Cards

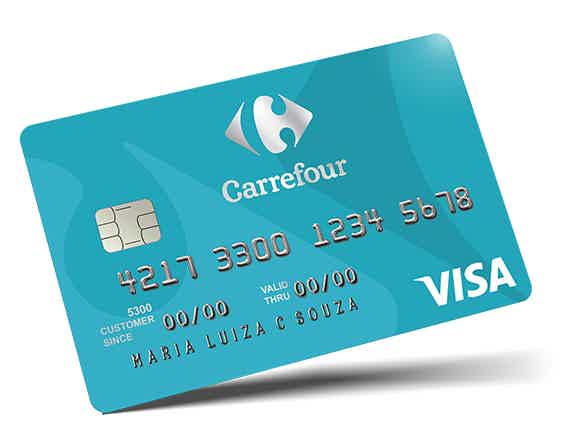

Discover the Carrefour Visa Gold card

Looking for a card that will give you access to the best deals at Carrefour stores? Get to know the Carrefour Visa Gold credit card and request yours to enjoy all the benefits.

Advertisement

Carrefour Visa Gold Card: exclusive benefits and offers for you

Today Mr. Panda will introduce you to the Carrefour Visa Gold card. So, another credit card modality from one of the largest retail stores in the country. Thus, with its card, Carrefour seeks to offer customers the possibility of buying at the chain's stores at different prices, offering exclusive promotions.

In addition, Carrefour Visa Gold has international coverage and has several other advantages, both from the brand and offers by Carrefour itself. That is, it is information such as these characteristics, advantages, disadvantages and how to request that we will bring to you in today's post.

So, read on and find out all about the Carrefour Visa Gold card!

| Annuity | 12x of R$14.99 Exempt if you buy 1x at Carrefour |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | It goes from Visa, price protection, travel assistance, Visa Checkout. |

How to apply for the Carrefour Visa Gold card

Learn how to apply for the Carrefour Visa Gold card and access Vai de Visa benefits and exclusive offers at Carrefour stores.

Main features of Carrefour Visa Gold

The Carrefour card is made especially for store consumers, that is, it is recommended for those people who make frequent purchases at any Carrefour store, whether at hypermarkets, drugstores or gas stations.

However, the card can also be used outside the network, considering that it has the Visa flag, considered one of the most accepted worldwide. In fact, your Carrefour Visa Gold card has international coverage, allowing you to make purchases in Brazil or abroad.

Other points to be considered here in relation to the characteristics of the card is the annual fee. Therefore, when acquiring the card, the customer is aware of the monthly charge of R$14.99. However, this annual fee may be free and, for this, it is enough that at least 1 monthly purchase is made at a Carrefour store.

In addition, important requirements to be considered when applying are the requirement of proof of income and the credit analysis carried out. So, on this last point, it is worth mentioning that it is very likely that the customer with a negative name will not get the card approved.

So these are the main features. In addition, the card has advantages and disadvantages that we will show you below. But first, check which audience Carrefour Visa Gold is indicated for.

Who the card is for

The Carrefour Visa Gold card is very similar to the Mastercard card, with a different brand and some specific functions that can be found on both cards.

Therefore, in view of some advantages that we will emphasize later on, such as exclusive offers in the chain's stores, the card is more suitable for the Carrefour consumer public.

In addition, to apply for the card, you must be over 18 years old, have proof of minimum income and have no credit restrictions.

These are the criteria that indicate the target audience for the Carrefour card. Now, check out all the advantages it offers its users.

Is the Carrefour Visa Gold credit card worth it?

Benefits

Therefore, the first advantage of the card is the exclusive promotions for customers who pay for their purchases with the card.

Besides, with the current price of fuel, it's always good to be able to take advantage of installments, isn't it? With your Carrefour card this is possible. When refueling at Carrefour stations, you can pay your purchase in installments.

The Carrefour card has a price protection function for its users, this protection prevents the holder from making purchases at unrealistic prices and comparing with several other places.

In addition, for Visa-branded cards, we always have the exclusive benefits of Vai de Visa. Which is an exclusive program for cards with that flag.

Finally, we have travel assistance offered by the card, which is a benefit related entirely to travel. In other words, it is a benefit that helps customers on trips they want to take with financial security.

Disadvantages

For people who want to know if there is a way to have zero annuity, it is possible! However, only for those who use their credit card at Carrefour establishments.

The Carrefour card, in addition to charging an annuity, has fees related to the IOF. Fees that are often not charged on other credit cards.

How to make a Carrefour Visa Gold credit card?

Quite simply, the Visa card can be requested through the website. Therefore, follow the step by step to be able to apply for your Carrefour credit card:

- First, go to the Carrefour website;

- After that, go to your interest card option;

- Then, access the request option;

- Now fill in the presented form;

- Ready! Just wait for the approval time.

Anyway, see how simple it is? So, go to the website and request your Carrefour Visa Gold card!

How to apply for the Carrefour Visa Gold card

Learn how to apply for the Carrefour Visa Gold card and access Vai de Visa benefits and exclusive offers at Carrefour stores.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to become a Loggi courier?

See in this post what are the requirements to work as a Loggi courier and how you can register.

Keep Reading

Afinz Card or Santander SX Card: which is better?

There are several similarities between the Afinz card and the Santander SX card, such as international coverage and discounts with partners. Read this post and learn more!

Keep Reading

Zencard card or Ultraviolet Nubank card: which is better?

Decide between the Zencard card or the Nubank Ultravioleta card and enjoy advantages such as club discounts and cashback, respectively.

Keep ReadingYou may also like

Pan Mastercard Internacional credit card: how it works

Get to know the Pan Mastercard International card and discover its advantages, such as the Pan Mais program. In addition, the card is issued by Banco Pan and has international coverage. Check out more details here!

Keep Reading

Discover the online English course Rachel's Academy

Do you want to learn English in an easy and intuitive way? Ráchel's Academy platform is a teaching method and can help you. Continue reading and learn more.

Keep Reading

Novo Banco Mortgage Credit: what is it?

Want to conquer your own address? So, check out the advantages of Novo Banco Mortgage Credit and finance up to 90% of the property. Check out!

Keep Reading