Cards

Discover the Zuum card

In need of a card? Find out about the advantages of the Zuum card and whether it's worth applying for yours!

Advertisement

Zuum Card: discover its characteristics and find out how to request yours

The Zuum card is a service offered by the operator Vivo throughout Brazil for its customers, but not just for them, as anyone with a valid number can request it.

This means that the benefits of the card are available to all interested people. However, it is important to carry out an analysis of this card.

In short, let's get to know the card in more depth and find out whether it's worth applying for or not!

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | National |

| Benefits | Rate reduction for live customers, Advantages for Vivo customers, available for negative customers |

How to apply for Zuum card

ZERO annual fee, national coverage, available to negative people and exclusive benefits for VIVO customers. Check here how to request yours.

Zuum main features

The Zuum card is very affordable, being available to Vivo customers and also to customers of other operators who have a valid number.

Furthermore, the card has the Mastercard brand which, in turn, is the most accepted brand worldwide. However, the card offered by the operator does not have international coverage.

Therefore, it is correct to say that the card offered by Vivo is a homemade card, aimed at common everyday purchases and is easy to request.

Furthermore, the card is not considered a credit card but a prepaid debit card. With it, the customer does not need to have a current account. Thus, your movement is done via the app on your cell phone. Therefore, the user can make purchases, make withdrawals, transfers, payments and much more.

Zuum does not charge annual fees. However, there are some fees charged for using the card. For example, a fee of R$14.90 is charged to issue the card, and for Vivo customers this amount is used for recharging.

Anyway, who is the card suitable for? Let's follow along right now!

Who the card is for

The card is offered by Vivo, that is, it is very focused on the operator's customers and offers special conditions for people who already use the operator's numbers and services.

Therefore, it is highly recommended for Vivo customers, who, in turn, can have access to a card full of exclusive advantages and benefits.

But it is worth mentioning that the card is not exclusive to Vivo customers, anyone who has a valid number from any operator can request the card.

Is the Zuum debit card worth it?

When analyzing the characteristics of the Zuum card, it is difficult to reach a consensus on whether or not it is worth applying for. But we may have the impression that it does not surpass the features of a card from a large bank, financial institution or other institutions.

However, depending on what you are looking for in a card, the product offered by the Vivo operator may be worth it. Furthermore, as we initially pointed out, it works as a prepaid card available to negative people. Therefore, it could be a good option for this audience.

So, now let's analyze the advantages and disadvantages of the card.

Benefits

Even though it is offered by Vivo, the card is not limited to the operator's customers. Therefore, anyone with a valid number can request it, regardless of the operator.

Furthermore, the operator offers special conditions and advantages for Vivo customers. Advantages that customers of other operators do not have access to at the time of request.

Vivo does not consult credit agencies. Therefore, it is possible for negative people to request the card.

Disadvantages

One negative point of the Zuum card is that coverage is not international. So, this means that customers who requested the card can only make purchases within Brazil.

There is also a cost for those who want to request the card, which must be paid when the customer completes the process. Therefore, a payment must be made for the application fee in the amount of R$14.90.

In addition to the fee for the request, there are also charges for sending money, cash withdrawals, payments and transfers.

How to make a Zuum debit card?

There are two different ways to request the card. In other words, one way for Vivo customers and another way for customers of other operators.

Therefore, Vivo customers must call *7890 and request the card through this number offered directly by Vivo. However, customers of other operators must access the Zuum website to request the card.

So, when making the call or accessing the website, go through the entire request process and wait until the Zuum card is sent to your home.

Furthermore, if you want to know more details about the request, see the recommended content below.

How to apply for Zuum card

ZERO annual fee, national coverage, available to negative people and exclusive benefits for VIVO customers. Check here how to request yours.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Where can I withdraw the Auxílio Brasil benefit?

Find out here where to withdraw the Auxílio Brasil benefit and run to make the withdrawal before the 120-day period ends. Check out!

Keep Reading

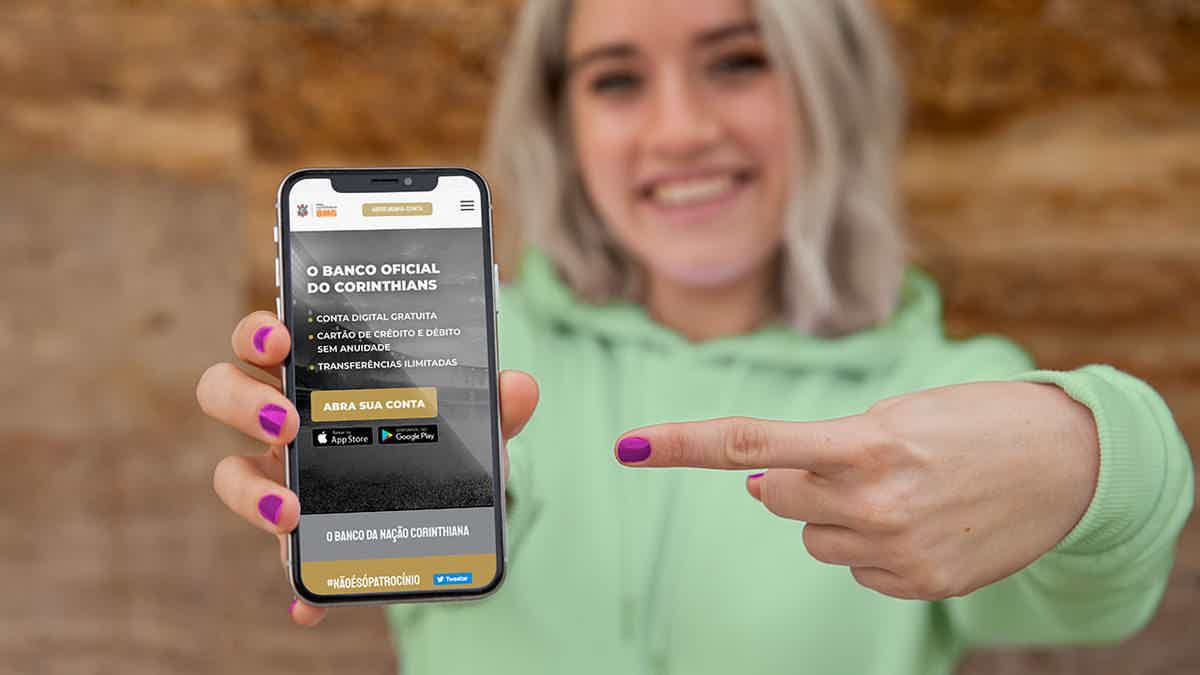

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

Discover the Avista credit card

The Avista credit card is a great option for anyone looking for a card without a lot of bureaucracy. Think this is the card for you? Check out!

Keep ReadingYou may also like

IPVA 2023: everything you need to know

If you have a car in your name, remember that, at the beginning of every year, you must pay the IPVA. Do you want to know more about the tax, how to consult it and where to make the payment? Continue reading the article and learn more.

Keep Reading

Federal Government announces microcredit program for MEI and negatives

According to the Federal Government, Caixa should provide microcredit for MEI and people with negative credits starting in February. The idea is to offer a low-interest loan to strengthen entrepreneurship in the country.

Keep Reading

How to become Platinum Nubank and have more benefits?

If you have a Nubank Gold credit card, check out the article below on how to become a Platinum customer and enjoy more benefits while enjoying your vacation with peace of mind. Learn more below.

Keep Reading