Consortia

Get to know the Banco do Brasil real estate consortium

With the Banco do Brasil real estate consortium, you will find interest-free plans, with differentiated rates and installments that fit in your pocket. All to help you acquire your dream home. Find out here and learn how to hire!

Advertisement

Banco do Brasil Consortium: buy your property at a discount

Don't stand still, there's still time to conquer your own home in the first half of 2022. With the Banco do Brasil real estate consortium, you can acquire your dream home through self-financing or joint purchase, as it is also known. In this purchase mode, customers do not need to worry about paying interest or even the famous down payments.

BB customers receive contemplation through a letter of credit, so it is possible to buy any type of property or property. That is, the consortium member can choose to purchase a house, apartments, land and other assets.

Being the most viable way to acquire high-value goods, the first differential of the consortium is the joint purchase based on self-financing. That way, at the end of the consortium, everyone receives their property.

Learn about the advantages of the Banco do Brasil real estate consortium!

| Minimum Income | not informed |

| Interest rate | Exempt |

| Deadline to pay | Uninformed |

| release period | Uninformed |

| Consortium Value | Uninformed |

| Do you accept negatives? | Uninformed |

| Benefits | High credit values, great payment terms |

How to apply for the BB real estate consortium

See here how to apply for the Banco do Brasil real estate consortium. Thus, it is possible to buy a property with zero interest and installments that fit in your pocket.

How does the Banco do Brasil real estate consortium work?

Like other consortium modalities that are available in the market, Banco do Brasil offers a shared purchase option from its consortium.

In this sense, a certain number of people join consortium plans and pay a monthly installment that allows BB to grant a letter of credit each month.

Therefore, with the Banco do Brasil real estate consortium, all participants can acquire a property with no down payment and no interest.

The contemplation of the consortium takes place by way of lottery or bidding. In the first option, the card becomes available and the BB randomly grants it to a member of the group, making the draw fair.

In the second type of contemplation, the consortium participant can anticipate the letter of credit through the bid. That is, you advance some payments and receive the amount sooner than expected.

What is the limit of the Banco do Brasil consortium?

In general, the Banco do Brasil real estate consortium is one of those that releases the highest values for the purchase of properties.

Thus, self-financing reaches not only individuals but also legal entities that need a new property.

In addition, it is worth remembering that even if you are drawn, if you are pending payments from the consortium, you will not receive the letter with the amount.

Advantages Bank of Brazil

We have already talked about several important features of the Banco do Brasil real estate consortium, but now we are going to show you the main advantages of joining a bank consortium plan.

Check it out:

- No down payment and no interest: charges such as interest and IOF do not exist in the Banco do Brasil consortium. In contrast to this, what exists is the management fee, which in this case is very low;

- Change of credit: the consortium member can change the value of the credit he wants before contemplating it, being able to opt for more or less credit;

- Guaranteed purchasing power: BB customers do not suffer from changes in product prices over time, as the value of the letter is readjusted whenever necessary;

- Great deadlines: in addition to the deadlines being very long, you decide how many times you will pay your self-financing.

Main features of Banco do Brasil

The Banco do Brasil real estate consortium is available for all types of real estate: houses, apartments, land, sheds, subdivisions and others.

For whom the consortium is indicated

There is no rule limiting participation to a specific audience. It is only necessary that the contractor be over 18 years old and can actually commit to paying the installments.

Generally, if you don't have the full amount to buy your house in cash, the smartest thing is to join a real estate consortium.

How to make a Banco do Brasil real estate consortium?

There is no secret to buying a share in the Banco do Brasil consortium. Those interested in purchasing the service should follow the instructions below:

- Download the financial institution application via the application store (Play Store or App Store). However, this option is only available to bank account holders;

- If you are not a customer of the institution, you must enter BB's digital environment to simulate and close a deal;

- Preferential service is also available to both audiences, account holders or not.

Did you like it? To learn more about how to apply for the Banco do Brasil real estate consortium, just access our recommended content.

How to apply for the BB real estate consortium

See here how to apply for the Banco do Brasil real estate consortium. Thus, it is possible to buy a property with zero interest and installments that fit in your pocket.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Bolsa Família: activate the program in Caixa Tem

Learn how you can activate the Bolsa Família benefit in the Caixa Tem app from the Federal Government and see how to use it! Check out!

Keep Reading

Havan Card or Neon Card: which is better?

Find out about credit options that appeal to different audiences. So, read this post choose between Havan card or Neon card.

Keep Reading

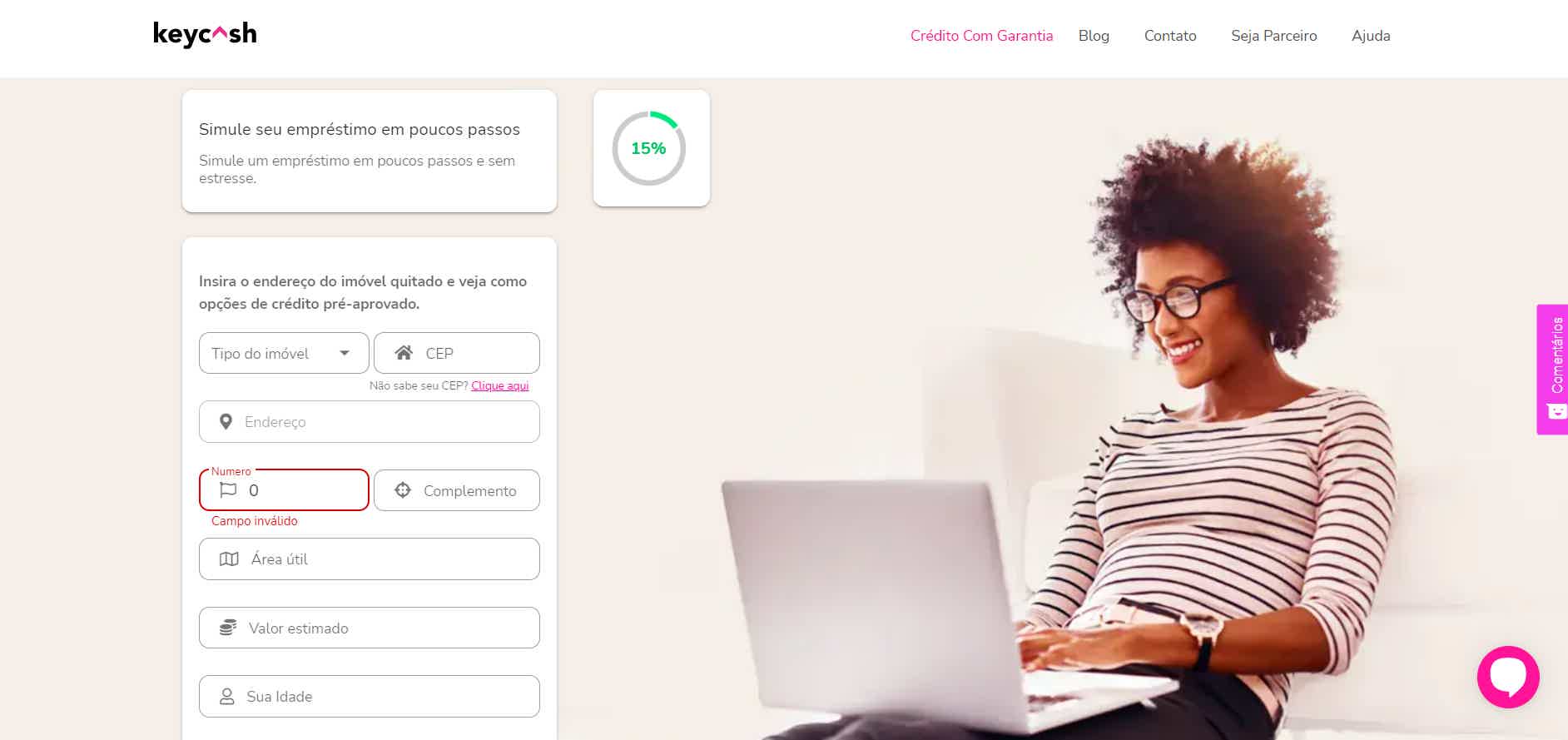

How to apply for the KeyCash loan

The KeyCash loan aims to make it easier to take out credit and help you leverage your business. See here how to apply!

Keep ReadingYou may also like

How is a refinance done?

Refinancing can be a great way to avoid payment delays and renegotiate credit terms. Continue reading this text and see how this practice works!

Keep Reading

TD Double Up Credit Card: How It Works

Want a credit card with cashback and no costs? Then, you need to know the TD Double Up card, issued by TD Bank. To find out how it works and what it offers, follow this article.

Keep Reading

All about the Banco do Brasil Altus Visa Infinite card

The Banco do Brasil Altus Visa Infinite card is one of the most recent innovations in the Brazilian market and is only available to customers in the BB Private segment. Read our text and understand.

Keep Reading