digital account

Discover the Inter digital account

Find out here about the exclusive advantages of the Inter digital account, such as a free maintenance fee, free transfers, payments and withdrawals, as well as a credit card with no annual fee and cashback. Check out!

Advertisement

Conta Inter: free account with free transfers and withdrawals

First of all, Inter digital account is free and 100% online. That is, the opening and movement is done by the application.

Therefore, it has little bureaucracy. This means that opening an account is immediate, unlike a credit card that requires a credit analysis.

Also, don't worry about fees. Since the account is free, the main movements also have no cost.

With this introduction, we invite you to check out the details. So, continue reading and check out everything about the Inter account. Let's go!

How to open inter account

Grab the chance to have a free account with free transfers and withdrawals. So, learn how to open your Inter digital account and enjoy these advantages.

How does the Inter digital account work?

Just to exemplify, the digital account is opened by the application. Still, you can start the process through the Inter website. Therefore, the account is opened in minutes.

Bank transactions are made in the application. That is, make transfers, payments and ask questions. Along the same lines, withdrawals are made at ATMs in the Banco24Horas and Saque e Pague networks.

When opening the account, a card with the debit function is sent to your address. Also, ask for the credit function in the app. Likewise, upon analysis, the limit is approved after a maximum of seven days.

Thus, you will have a free digital account, as well as an international debit and credit card with the Mastercard brand that allows purchases in thousands of accredited establishments inside and outside the country.

What is the Inter digital account limit?

Unfortunately, Banco Inter does not inform the minimum approved limit. However, a client with a clean name, a high credit score and good financial transactions gets approval. Certainly a high income also contributes to this analysis!

Inter digital account worth it?

To find out if the Inter digital account is worth it, check out the details below. That's because we separate the advantages and disadvantages of this option.

Benefits

Among the main advantages is the monthly savings. Certainly, not charging fees is interesting. Check out other benefits below.

- Digital account without charges;

- Credit card with no annual fee;

- Cashback on purchases at the super app mall;

- Unlimited and free transfers, payments and withdrawals.

Disadvantages

We were not able to identify a major disadvantage of the Inter digital account, but remember that it is important to inform yourself about all the conditions related to the services provided by the bank, to avoid problems later.

How to make an Inter digital account?

In short, download the app. Open free digital account in few minutes. If you want to go through the website, click on the “open your account” tab.

After that, fill in your personal data, telephone and e-mail. So, accept the privacy policy and enjoy this account free of charge!

If you still have doubts, click on the recommended content below and you will be directed to the step-by-step process for opening an Inter digital account.

How to open inter account

Grab the chance to have a free account with free transfers and withdrawals. So, learn how to open your Inter digital account and enjoy these advantages.

Trending Topics

How to open an Inter Kids account

Learn how to use the Inter Kids website or application to open an Inter Kids account and enjoy all the benefits offered. Learn more here!

Keep Reading

Tracking Detector: discover the Apple app!

Tracking Detector: discover the Apple app! Apple has launched an app to help you track AirTags!

Keep Reading

Agibank loan or Itaú loan: which is better?

The Agibank loan or Itaú loan offer exclusive advantages and a long payment term. Want to know more? Check it out here!

Keep ReadingYou may also like

Digital account + Card: the best options of 2021

How about knowing the best digital account options with a credit card on the market? So, read on and check it out!

Keep Reading

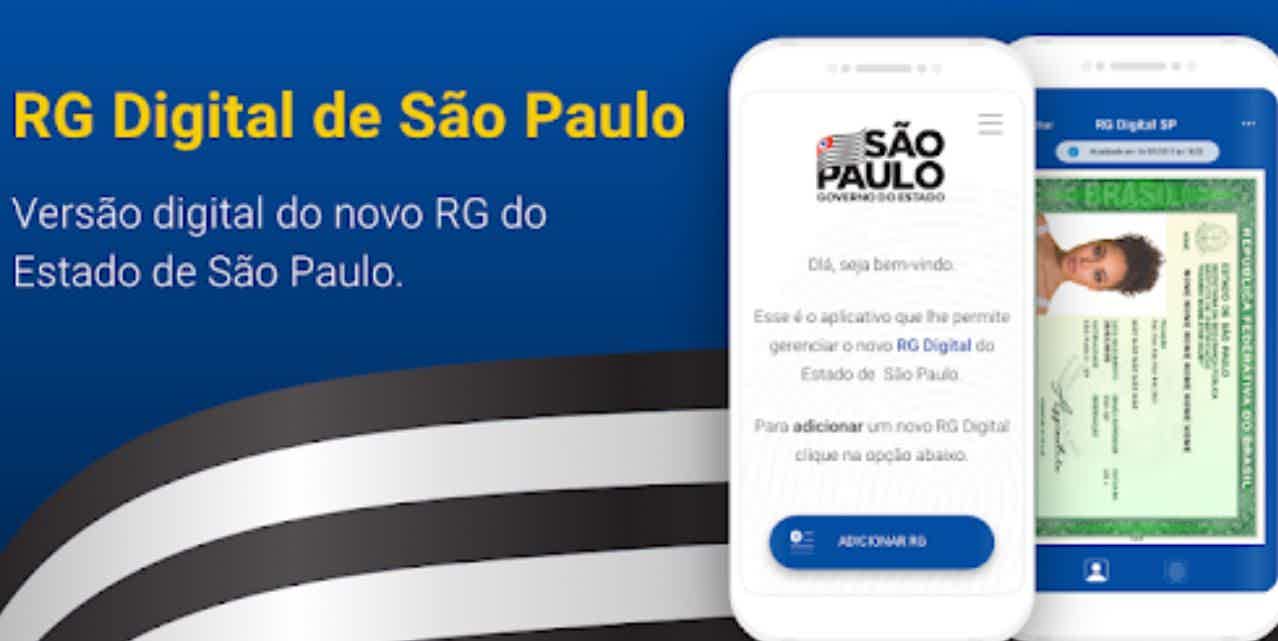

See the details announced on how to make the digital RG

By March 2023, all citizens must be registered for the new RG model, the digital model. In this way, Brazil conforms to the international standards of the MRZ, Machine Readable Zone and Brazilians will be able to travel through Mercosur only carrying the new digital RG.

Keep Reading

Discover the Revolut Metal card: advantages for daily use, travel and investments

Discover a new standard in financial convenience with Revolut Metal. Hassle-free global transactions, enhanced security, and exclusive benefits, all on a single card. With Revolut Metal, take your financial journey to a new level!

Keep Reading