digital account

Discover the Next digital account

In the Next account, you can carry out your financial transactions in the comfort of your home. As well as making free and unlimited withdrawals on the Banco24Horas network and Bradesco bank, and also opening your investment portfolio. Check out!

Advertisement

Next digital account: free, digital and without fees

In an increasingly digital world, some financial institutions have had to migrate to the digital world, among them Bradesco bank, creator of the digital bank Next. In the Next digital account, you have access to all the financial services you need without having to leave your home!

| open rate | Exempt |

| minimum income | not informed |

| rates | Exempt |

| credit card | Yes |

| Benefits | free account card without annual fee WhatsApp transfers without having to leave the conversation Investment portfolio |

How to open account Next

Learn how to open the Next account with free and unlimited withdrawals, completely free of charge and also gives you access to an investment portfolio.

So, stay tuned because below we will tell you a little more about how this digital account works, in addition to the advantages and disadvantages. Check out!

Discover the personal loan Next

Check here how to acquire the loan for those who are current bankers at Next.

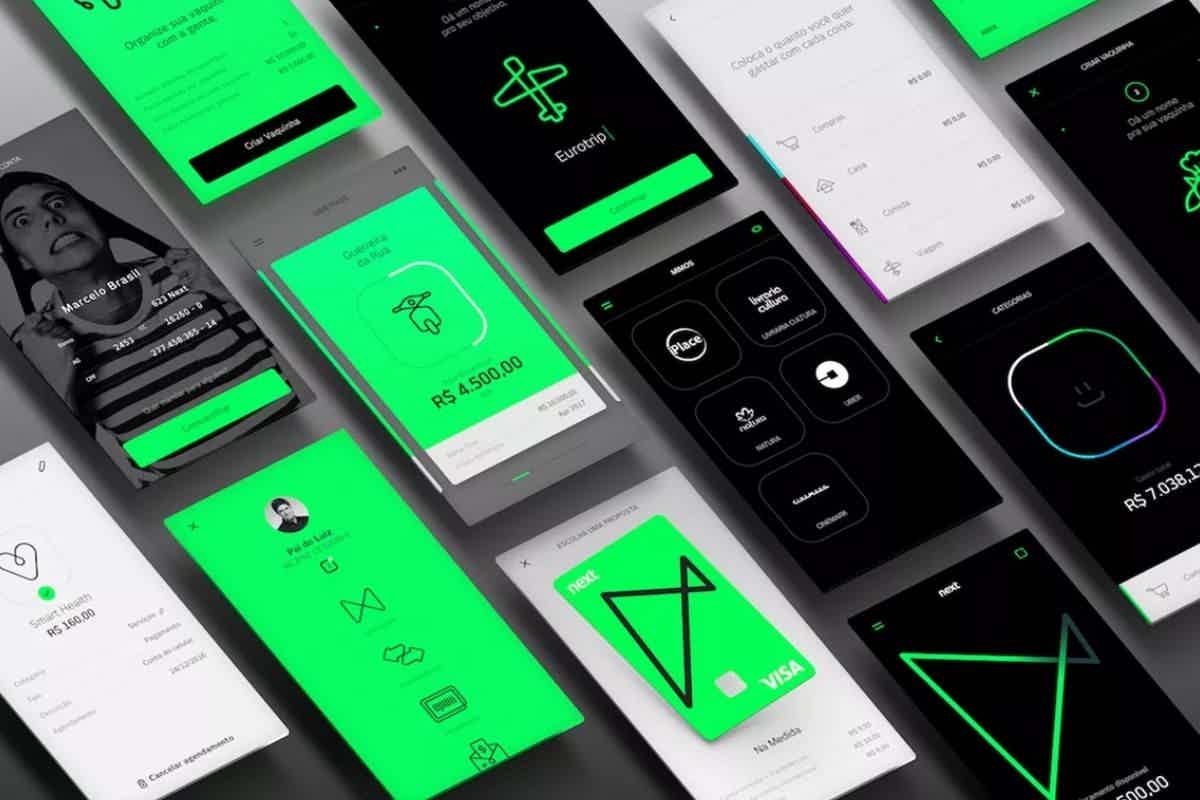

Main features of Next

Since 2017, the digital bank Next, created by Bradesco bank, has been on the market to bring more comfort and practicality to Brazilians.

This is because, as it is a fully digital bank, it is also aimed at the younger public, with financial services ranging from carrying out online transactions to obtaining your investment portfolio.

Among the services offered are a digital account with a current account, savings account and Visa International debit and credit card, PIX, unlimited and free TEDs, direct debit, loans, mobile recharge and payment of bank slips.

And, in addition, you can make unlimited and free withdrawals at Bradesco branches and the Banco24Horas network.

Also, the application has very interesting tools such as Mimos, with exclusive discounts at partner establishments and the Flow tool to help you control and organize your finances.

By the way, to open a Next account, just install the application and send your personal documents, including proof of address.

Thus, the application has very specific functions, and is very intuitive and you won't have to break your head to use it. In addition to having a fingerprint reader to bring more security when using the Next!

Who the account is for

It is indicated for those looking for an account that offers services, for the most part, free of charge.

This is because the services provided by Next are free and you can open an account more easily than in other financial institutions.

What is the limit of the Next digital account?

So, the Next account limit is up to R$20 thousand. This is because, if you need to move more values above this, you will need to register your biometrics. So, for more information, consult the institution!

Is the Next digital account worth it?

Now, let's get to know the advantages and disadvantages of your digital account!

Benefits

Among the advantages, Banco Next is 100% digital, so you can solve all your questions through the application itself and you don't have to pay any monthly fee for it.

And, in addition, the debit and credit card has a Visa flag, which is the second largest flag in the world, and can be used in other countries and thousands of establishments.

Also, you have access to unlimited and free PIX and DOC transfers, free and unlimited withdrawals and deposits in the Banco24Horas network or Bradesco branches, bank loans, salary portability, cell phone recharge and payment of slips.

Among other advantages, we have discounts and benefits tools, such as Treats and NextShop, in addition to insurance!

Disadvantages

So, among the disadvantages, Banco Next does not offer automatic income like most digital banks.

According to the institution's customers, it is also considered difficult to get credit card approval and customer service is poor. Also, the Visa Platinum card charges an annual fee and to unlock the credit card, you need to go to a cashier!

How to make a digital account Next?

To make the digital account, you must install the application on your cell phone, available for Android or iOS, and follow the recommendations. Thus, you will need some personal data, send proof of address and photo of documents.

So, click on the recommended content below to find out more information about how to open the account!

How to open account Next

On the Next account, you have free withdrawals, a credit card with no annual fee and discounts of up to R$30 on Uber every month. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Enjoy all the benefits of PIS/PASEP: sign up now

Do you want to know how to enroll in PIS/PASEP? It's very simple. Read this article and discover the step by step to receive the benefit.

Keep Reading

Discover the banQi prepaid card

The banQi prepaid card gives you the freedom of a card with a credit function, but without the bill scares. Find out how it works in this article!

Keep Reading

How to apply for the Torra Torra card

The Torra Torra card allows its customers to buy all garments with discounts and promotions. Check out how to order yours!

Keep ReadingYou may also like

Get to know the quick loan Credistar

Credistar is an excellent loan option for anyone in need of easy money. This is because it offers credit with an interest rate starting at 1.49% per month and a payment period of up to 12 months. Continue reading and find out more!

Keep Reading

How to apply for the El Corte card

Do you want to make your El Corte card? So check out how to order yours to take advantage of discounts in stores.

Keep Reading

Discover the Millennium Serviços Mínimos current account

In the Millennium Serviços Mínimos account, you can transfer amounts to other bank accounts, make deposits, register direct debits and much more. Take the opportunity to learn all about this service in the post below.

Keep Reading