Consortia

Get to know the Honda consortium

Make your dream of owning a Honda vehicle come true with conditions that fit your budget. Check out how easy and hassle-free it is to acquire your consortium.

Advertisement

Honda Consortium: your chance to have the car you always dreamed of

The Honda consortium brings several advantages to future recipients and provides an economical and planned shopping experience. In this sense, the consortium offers excellent payment terms, installments and much more for customers.

Therefore, we have prepared content with the main characteristics of the consortium and how it works. So, if you want to know about all this, continue until the end of this post.

| Minimum Income | not informed |

| Interest rate | Exempt |

| Deadline to pay | Uninformed |

| release period | Uninformed |

| Consortium Value | Uninformed |

| Do you accept negatives? | Uninformed |

| Benefits | Plots that fit in your pocket |

How to apply for Honda consortium

Learn here how to acquire your motorcycle or car with installments that fit in your pocket and without bureaucracy!

How does the Honda consortium work?

Therefore, present on the market for more than 40 years, Consórcio Honda has more than 6 million vehicles delivered across the country. Furthermore, it is a reference in the consortium market.

The Honda consortium works in a very similar way to any consortium, where each month one customer is included while the others continue to make installment payments.

In addition, there is the bid contemplation system. Thus, customers place a few bids every month, with those who make the highest bid being considered.

But how does the Honda consortium work? Therefore, to participate it is necessary to purchase a share from an authorized reseller.

Furthermore, it is essential that the installments are paid on time so that, once you are eligible, you actually have the right to collect your vehicle.

Very important information is that all participants in the consortium are covered until the end of the program, that is, until the installments are paid.

What is the limit of the Honda Consortium?

The consortium quota limit may vary, this will depend on the type of consortium you wish to participate in. Therefore, there are consortia for individuals and legal entities, with a different limit being determined for each of them.

In this sense, natural persons have a limit of 5 shares, unlike legal entities which have a limit of 10 shares. Finally, each consortium member is entitled to have two consortium shares in the same group. But this can change for each dealership and standards used.

Honda Advantages

See some of the advantages of the Honda consortium:

Therefore, the first advantage of the Honda consortium is variety. In other words, at Honda you will find a consortium of both motorcycles and cars.

Furthermore, with the Honda consortium the customer plans the acquisition of their vehicle. Thus, when purchasing the consortium, he will pay the installments and can plan to bid, for example, at an opportune moment.

In addition to the planned purchase, the customer makes good savings compared to bank loans and other types of financing that charge high interest rates.

Remembering that although it sometimes takes a while, the customer always has the chance to view the vehicle.

Finally, another advantage is the delivery guarantee. Therefore, even at the end of the contracted period, the vehicle is guaranteed to be picked up.

Honda main features

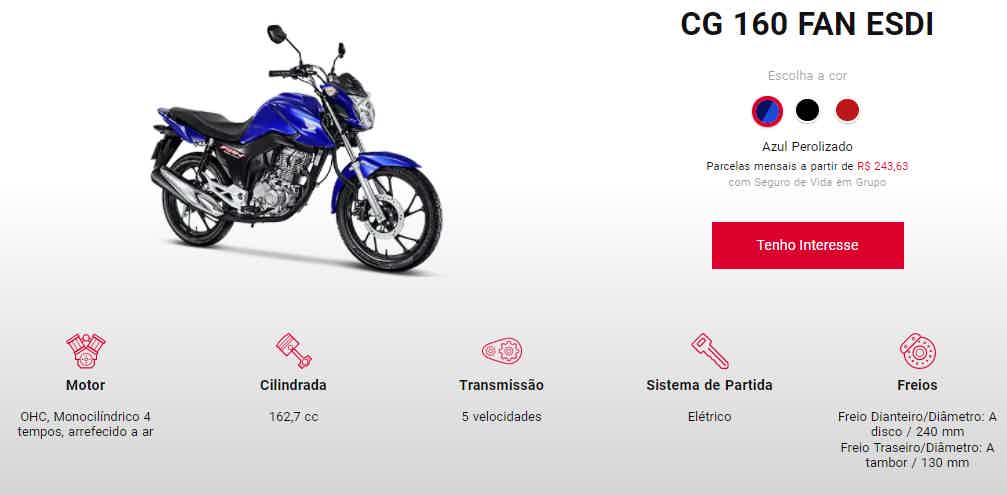

As already mentioned, in the Honda consortium it is possible to purchase both a car and a motorcycle. See some models that are part of the Honda dealership:

- Motorcycle: Street, Adventure (up to 300cc), Off Road, Sport. In some modalities there is more than one model available, for a total of 22 options;

- Car: New City Ex 35%, New City Ex 45%, New City Ex 55%, New City Ex 65%, New City Ex 70%.

Therefore, all these models can be found in the dealership's consortium. But now let's see the target audience is indicated.

For whom the consortium is indicated

The consortium is a way to facilitate the purchase of the first vehicle for those who are not in a hurry to purchase.

Furthermore, it is ideal for those planning to purchase a vehicle, as the customer pays the installments until they are eligible or pays for a certain part of the vehicle. So this is the target audience.

Furthermore, for people who do not have the full amount available to purchase the vehicle or cannot obtain financing, the consortium can be a good option.

How to form a Honda Consortium?

Therefore, to form a Honda consortium it is necessary to look for a nearest dealership. Furthermore, on the company's website you can contact the Customer Service Center to ask questions and schedule your visit to the dealership.

Valuable information is that, unlike some financing, it is possible for the consortium to be approved for negative individuals.

Therefore, in the Honda consortium there is no exact guarantee of approval. However, there is also nothing that prevents people with a negative name from participating in the consortium.

Therefore, to form a Honda consortium, the customer can schedule a visit or go directly to a dealership. It is important to always bring personal identification documents, proof of income and proof of residence.

Finally, for detailed information, access our recommended content and see the step-by-step guide on how to request your Honda consortium.

How to apply for Honda consortium

Learn here how to acquire your motorcycle or car with installments that fit in your pocket and without bureaucracy!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out now all about the Submarino card

Discover in this complete article all the features and benefits of the Submarino card and find out whether or not it is a good option for you.

Keep Reading

Discover the truth by downloading a lie detector app

Discover the hidden truth in words with the lie detector app! Uncover lies and have fun with intriguing tests.

Keep Reading

Discover the Credicard Zero credit card

With the Credicard Zero credit card, you control your account digitally and receive discounts at more than 50 partner stores. Check out!

Keep ReadingYou may also like

Check out the best apps to recover deleted photos from your cell phone

Apps to recover deleted photos will help you recover accidentally deleted images. Read the full article with details and the link to download the app. Restore your valuable photos quickly and easily!

Keep Reading

5 personal credit options with immediate response

Do you need to take out a personal loan quickly and don't want to wait days for the bank to give you a return? So take the opportunity to learn about personal credit with immediate response and check out 5 options to apply today!

Keep Reading

How to make money from Pinterest in 2021

Do you have a Pinterest account? We tell you here how it is possible to earn money through it. Find it out!

Keep Reading