Cards

Discover the Gol Smiles credit card

With this card, all your purchases can be converted into miles so you can save on your next trips! In addition, it gives you access to VIP lounges and allows you to board and check in without queues. Learn more below.

Advertisement

Pay your tickets in up to 12 installments

Do you travel a lot and want to access more benefits in upcoming destinations? So, you need to know more about the Gol Smiles credit card.

With this card, you can pay your Gol airline tickets in up to 12 installments and even access VIP lounges and preferential boarding on flights so you never have to queue again!

| Annuity | From R$ 26.00 |

| minimum income | From R$ 1,500.00 |

| Flag | Visa |

| Roof | International |

| Benefits | Miles expire after 3 years You can pay tickets in up to 12 installments Access to the Smiles Club to multiply points |

In addition, the Gol Smiles credit card also has an unmissable miles program that allows you to save on your next trips and fly with more than 50 Smiles partner companies!

Did you like what you saw so far about the Gol Smiles credit card? So get to know much more about him with us in this post!

What are the main characteristics of the Gol Smiles card?

In summary, the Gol Smiles credit card is a credit card created especially for those who like to travel and seek more benefits and comforts in their next destinations.

Namely, this card offers a miles program where all your purchases made with it offer miles for you to accumulate.

That way, you can use the miles to buy tickets or book hotels! Here, its main differential is that it is not necessary to transfer miles to any company! Just accumulate and go out using.

To offer all this, today there are 4 models of the Gol Smiles credit card, which you can access in the International, Gold, Platinum and Infinite modes.

All of them are issued under the Visa brand and offer various services, insurance and special benefits of that brand.

In addition, Smiles also has the Smiles Club, where you can earn up to 4 miles for every dollar spent and earn up to 20,000 bonus miles by joining the club!

Who is the card for?

At first, the Gol Smiles card is more suitable for people who usually travel more and who want to access some advantages on their next trips.

Here, it is also important to consider that each card offered by Smiles has a minimum income that must be proven in order to apply for it.

Therefore, it is important to be aware of this information to apply for the card that best suits your financial life.

Is the Gol Smiles credit card worth it?

So far you have been able to learn about the main features of the Gol Smiles credit card and see how it works.

But is it really worth having this card to earn miles? So that you can find out, we have separated below the main advantages and disadvantages of the Smiles card.

Benefits

Miles valid for 10 years, bonuses when renewing the club and access to VIP lounges are just some of the advantages you can access with the Gol Smiles credit card.

So, below we separate some more benefits that this card can offer!

- You do not need to transfer miles to use them;

- Earn return miles when using your card on trips;

- Boarding and preferential check-ins on Gol flights;

- Pay your tickets in up to 12 installments;

- Price and purchase protection;

- Extended warranty for your purchases;

- And much more!

Therefore, with the Gol Smiles credit card, it is easier for you to travel comfortably and more economically when using the miles accumulated on the card.

Disadvantages

On the other hand, despite the advantages, the Gol Smiles credit card also has its negative points.

Firstly, all cards have an annual fee and there is no way to get a discount for the amount of purchases made.

In addition, the cards can only be accessed under the Visa brand, and it is not possible to issue a Gol Smiles card under the Mastercard brand.

How to apply for a Gol Smiles credit card?

In summary, applying for a credit card is very simple and can be completed on the Smiles website.

That way, to follow the complete step-by-step process to apply for the Gol Smiles credit card, stay with us and check out the following post that shows all the guidelines on applying for your card!

How to apply for the Gol Smiles card?

Check out the complete step-by-step for you to order your Gol Smiles card!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What to sell to make money: 15 ideas for you

Check out our content on what to sell to earn money and find out how to get extra income at the end of the month.

Keep Reading

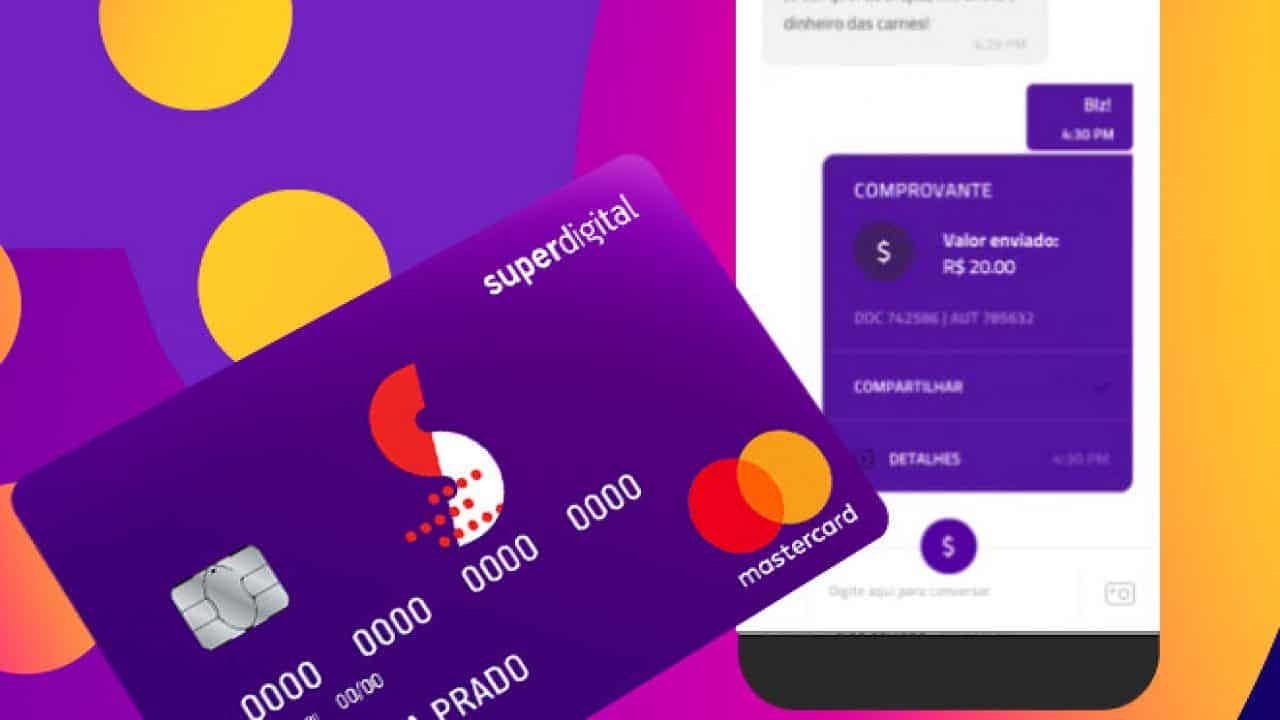

Superdigital card or Bradesco DIN card: which one to choose?

Either the superdigital card or the Bradesco DIN card, both are prepaid, offered by reliable banks and full of offers! Check out!

Keep Reading

How to send resume to Americanas? Check it out here

Learn in this post how to send resume to Americanas and know the requirements that the vacancies of this great retailer have!

Keep ReadingYou may also like

Find out which are the 10 best selling cars at auctions

The best selling cars at auctions are of various models and offer benefits at a good price. Discover the top 10 bestsellers!

Keep Reading

Which financial application yields the most?

Learn once and for all what a financial application is and how to start investing in one today! Your money needs to multiply, so invest!

Keep Reading

Discover the Social Bank digital account

Want a digital account? Social Bank can be a great alternative to give you more financial autonomy and day-to-day practicality.

Keep Reading