digital account

Discover the Easy account

Do you need a dollar account to send money to Brazil easily? This could be the Easy account! With it, you have free withdrawals and send money to Brazil very easily. In today's article, we will show you all the details of this account. Read more and find out!

Advertisement

Easy Account: your US account with Banco do Brasil

The Easy account is an account created by Banco do Brasil to meet the needs of Brazilians who need a dollar account. In short, it is the account designed for those who live in Brazil, but frequently travel to the United States.

This way, you always need to have a reserve in dollars. With this in mind, Banco do Brasil created the Easy account. With it, you can withdraw your money from banks in the USA and also send money to Brazil quickly.

In today's article, we will tell you everything about the Easy account and how it works. Continue reading to find out!

| open rate | Initial deposit of 100 dollars |

| minimum income | not informed |

| rates | free rates |

| credit card | Debit card only |

| Benefits | Send money to Brazil easily free withdrawals |

Easy main features

First of all, let's understand how the account works. Basically, this account is for those who travel a lot to the United States and need an account in dollars. Therefore, with Easy, you can withdraw money in the USA simply and quickly.

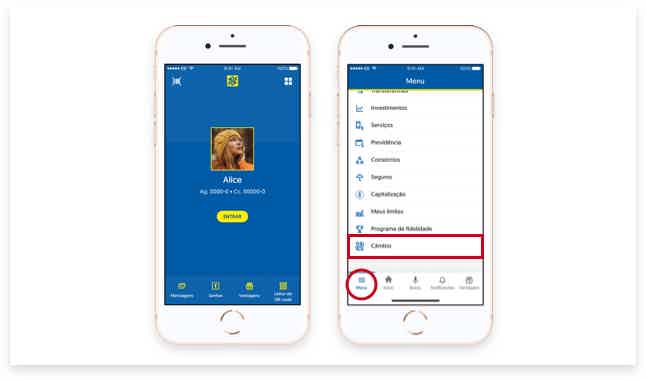

Furthermore, the Easy account is completely digital and can be monitored via the Banco do Brasil app. This way, you transfer money to Brazil directly via cell phone. All this through BB Remessa, where you send money to individuals in Brazil.

Furthermore, the account allows you to use NFC technologies such as Apple Pay and Samsung Pay. In addition to providing a debit card that you can also insert into PayPal, to make your purchases easier.

In this sense, the debit card allows a daily limit of US$500 for withdrawals. And also US$1,500 for purchases using the BB Americas Bank Visa card.

Who the account is for

In short, to request the Easy BB account you need to fulfill some prerequisites. But, in general, to have the account you need to go to the United States frequently, or else be saving up a dollar reserve.

Therefore, to be an Easy customer, you must live in Brazil and not have a BB Americas Bank account in the last 12 months. Therefore, the bill is not for those who live in the USA, but for those who travel frequently. Whether for leisure or business.

What is the Easy Account limit?

Although the account has several services, it still does not offer an overdraft. However, to have Easy, you must be an account holder at Banco do Brasil. Therefore, the BB account offers this limit service within the account itself.

With the Easy account, only the services we have already mentioned, such as the debit card.

Is Easy Account worth it?

For those who travel a lot to the United States, the Easy account can be very good. This is because it facilitates processes when transferring money to Brazil. In addition to having withdrawals available for free in the USA.

See the main advantages and disadvantages of the Easy account:

Benefits

First of all, we can mention the fact that the account is fee-free. Normally, transferring money abroad or from abroad to Brazil always involves absurd fees. Therefore, an account to save dollars without fees is a great advantage.

Furthermore, the account has a complete application, which helps you resolve everything online. In this sense, you can even request your account directly through the app. Just be an account holder and log into your normal account.

Another advantage is being able to make free withdrawals from ATMs in the United States. This way, when you are traveling, you can withdraw your money and be free from credit card fees.

Disadvantages

When we talk about disadvantages, we can say that there are not many. But, a big point is that to have the Easy account, you must already be a BB customer in Brazil. Therefore, it is only possible to create the account if you are already an account holder at the bank.

On the other hand, anyone who has been a BB Americas Bank customer in the last 12 months cannot create a new account. In other words, there are some bureaucracies to create the account that can prevent you from choosing the account.

How to make an Easy Account?

In short, requesting an Easy account is very easy and the process can be done online. In fact, there are some documents required to request. Look:

- Driver's license or identity;

- Proof of address.

With these documents in hand, simply access your Banco do Brasil application to make the request. It is worth remembering that to have the account, you need to make an initial deposit of US$100.

In this other article, we will explain in detail the step-by-step process for you to become an Easy Account account holder. Check out!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to Apply for the Original Mastercard Credit Card

Find out how to apply for the Original card, which is growing every day in the digital market and you need to know.

Keep Reading

How to enroll in ProUni

If you already know ProUni, it's time to find out how to apply for this program. Read this post and see the step by step!

Keep Reading

Follow your health closely: Application to measure cell phone pressure

Take care of your health with the best apps to measure blood pressure. Track your results and prevent disease. Learn more now!

Keep ReadingYou may also like

How to open a BB Conta Jovem account

Do you want to know how the opening process of BB Conta Jovem works? Continue reading the post and see how simple, easy and super fast it is!

Keep Reading

How to apply for the BMG card

Do you want to participate in the Volta Pra Mim Cashback Program and the Poupa Pra Mim Program of Banco BMG? So, read this text and learn how to apply for a BMG credit card.

Keep Reading

Unibanco Personal Credit or Universe Personal Credit: which is better?

At first glance, Unibanco's Personal Credit is very similar to Universo's, as both offer attractive interest rates, amounts of up to €75,000 and extended terms. However, they work differently and we want to show you that from now on so that you can choose what suits your needs. Let's go!

Keep Reading