Cards

Get to know the Minha Casa Melhor card

Did you purchase your property through the Minha Casa Minha Vida program, but now you don't know how to furnish your home? Don't worry! Learn about the Minha Casa Melhor card and see how it can help you.

Advertisement

Minha Casa Melhor Card: find out all the benefits and how to apply

The Minha Casa Melhor card is another benefit for low-income families. In other words, the card is available to families who have purchased a property through the Minha Casa Minha Vida program. With the card, these families have the possibility of furnishing their homes with the available limit.

Therefore, in this post, Mr. Panda will show you the main features of this card and why it is worth applying for. Keep reading and find out more!

| Annuity | not informed |

| minimum income | not informed |

| Flag | no flag |

| Roof | National |

| Benefits | Reduced interest, payment term of up to 48 months. |

How to apply for the Minha Casa Melhor card

Furnish your home with reduced interest rates and extended payment terms. To do this, see how to apply for the card here.

Main features of My Better Home

Firstly, the card is exclusive to families who purchase property through the Minha Casa Minha Vida Program. In this sense, the card is a kind of complement to the Caixa program. To apply for the card, no minimum income is required.

In addition, the limit is variable and can reach R$1,095,000. With it, you can buy furniture and appliances for the property you have purchased. However, it is worth noting that this limit is established according to a credit analysis carried out by Caixa.

Remember that the card has its own brand, as it is exclusive to beneficiaries of Caixa Econômica programs in partnership with the federal government.

Who the card is for

The Minha Casa Melhor card is directly linked to the Minha Casa Minha Vida program. Therefore, only beneficiaries of this program can apply for the card.

Furthermore, they must be registered with CadÚnico, have their registration updated and meet the requirements that already include them in the Minha Casa Minha Vida Program.

Is the Minha Casa Melhor credit card worth it?

As already mentioned, the card limit is a maximum of R$1,950,000.00. In addition, it is exclusively intended for low-income families who purchase properties through the Minha Casa Minha Vida Program. Therefore, to save as much as possible and take advantage of the program's benefits, it is worth applying.

So, now let’s look at some of the card’s advantages to prove its viability.

Benefits

With the Minha Casa Melhor card, the user is entitled to a payment term of up to 48 months to pay the credit installments that were made at the time of purchase of household appliances and furniture.

In addition, users have a credit limit of up to R$1,000.00 to make purchases. And the interest rate is lower, that is, around R$5,000.00 per year for cardholders.

Disadvantages

The card is not available to everyone. Therefore, only beneficiaries of the Minha Casa Minha Vida program from Caixa Econômica Federal can apply for the card.

Remembering that the card does not have a Visa, Mastercard or any other brand that we know of. Therefore, the card is a charitable program for participants in the Caixa program.

How to get a Minha Casa Melhor credit card?

The card request must be made at the Caixa branch closest to your home. In addition, you can use Caixa's call center to contact the branch, request the card in advance and have it shipped. Then, after requesting it, the Minha Casa Melhor card will arrive at the registered address within a few days.

See how easy it is? Check out our recommended content below and see in detail how to apply for your Minha Casa Melhor card and enjoy all its benefits.

How to apply for the Minha Casa Melhor card

Furnish your home with reduced interest rates and extended payment terms. To do this, see how to apply for the card here.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Payroll loan to clear name and renovate home

Have you ever thought about taking out a payroll loan to clear your name and renovate your home, fulfilling your big dream? Find out how to do it right now!

Keep Reading

Discover the Nubank personal loan

With the Nubank personal loan, you can consult all the information directly through the application and have up to 24 months to pay. Know more!

Keep Reading

How much does an App Delivery Person make?

Find out here how much an app delivery person earns, which platforms are available and if it is still worth investing in the profession in 2022.

Keep ReadingYou may also like

What is the best credit card 2022?

The best credit card 2022 is what you need to pay your purchases in installments with peace of mind and have the resource whenever you need it. To learn more about card options without annuity and with various benefits, just continue reading with us!

Keep Reading

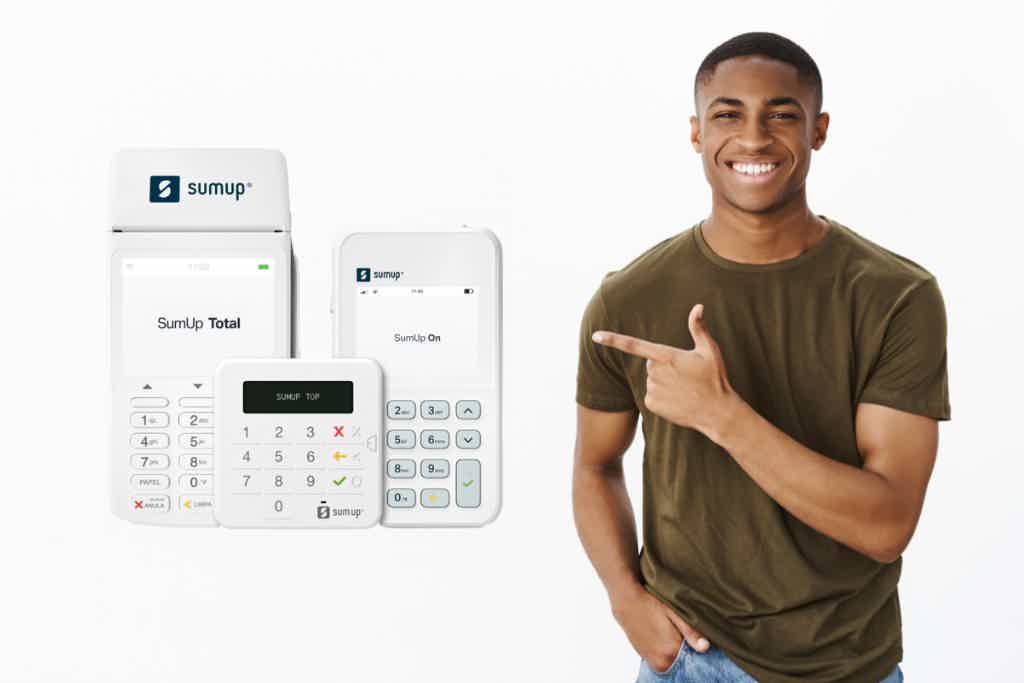

Meet the SumUp card machine

Accept multiple card flags? Have affordable rates for both your business and your customer? All this and much more is possible with SumUp. To learn more, follow the article.

Keep Reading

CGD or Montepio car loan: which is better?

If you want to have more facilities when buying your vehicle, and don't have the down payment to finance it, no problem. With CGD or Montepio car credit, you can make this dream come true. To find out more, just continue reading.

Keep Reading