Cards

Discover the Vooz credit card

Do you want to know everything about how the Vooz credit card works? It offers a reward program associated with the brand, contactless technology and international coverage. So, continue reading to find out how this card can be a great ally in your everyday purchases.

Advertisement

Vooz: enjoy the loyalty program and all the benefits of Visa and Mastercard

Check out how the Vooz credit card works and find out how it can be a great ally in your purchases, as it brings more practicality and security to your daily life. Furthermore, find out about its benefits, such as international coverage, contactless technology, additional cards at no cost and two brand options.

So, continue reading, as we will tell you everything about this card.

How to apply for the Vooz card

Find out how to apply for the Vooz card. It is international, has two flag options and has contactless technology. Check out!

How does the Vooz credit card work?

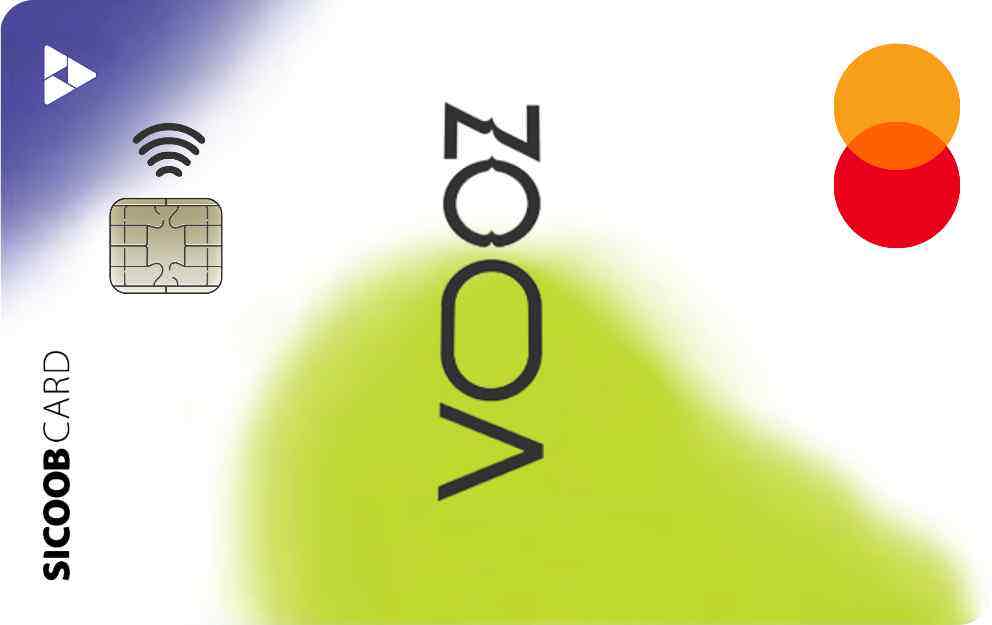

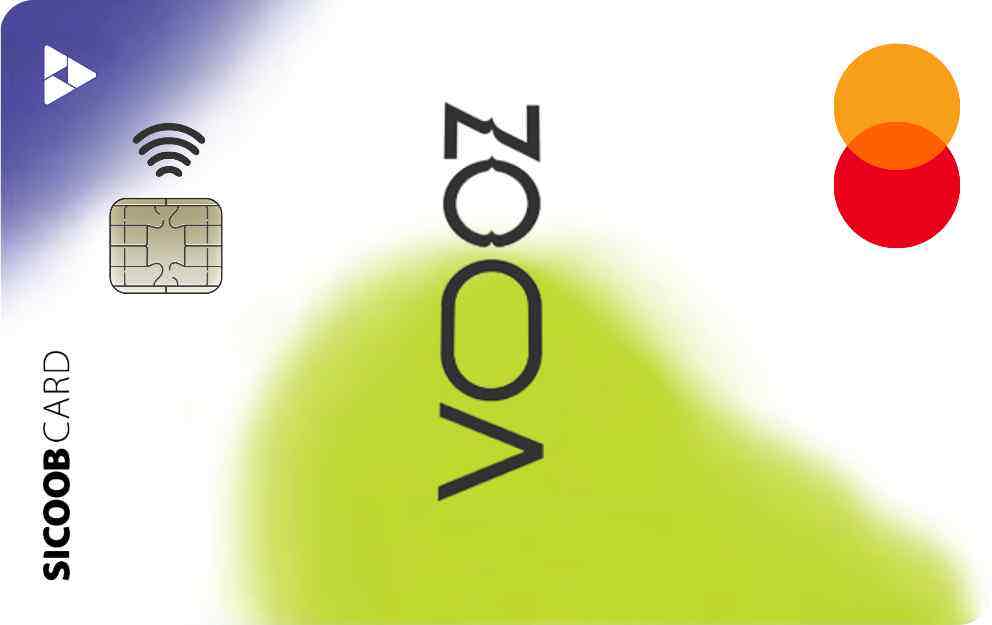

Firstly, the Vooz card works like a credit and debit card, that is, you can make purchases in cash and in installments.

And, in addition, Vooz is an international card, which means you can use it in other countries, however, before traveling you need to release the card for use abroad.

Furthermore, the card has a relatively low annual fee of R$9.90 per month, but you can waive this fee. To do this, just make a monthly purchase, regardless of the value of the transaction. And, we couldn't fail to mention that, when you request Vooz from the cooperative, you leave with it ready!

What is the Vooz credit card limit?

So, according to Sicoob, Vooz's initial limit is R$1,000.00. But remember that the more you use the card, the greater the chances of the cooperative increasing your limit later.

Is the Vooz credit card worth it?

To know whether or not a card is worth it, you need to evaluate its pros and cons. Therefore, we have listed below some information that can help you decide whether this financial product is ideal for your needs. Check out!

Benefits

Among other advantages, Vooz is exempt from annual fees if you make at least one purchase per month, regardless of the value. It also has national and international coverage and two brand options for you to choose from, Mastercard and Visa. Furthermore, depending on your choice, you will be able to enjoy important benefits associated with the brand, such as rewards programs.

And, in addition, you can control all your card transactions through the application, such as, for example, having access to a digital invoice. Furthermore, just go to one of the Sicoob branches and you will leave with your Vooz ready to be used.

Disadvantages

So, one of the disadvantages of Vooz is that even with the possibility of being exempt from the annual fee, if you do not make any monthly purchases, you will be charged a fee of R$9.90.

Furthermore, you must go to one of the Sicoob branches in person to open your account and request the card. So, before opting for this card, check out the other options on the market that accept applications completely online.

How to get a Vooz credit card?

Firstly, to get a Vooz credit card, simply go to one of the nearest Sicoob branches and ask for the account to be opened, so you can have access to the financial product. Furthermore, if you want to know more details about the request, click on the recommended content below.

How to apply for the Vooz card

Find out how to apply for the Vooz card. It is international, has two flag options and has contactless technology. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Leroy Card

You can order the leroy card directly at the store! But check out our article for other ways to get in touch and clear your doubts.

Keep Reading

Get to know the personal loan Banco do Brasil Consignado

Get to know the Banco do Brasil payroll-deductible personal loan and guarantee low interest, up to 96 months to pay and the first payment in up to 180 days.

Keep Reading

How to apply for an Itaú payroll loan

Find out here how to apply for the Itaú payroll loan to start paying in 90 days and also choose the amount of the installments.

Keep ReadingYou may also like

Discover the current account BPI Age Júnior

Looking for a simple account to start your little one's financial education? So, check out, in the following post, everything about the BPI Age Júnior account and find out if it is what you need.

Keep Reading

Right Agreement: negotiate Bradesco debts

Do you have outstanding debts with Bradesco bank? Know that it is possible to make the payment with unmissable payment conditions through the Agreement Right platform. Learn more here.

Keep Reading

Caixa Real Estate Credit what is it?

Do you want to fulfill the dream of owning your own home and live more comfortably in your home? Then learn about the advantages of financing Caixa real estate.

Keep Reading