do you accept negatives? | Yes |

| Benefits | Installments from R$151.00 Up to 90% of the value of the vehicle used in the credit 5 years to pay off the loan |

How to apply for a loan with Creditas guarantee

See here how this type of credit works and how to request it to take advantage of its advantages.

Therefore, to learn more about the loan, just continue reading this article and, thus, find out if it is the best option for you!

How does the Creditas secured car loan work?

The secured car loan offered by Creditas works completely online. That way, you don't have to leave the house to access credit!

Therefore, to access the credit, just go to the Creditas website and simulate the loan amount and the number of installments you can make the payment.

When doing so, just make the request, send your personal data and wait for the company to contact you about your credit analysis.

Thus, when you receive the answer, you will know the amount of credit that the institution has approved and, in this way, you will be able to apply for it.

In addition, when accepting the proposal, you only need to wait until the money is released and falls into your account.

What is the loan limit?

Creditas' vehicle secured loan has a minimum credit of R$5,000.00 and a maximum of R$150,000.00.

That way, you can access a high amount for credit and thus continue with your projects and plans.

Advantages of the Creditas car loan

Knowing the advantages that the Creditas loan can offer is essential to decide whether the option offered by the institution is the one that meets your needs.

Therefore, one of the biggest advantages of Creditas credit is the fact that you can use up to 90% of the value of your vehicle on credit. In this way, you guarantee that you will be able to access a higher amount on your loan.

In addition, Creditas manages to make small installments that fit in your pocket. From there, the installment values start from R$151.00, and you have up to 5 years to pay off the loan.

Main features of the loan

Regarding the Creditas loan, there are some important characteristics that you need to know before applying for it.

The first one refers to the type of vehicle that the institution accepts. Currently, Creditas accepts passenger cars that have been manufactured from 2010 onwards.

In addition, the vehicle must have at least 50% of its value already paid off, if it has been financed.

In this way, it will be possible for you to transform a good part of the value of the vehicle into credit and pay much lower interest rates compared to personal credit.

According to the official website of Creditas, you can pay up to 4x less interest on a secured car loan compared to personal credit.

Who the loan is for

The Creditas vehicle loan with guarantee is indicated for those who own a vehicle manufactured after 2010 and need urgent credit, but do not want to pay high interest rates.

He is also the ideal option for those who like to carry out the processes online. From there, all loan requests are made from the Creditas website, allowing you to carry out the entire process without leaving your home.

How to take out a car loan with Creditas?

In summary, the Creditas loan can offer a high loan amount, low installments and up to 5 years to make the payment.

Therefore, it becomes a great option for those who own a vehicle and like the practicality of online.

Therefore, to find out how the loan application process works in practice, just check out the content below!

How to apply for a loan with Creditas guarantee

See here how this type of credit works and how to request it to take advantage of its advantages.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

GINEAD free mason course: learn how to do it!

See here how the mason course works, discover all the subjects, workload and how to get the certificate. Learn more details!

Keep Reading

New rules payroll loan INSS 2022

Get to know the new INSS payroll loan rules and stay on top of all the details on how it works to apply for yours.

Keep Reading

How to apply for the Meu Galo BMG card

The Meu Galo BMG card is full of advantages, international, Mastercard and even has exclusive benefits for rooster fans.

Keep ReadingYou may also like

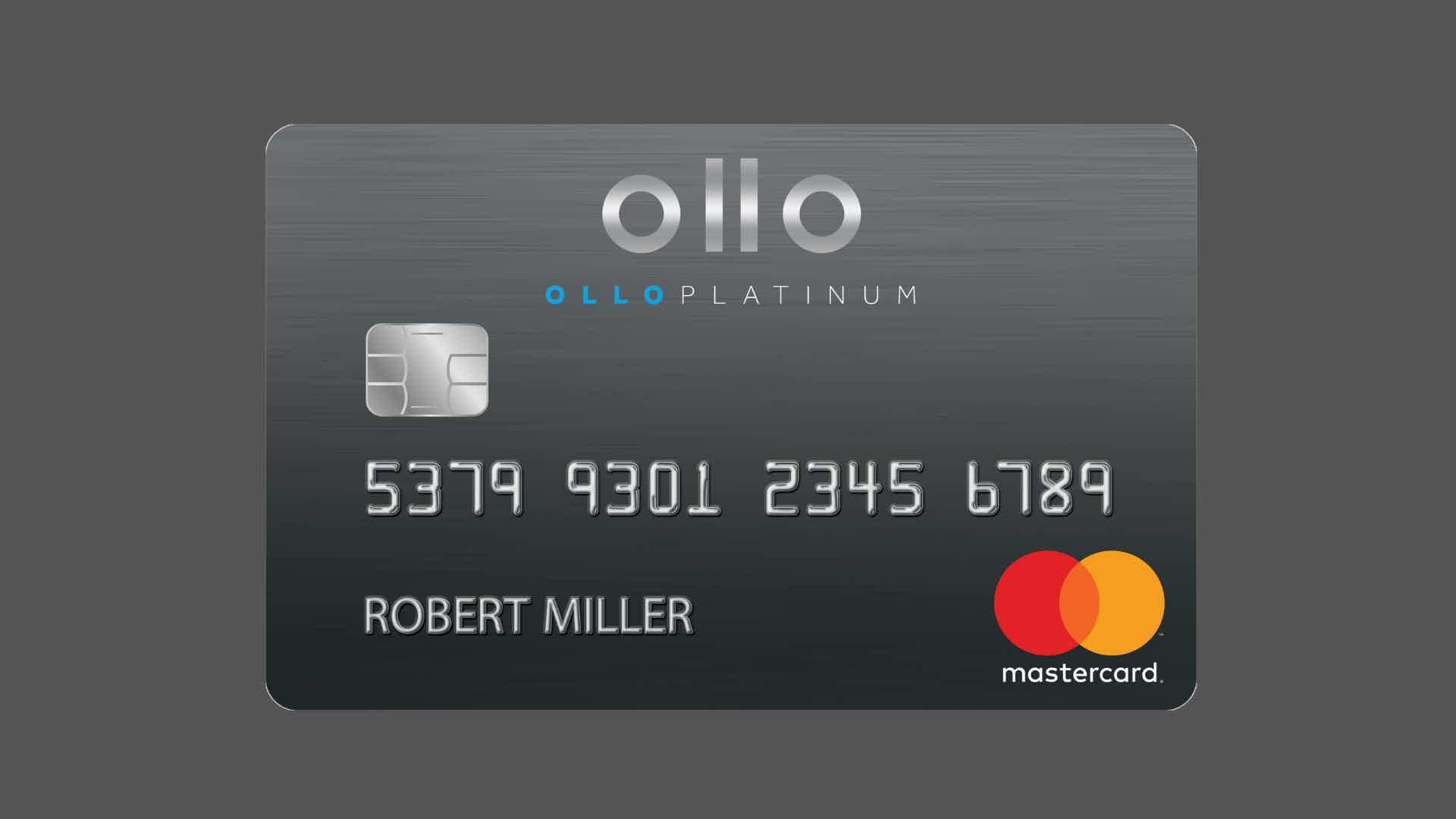

How to apply for Ollo Platinum card

The Ollo Platinum card has no annual fee, no foreign transaction fees or other hidden fees. Furthermore, it is international, and you can use it for your shopping or traveling. Want to know how to request yours? Check it out here!

Keep Reading

Get to know the Santander Visa Infinite Takeoff Card

Do you want a travel card, with exclusive discounts on airline tickets, accommodation and tour packages? Decolar Santander Infinite offers you these advantages and many other super exclusive ones.

Keep Reading

Visa Platinum Card or Visa Signature Card: Which is Better?

If you are looking for a credit card to call your own and have access to the main resources to take care of your finances, the Visa Platinum card or Visa Signature card is a great alternative. To learn more about them and their main differences, just continue reading the article and check it out!

Keep Reading