Cards

Discover the PicPay credit card

Meet the PicPay credit card! Basically, with this card, customers have the advantage of getting rid of the annuity and paying zero fees.

Advertisement

PicPay credit card

The PicPay credit card is a product PicPay is a fintech created in 2012 in Vitória, Espírito Santo. Currently, it is considered the largest application for making payments in Brazil.

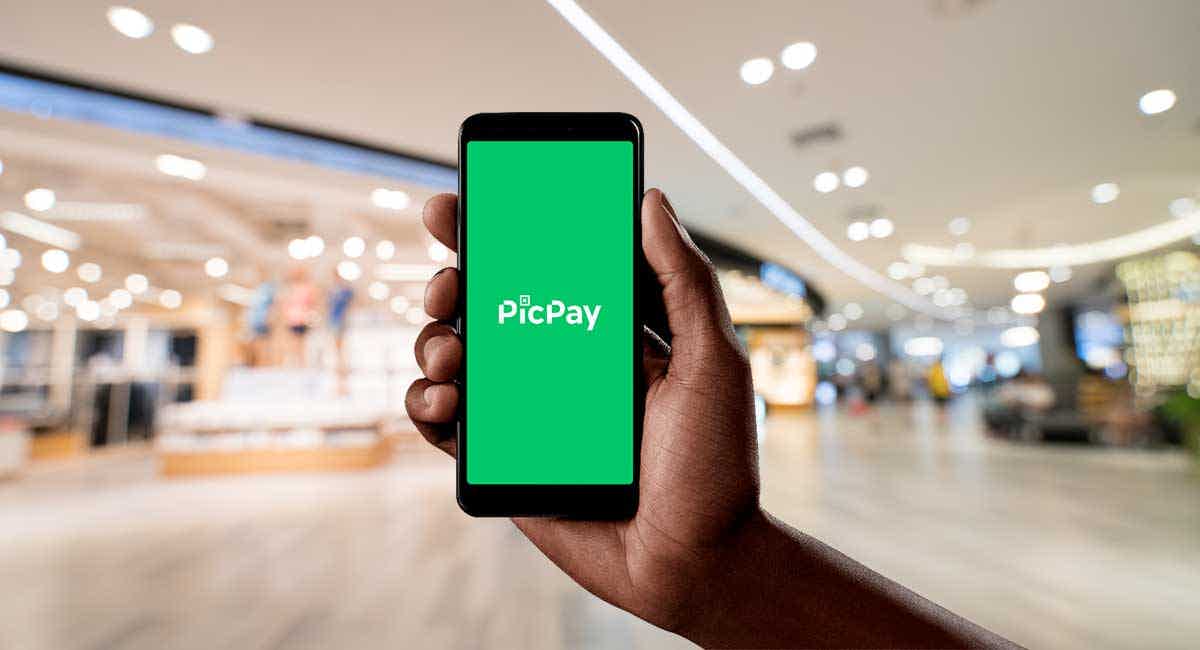

Therefore, it works as a digital wallet, where customers have the option to make payments and transfers directly from their smartphone. So, if you're looking for ease, consider creating an account on the spot.

Above all, in addition to the PicPay credit card, customers also have the option of making payments via debit.

In other words, it emerged as a great alternative for making payments within the financial market. It has even surpassed more than 20 million users looking for practicality.

However, the practicality found in this form of payment is unique, in addition to offering more benefits. Customers who already have access to digital wallets find PicPay easier to perform different services.

However, if you want to leverage the PicPay credit card tools, just use the fintech digital account. Therefore, this is a great option, especially for those who want to achieve more possibilities in their daily activities.

How to apply for the picpay card

The PicPay credit card is a product PicPay is a fintech created in 2012 in Vitória, Espírito Santo. See more here!

| Minimum Income | Minimum wage |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | No annual fee, cashback of up to 5%, versatile card, exemption from maintenance fees and others. |

How does the PicPay Credit Card work?

First off, the PicPay credit card works in different ways, including:

- Possibility to choose the payment method directly in the application;

- Scanning the QR Code at establishments that accept PicPay as a payment method;

- Making the payment by approximation of the physical card in the machines available.

Therefore, when using the debit payment function, the money will be debited from your digital wallet, facilitating the checkout process.

However, the transaction is subject to acceptance, verifying whether or not there is a balance in your account, preventing unduly debits.

That way, when you make payments with the PicPay credit card, the amount will be deducted from the limit available on your card. These payments are made both in physical and virtual stores.

Even so, the customer chooses when he wants to pay for the card bill, and it is necessary to pay the debt on time. Basically, this is true of every credit card on the market.

Furthermore, it is worth remembering that payments via credit are accepted both in national and international stores.

That way, if you are interested in withdrawing money from your PicPay card, just go to a Banco24Horas ATM.

However, the desired amount will be withdrawn from the balance available in your digital wallet and, if you wish, from your credit card limit.

What is the card limit?

However, the PicPay credit card limit can reach up to R $5 thousand. It is important to note that the modalities accepted on this platform are credit and debit.

However, some of the benefits of this card are cashback of up to 5%, without an annual fee, with discounts and various offers through the Mastercard Surpreenda program.

By the way, the card brand is from Mastercard, being accepted in national and international establishments that make this payment available.

Is PicPay credit card worth it?

In addition, one of the main benefits of the PicPay card is, without a doubt, the exemption of fees for maintenance to be carried out, in addition to the zero annuity.

In addition, it is also a versatile card, that is, available for both physical and digital card payments.

However, before opening an account on this platform, it is important to consider the advantages and disadvantages:

What are the vavantages and disadvantages of this card?

Furthermore, the benefits to request the PicPay card are:

- Cashback up to 5%;

- Zero annuity;

- Mastercard Flag;

- Versatile card, that is, it works as debit and credit;

- Installment of any payment;

- between others.

However, the disadvantages of this credit card option are:

- No additional card;

- No access to VIP rooms;

- Only one free withdrawal per month;

- Subject to credit review;

- Cashback credited only after closing the invoice.

How to apply for the Picpay credit card?

First, for you to be able to apply for the PicPay credit card, take into account the following characteristics:

Finally, it is important to emphasize that the customer is subject to credit analysis.

How to apply for the picpay card

The PicPay credit card is a product PicPay is a fintech created in 2012 in Vitória, Espírito Santo. See more here!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Carrefour Mastercard Gold card

The Carrefour Mastercard Gold card has international coverage and offers exclusive benefits for network customers. Check out!

Keep Reading

PicPay Card: no annual fee and installments in 12 installments

Get to know the PicPay Card here firsthand and be surprised by its benefits, such as payment in installments, zero annuity and much more.

Keep Reading

How to apply for Sou Barato card

The Sou Barato card is easy to apply for, as well as offering special offers and discounts for customers. See here how to order yours right now!

Keep ReadingYou may also like

Meet the XP broker

Learn more about XP Investimentos, a reference in the financial market. With it, you can start investing in fixed income with just R$ 30.00. Read this post and check out all about it.

Keep Reading

How to open an Itaú Gamers account

Are you looking for a fee-free digital account with many benefits? You just found it! So, find out how to open your Player's Bank account at Banco Itaú to enjoy various advantages and features.

Keep Reading

Get to know the Personal Credit of Agricultural Credit

The customized personal loan from Crédito Agrícola allows you to use the loan amount for whatever you want. See here how this credit works and learn how to join.

Keep Reading