Cards

Discover the BV Único card

The BV Único card is available under the Visa Infinite brand. It offers 1.5% cashback on your purchases and the possibility to save that money in a free digital account. Learn more here.

Advertisement

BV Único Card: the ideal card for your profile

The BV Único card is one of the many credit cards offered by BV for its customers to apply for and have access to a series of advantages such as cashback and much more.

In addition, it has the Visa Infinite brand, which in itself already offers some advantages for the cardholder. So, you can see that there are many benefits.

There are several plans and insurance, in addition to 1.5% cashback on all purchases. That is, it is a perfect card for those who are able to pay the relatively high annuity.

Anyway, let's talk about that and much more. So, don't leave there and get to know all the details about this credit card with us.

| Annuity | 12x of R$59.90 Exempt if you spend R$ 10,000/month |

| minimum income | not informed |

| Flag | Visa Infinite |

| Roof | International |

| Benefits | Cashback and VIP Lounge at airports |

How to apply for the BV Único card

1.5% cashback, VIP Room, free digital account and another world of benefits. Check out!

Main features of BV Único

The most common features found in this card are the aid and various insurance. There are many and each one of them has a specific function to give even more attention to card users.

For this reason, many customers describe this card as a more personal product that cares a lot about the cardholder. This is shown, for example, through the home and funeral assistance that the card has.

Available under Visa, it has international coverage, gives you access to a free BV digital account, virtual card and additional card.

Anyway, the card has another series of advantages like pix and unlimited transfers, cash income and much more.

That is, when it comes to advantages in purchases and values, the BV Único card is by no means behind. Just analyze the advantages and features.

Who the card is for

The main features that we can see right away in this card are the very specific benefits and functions that it offers to cardholders and families of card users.

Therefore, it is a card suitable for the whole family, because when ordering online, the customer can already request an additional card.

In addition, it is also highly recommended for buyers who like to receive cashback and, above all, those looking to save. This specific card provides 1.5% of cashback on purchases. The customer can choose to save this amount in a BV digital account that yields more than savings.

Is the BV Único credit card worth it?

As it is not yet a well-known company, what most draws attention to people who analyze this card is to find out if it is really good, as well as the number of benefits and functions it offers to the cardholder.

In this sense, we can really say that there are many, such as, for example, aid, insurance, special plans, partner discounts, cashback and exclusive benefits of Visa brands.

In addition, when requesting the BV Único card, the customer can, together, open a BV digital account, where all the money from their cashback can be earned.

These and many others make up the entire card and form a great credit service.

However, all these advantages do not come for free, as there is an annuity charge and the amount is R$718.80 per year or R$59.90 am. Therefore, it may be slightly above the acceptable amount for most people with low incomes.

Finally, analyzing the BV Único card as a whole, it can be said that it is really worth it, as it offers many services and benefits. However, it is more suitable for people with greater purchasing power who spend more with their credit card.

Benefits

First, the card offers 1.5% of cashback on all your purchases and also gives you the possibility to save this amount through the digital account that yields more than savings. Furthermore, by purchasing the BV Único, the customer has access to the exclusive benefits of Visa Infinite brands, such as Free Valet in shopping malls, VIP Room, Visa Luxury Hotel Collection, Visa Airport Companion, among others.

In addition, BV offers insurance that aims to help and protect the cardholder against damage that may occur at their home, such as damage or emergency events. In addition, card insurance protects the owner against improper operations and other irregularities that may cause financial damage to the holder of the BV Único card. It is worth remembering that these insurances are optional and may incur an additional charge.

We cannot fail to mention other advantages, such as discounts with Banco BV partners, residential and vehicle assistance, bill payment in up to 24 months, among others.

Disadvantages

Despite offering a series of incredible advantages to the cardholder, it is not exempt from having to pay an amount related to the annuity. Therefore, you must pay an annual fee of R$59.90 per month to continue using the card and having access to all its benefits. However, if you spend at least R$ 10,000 per month, you will be exempt from the annuity.

How to make a BV Unique credit card?

You can apply for the card through the website or app. Just choose the best or the most affordable way. However, the most common way and where you can get more information is on the website itself.

Therefore, the application procedure to make your card is quite simple. Just access the website and choose the BV Único card.

Once you choose, just click on the option to order now. At the same time you will be redirected to a page where you will have a form to fill out.

Therefore, fill in all fields with the updated information that BV has requested. Once you provide personal information, you must fill in your residence information.

Ready! After all, your request will be forwarded to the BV team and you will be notified of the possible approval within 5 business days via email regarding the BV Único card.

Also, if you want to know more about the application process, read our recommended content below.

How to apply for the BV Único card

1.5% cashback, VIP Room, free digital account and another world of benefits. Check out!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Ame Digital account

Do you already know the Ame Digital account? In today's article, we'll show you the pros and cons of this account. Continue reading and discover more.

Keep Reading

Digital account: how it works

Learn how the Digio account works and how it can help you make your money yield more than savings without bureaucracy and safely.

Keep Reading

How to earn miles with the Porto Seguro card: understand the process

See in this post how to earn miles with the Porto Seguro card and check out the main features that this card can offer!

Keep ReadingYou may also like

How to open a EuroBic Prime current account

Do you want a current account with more facilities for everyday life? If so, take the opportunity to check out, in the following post, everything about the EuroBic Prime account, which makes managing your finances even simpler.

Keep Reading

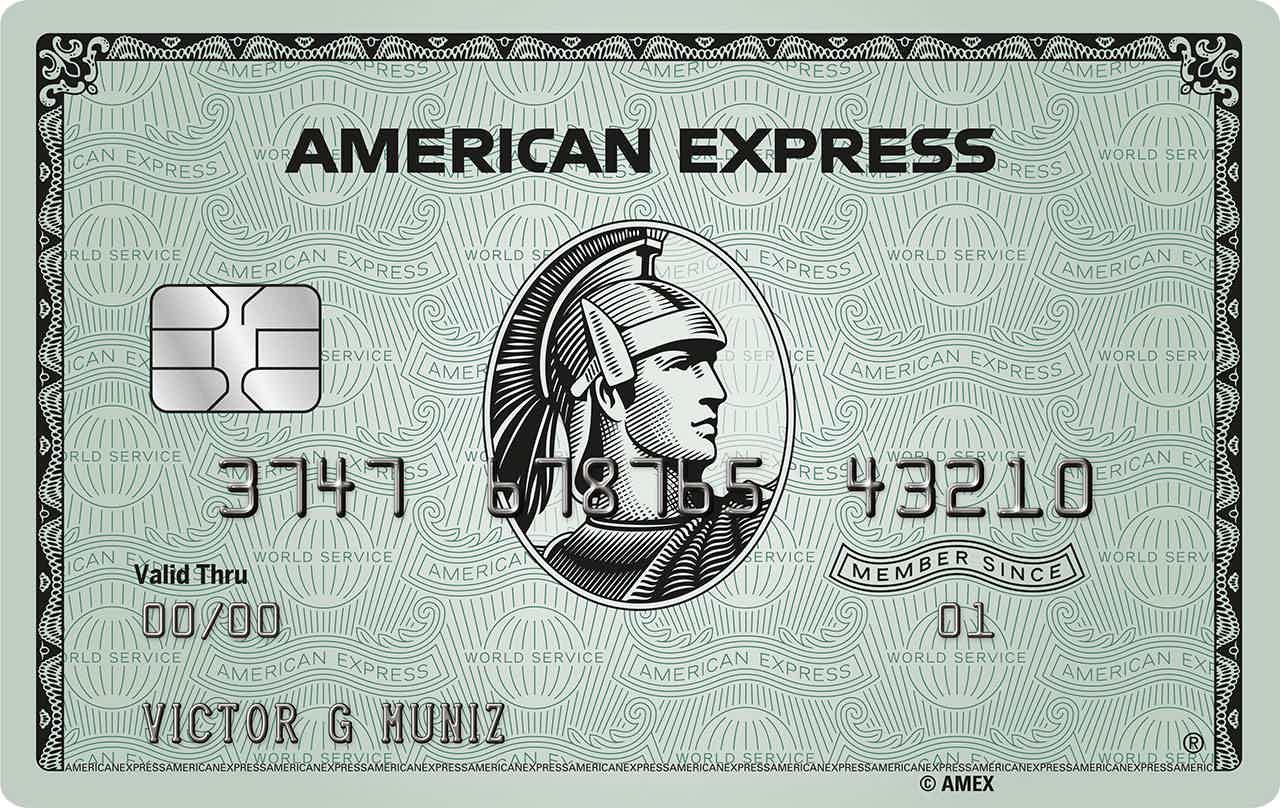

Discover the American Express Green Card

Do you know the American Express Green Card? It is a great financial product. Continue reading and learn all about this plastic.

Keep Reading

How to open an Atlantico Europa Plus account

At Atlantico Europa you have access to a full current account via the application and can take advantage of all the features of the Plus plan for just €5.99 per month. Check below how to register online.

Keep Reading