Cards

Discover the banQi prepaid card

Want to have a card to make your online purchases, without worrying about surprises on your bill? Learn more about the banQi prepaid card! The financial product that you can use for any cash purchase. Continue reading and find out how it works.

Advertisement

banQi: discover the advantages of this card without credit approval

banQi is a fintech company created in 2018 in partnership with Via Varejo. In 2020, the company reached one million downloads of its platform. Since then, banQi has continued to grow. The BanQi prepaid card is the ideal option for those who need to make purchases online but do not want to have a traditional credit card. Or, for those who have money to deposit but cannot get credit approval.

In today’s article, we’ll tell you everything about this fintech’s prepaid card. Keep reading and learn all its advantages!

| banQI | |

| Annuity | Exempt |

| minimum income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | 1% Cashback; Greater spending control. |

How to apply for banQi card

Applying for your banQi prepaid card is very simple. Check out the step-by-step in this article and start having financial independence!

How does the banQi prepaid card work?

Firstly, the banQi prepaid card gives you the possibility to buy online, sign up for subscription plans and even make international purchases. Secondly, it is a great option for those who don't want to be surprised by the bill. In order to spend, you need to make a deposit in advance. You really only spend what you have.

Together, the banQi prepaid card has no fees. Zero annual fees, all so you can save even more!

In this sense, this card does not even require credit approval. You only need to open a banQi digital account. Then, you must make a deposit of at least R$$10.00. And that's it, you can now request your prepaid card and start making your purchases.

Just like requesting the card, making a deposit is also simple. You can make a Pix or deposit using a bank slip. If you prefer, you can also go to one of the Casas Bahia stores. There you can make the deposit in cash and the amount will be deposited into your account immediately.

After ordering your physical card, it takes an average of 15 business days to arrive. However, in the meantime, you can use the virtual card. It has a different number than the physical one and is also completely free.

In addition to all this, another advantage is the cashback from the banQi prepaid card. With every purchase made with your physical or virtual card, you earn 1% cashback. This amount is credited directly to your account at the end of each month.

What is the limit of the banQi prepaid card?

Since it is a prepaid card, there is no set limit. Expenses depend on the amount of the deposit you make into the digital account.

Is the banQi prepaid card worth it?

The banQi card is a great option for those who are just starting out in their financial life and want to learn how to control their finances. It is also a good option to give to a dependent, for example. This is because it is easier to control expenses directly from the account. Continue reading and check out all the advantages and disadvantages of these cards.

Benefits

The prepaid card has several advantages similar to a regular credit card. See:

- No credit approval required;

- You only spend what you have in your account;

- You can buy from online stores and make digital subscriptions;

- The card is international;

- Has a virtual card;

- There are no annual fees or charges;

- Every purchase made with a card entitles you to 1% cashback.

With these services offered by the banQi card, the prepaid card is practically a debit card with a credit function. It is a great option for those who are just starting out in their financial life and want to learn how to control themselves.

Disadvantages

One of the only disadvantages is that it is a prepaid card. So, if you are looking for a credit card, this is not the best option. This is because it does not allow you to pay in installments. Even so, the banQi prepaid card is worth it. Mainly to avoid debts and credit card interest.

How to make a banQi prepaid card?

To request your banQi prepaid card, it’s very simple. First, just download the app and create a digital account. As soon as you make your first deposit, you’ll be able to request the card. In the recommended article below, we list the step-by-step process for you to request yours.

How to apply for banQi card

Applying for your banQi prepaid card is very simple. Check out the step-by-step in this article and start having financial independence!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in iPED courses

Find out how to enroll in free iPED courses and take advantage of certificates to improve your resume and stay up to date in your field!

Keep Reading

Agibank loan or Creditas loan: which is better?

The Agibank loan or Creditas loan offers low interest rates and facilitates payments. Learn more about them here!

Keep Reading

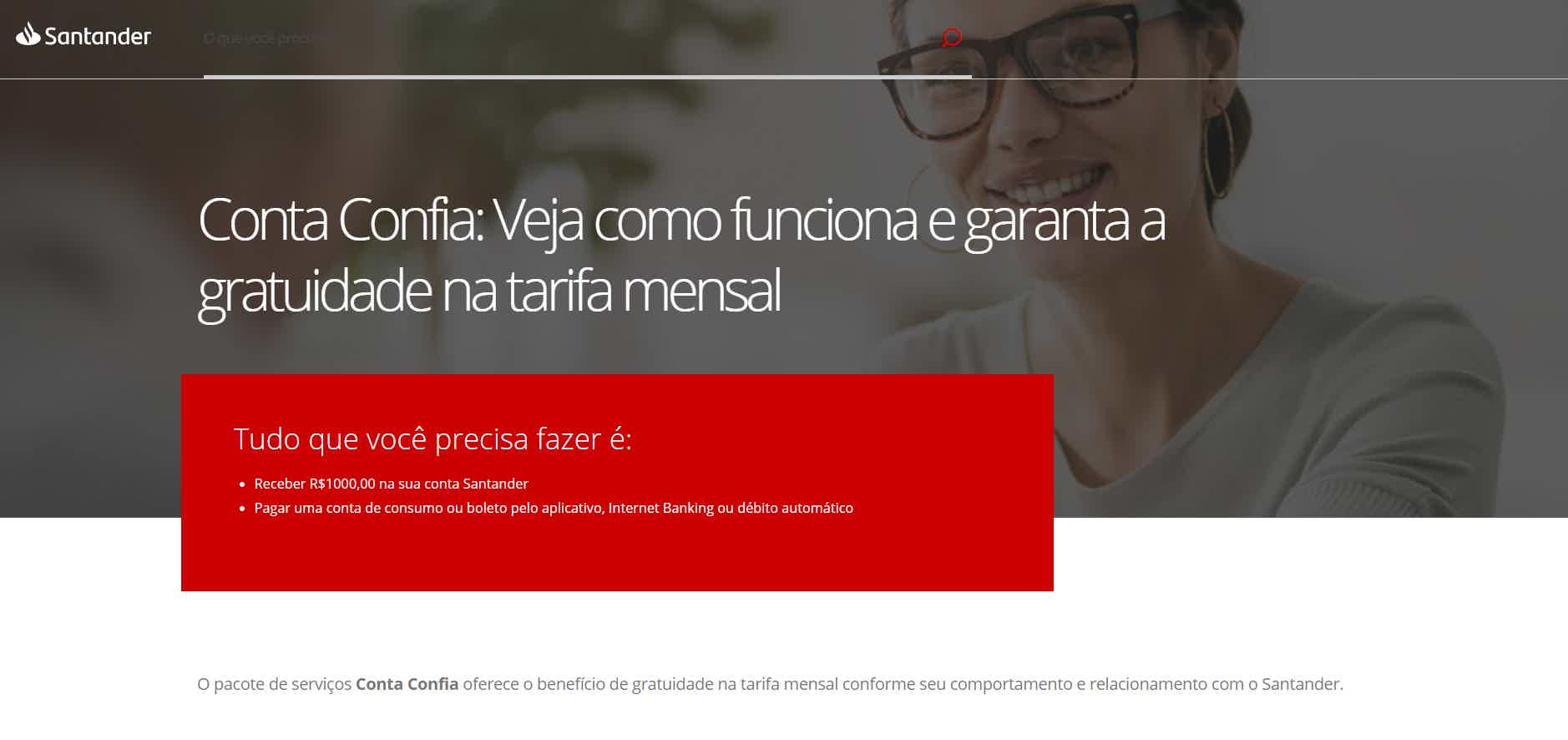

Santander account: how it works

Choose the Santander account and have unlimited withdrawals and transfers, an exclusive application and the possibility of waiving the monthly fee. Learn more here!

Keep ReadingYou may also like

Federal Revenue announces release of the 2022 IR declaration program

According to the Federal Revenue, the program for that year's income tax declaration should only be made available on March 7, when the deadline for declaring the IR begins. Previously, the program was made available in advance.

Keep Reading

Discover the Bunq Credit Card

If you are looking for a credit card to accompany you anywhere, then you need to know and have the Bunq card for yourself.

Keep Reading

Is buying financed house worth it?

When that doubt hits about what to do when deciding on our housing, it is a warning sign: we need more professional information and concrete data on the subject. After all, is buying a financed house worth it? Or is renting a house more advantageous in my current reality? Learn more about it here.

Keep Reading