Cards

Meet the woman cashier credit card

Do you know the Caixa Mulher credit card? Be aware that it stands out for being free and providing numerous benefits, even without fees. Check it out here!

Advertisement

Woman cashier credit card

Discover the Caixa Mulher credit card today. It is available to Caixa Econômica customers and offers several benefits and amenities.

This card appeared in 2020. It has the Elo brand, which is Brazilian in nature and is already in more than 130 million establishments. With that, it starts with the benefits specific to the flag. Furthermore, it is international, and therefore more comprehensive.

In addition, the card has a series of customizable advantages. In other words, you can choose the ones that best fit your profile and needs.

Therefore, this card revolutionizes by allowing consumers to choose their benefits. And all this, in fact, without paying fees! To learn more about everything this credit option can do for you, keep reading.

How to apply for a cashier card

See here how to apply for the Caixa Mulher card, an exclusive product for women launched by Caixa Econômica Federal.

How does the Caixa Mulher credit card work?

This card works in the same way as other similar cards. In other words, it allows purchases by debit and credit. For this, there is a limit that is set by Caixa Econômica itself according to the customer's profile. Therefore, at the end of each month there is an invoice that must be paid to maintain the services.

The card's brand is Elo and it has national and international coverage. That is, it allows purchases in Brazil and abroad. This further increases its possibilities of use, whether in person or on the internet.

The Caixa Mulher card is exclusive to CEF customers. Therefore, only those who already have a current account at the institution can apply. To be successful in the application, it is essential to have a bad name.

This is because the CEF performs a prior analysis regarding the existence of outstanding debts registered with the SPC or Serasa. Therefore, one of the requirements is the regular status of the CPF.

Furthermore, this is a card exclusively for women. In other words, only women can apply for it, so men must seek other alternatives.

What is the limit on a Caixa Mulher credit card?

The Caixa credit card limit depends on the credit analysis and profile of each customer. Therefore, the better the consumer registration score, the greater the chances of a good limit. They also grow according to their good relationship with the CEF and transparency in registrations.

Is the Caixa Mulher credit card worth it?

See what the advantages and disadvantages of the Caixa Mulher Card are to find out whether it is worth it or not!

free annuity

However, this card is a good alternative as it does not charge an annual fee. Thus, it offers a series of benefits even without charging fees.

Choose your benefits

The great highlight of the Caixa Mulher credit card is that it allows personalization of benefits. It is possible to choose up to 5 benefits. So, here are some that you can use:

- See some of the benefits you can choose and use for free:

- Free access to more than 1,300 Eduk courses;

- Elo tranquility assistance (personalized advice)

- Funeral assistance;

- Bike convenience, (bike insurance);

- Body and mind (fitness, nutritional and psychological guidance);

- Automotive care (beautification, cleaning, overhaul);

- Deezer;

- Offers and discounts;

- Pet convenience (free consultations and other emergency care);

- Promotions and prizes;

- car insurance;

- Travel insurance;

- Home services (protection and adaptation of the home for the elderly or children, furniture installations and revisions);

- Free Wi-Fi, etc.

Credit analysis

However, one negative point is that only people with a clean record can obtain it. Therefore, those with outstanding debts with the SPC or Serasa cannot obtain it.

Exclusive for women

However, not all CEF customers can obtain the Caixa Mulher card. After all, it is exclusive to the female audience.

How to get a woman cash credit card?

You can apply for your Caixa credit card directly on the institution's internet banking app. However, you can also apply by phone. You can also apply in person at CEF branches.

How to apply for a cashier card

See here how to apply for the Caixa Mulher card, an exclusive product for women launched by Caixa Econômica Federal.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How much does a 2022 App Driver make?

Find out firsthand how much an app driver earns in 2022 and see if it's worth investing in the profession these days.

Keep Reading

How to apply for the C6 payroll loan

Do you want to know how to apply for the C6 Payroll Loan? In today's article, we'll show you step by step. Read now and find out!

Keep Reading

How to apply for the Piki loan

See here how the Piki loan application process works and be able to borrow up to R$2,500.00, which will be credited to your account in 1 business day!

Keep ReadingYou may also like

How to open a current account CEMAH Especial Particulares

Are you looking for a current account designed for you and with less commissions? Then see how to open your Special Particulars account at CEMAH and have access to everything you need. See more information below.

Keep Reading

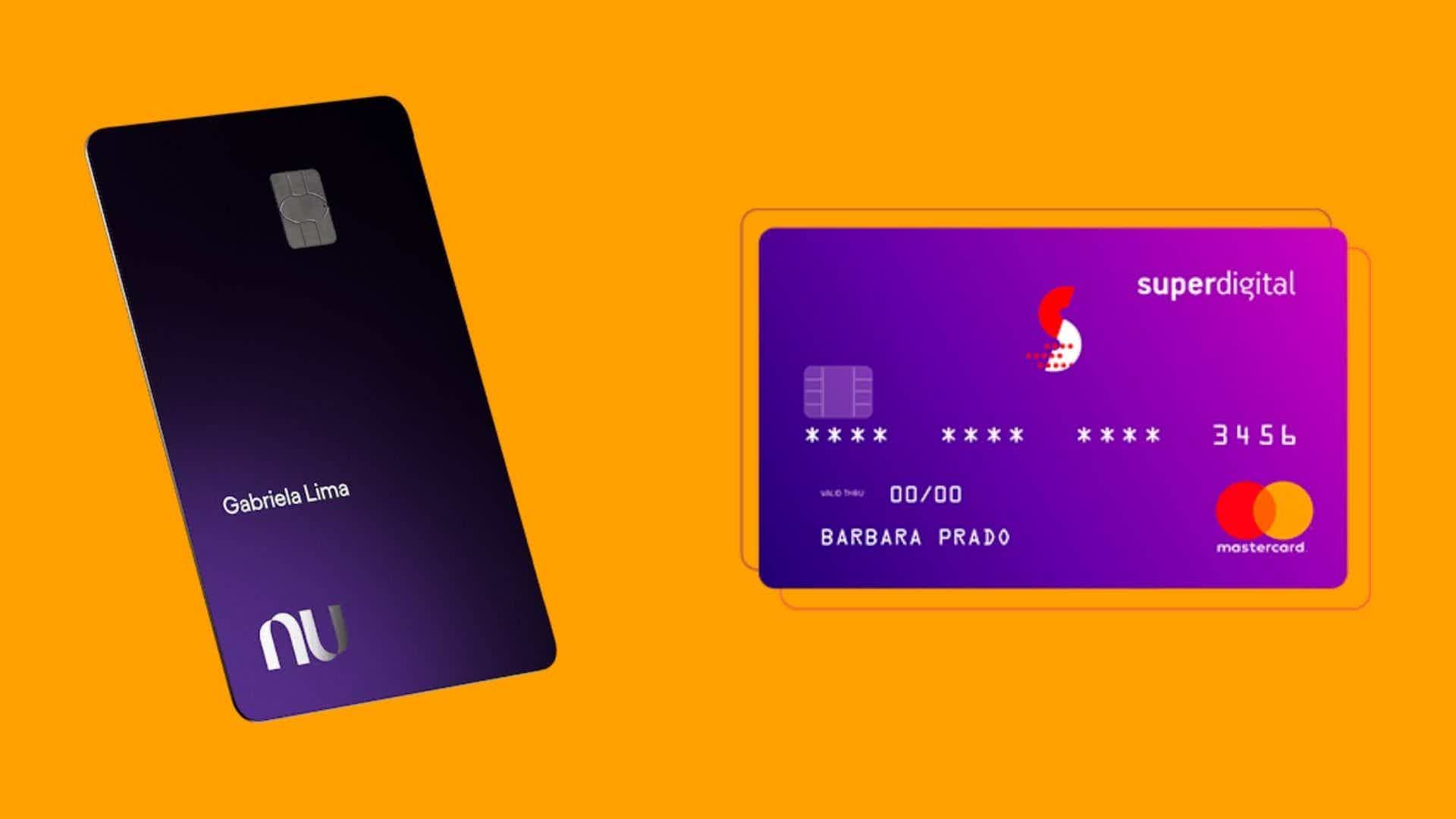

Nubank Ultraviolet Card or Superdigital Card: which is better?

Among the credit card options on the market, many offer exclusive advantages and varied conditions. Some are more demanding, and others not so much. In that case, what might be the best option: Nubank Ultraviolet card or Superdigital card? Find out here!

Keep Reading

Discover the Itaú Samsung credit card

Do you already know Itaú Samsung? This credit card full of style and full of advantages can be your new ally. That's because it offers more practicality and security to make your day to day easier. Learn more about him here.

Keep Reading