Cards

Discover the Bradesco Infinite card

Bradesco Infinite is the ideal card for those who want a card with exclusive benefits and VIPs. This is Bradesco's premium line with great advantages. Discover them all in this article!

Advertisement

Bradesco Infinite Card: for those who want exclusive benefits

When you've been in your financial life for a while, it's common for you to want access to increasingly exclusive advantages. Therefore, financial institutions offer cards to their Premium customers. One example is Bradesco Infinite.

It has insurance, protections and personalized 100% service. In today's article, we will show you all the details of this card. Continue reading and find out more!

| Annuity | 12x of R$ 83.00 |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Support services around the world Livelo scoring program |

Bradesco Infinite main features

Initially, the Bradesco Infinite card offers several exclusive advantages. But it is worth remembering that all of this is within the value of the 12x annual fee of R$ 83.00 (R$ 996.00). Although the value is high, it fulfills the purpose of being aimed at a select group of customers.

Therefore, Bradesco Infinite has contactless purchasing technology. In other words, you can make your purchases quickly, just by bringing the card to the machine. Furthermore, with it, you also have access to personalized concierge service.

In this sense, the concierge assists you in all travel matters. They can also help you with the itinerary, choosing the hotel, tickets and even tours during your vacation. All this 24 hours a day.

Furthermore, the Bradesco Infinite card has a partnership with Livelo, to guarantee an excellent points program. This way, for every dollar spent, you earn two points. These accumulated points can be exchanged for more than 700 thousand rewards. Including trips, airline tickets and even products in the Bradesco Loyalty Program.

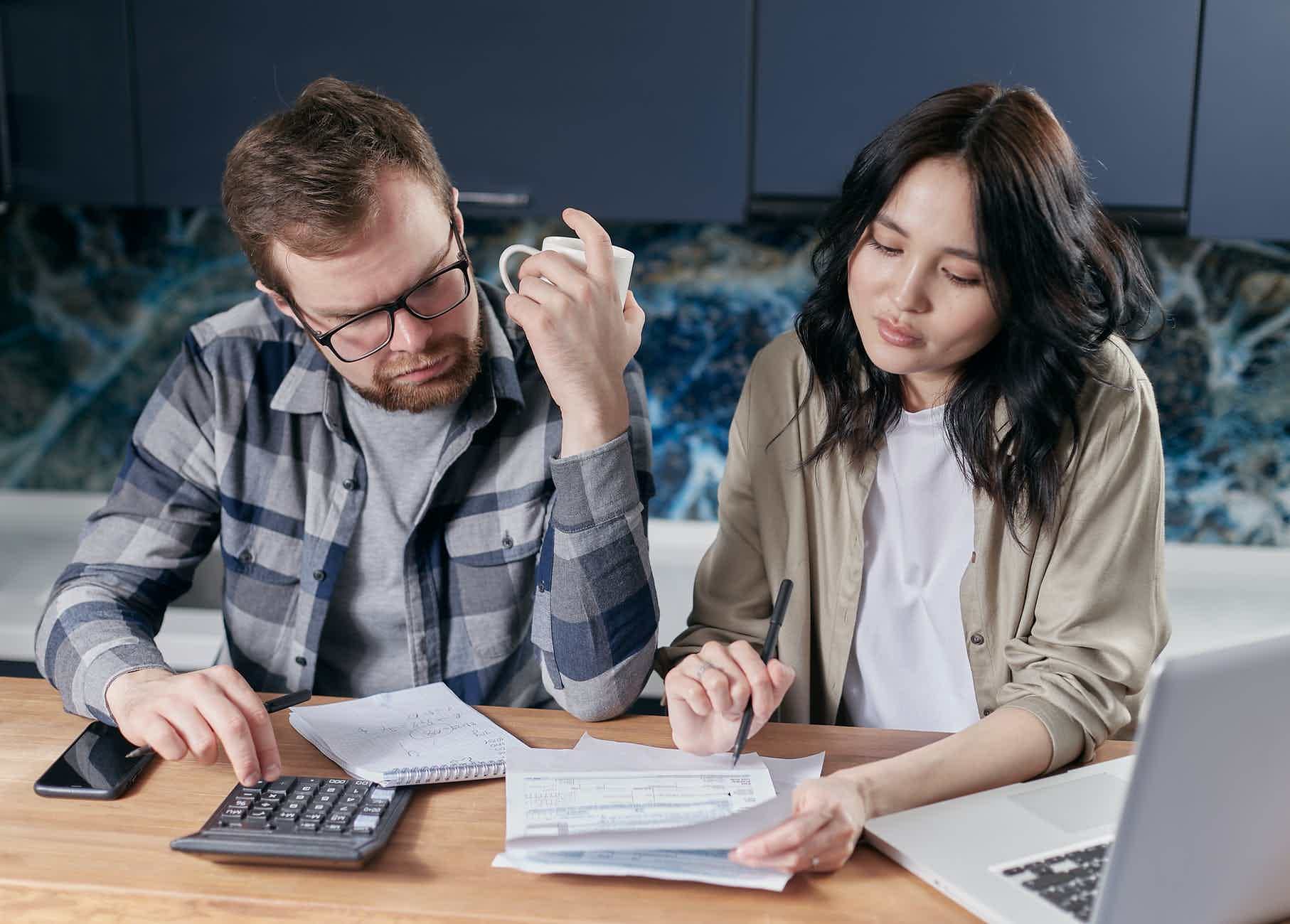

Who the card is for

In short, as we already mentioned, the Bradesco Infinite card was created to serve the financial institution's Premium customers. Therefore, the card is recommended for those who already have a much higher income. Furthermore, it is also recommended if you already travel a lot internationally. This is because the card has exclusive international assistance services.

Is the Bradesco Infinite credit card worth it?

After all, the Bradesco Infinite card can be a great option for those looking for a card with super exclusive benefits. As well as for those who are very picky about the credit card they use. Check out the pros and cons below!

Benefits

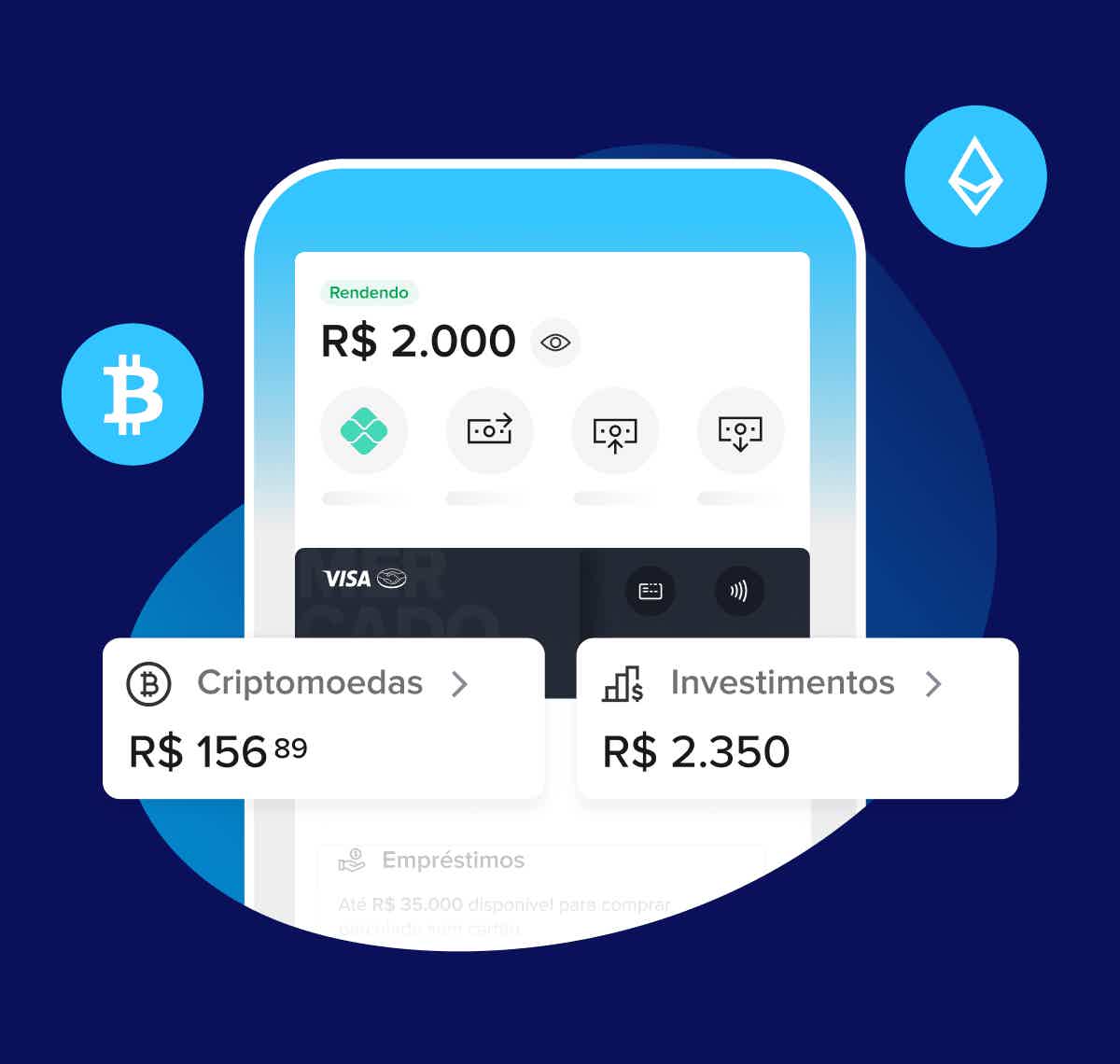

Firstly, the Bradesco Infinite card has the Livelo points program. With it you accumulate 2 points for every dollar. This way, you can exchange it for airline tickets, trips and special products. In fact, joining the program is automatic, just use your card!

Furthermore, as we mentioned, the card has exclusive advantages for those who travel a lot. In this sense, with the Visa Luxury Hotel Collection, you can have access to the most exclusive hotels in the world. As well as 4 free access to the VIP Rooms of the LougeKey Program. In other words, your travel experience will be much better with Bradesco Infinite.

Disadvantages

In general, the main disadvantage of the Bradesco Infinite card is the high annual fee. This is because its benefits are good and compatible with the product category. However, the annual fee of R$ 996.00 can still be a bit heavy.

How to get a Bradesco Infinite credit card?

Finally, now that you know the Bradesco Infinite credit card, you still need to know how to apply for yours. In short, the request can be made online. In other words, all without having to leave your home. In fact, to apply you must present a document with photo, proof of residence and proof of income.

In this other article, we show you the complete step-by-step guide to requesting your Bradesco Infinite. Continue reading and check it out!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for Creditas Reforma credit

Do you want to renovate your property with freedom to spend your money? Then, the Creditas Reforma credit could be ideal for you! Check here how to apply.

Keep Reading

How to apply for the BxBlue loan

Learn how to apply for a BxBlue payroll loan online, as well as other useful information about this loan that accepts bad debts!

Keep Reading

How to query CPF by name

Learn now how to query the CPF by name in this article. In addition, we will show you some precautions with your registration. Check out!

Keep ReadingYou may also like

What is the difference between SPC and Serasa

A lot of people think that SPC and Serasa are the same thing. But be aware that there are differences between the two credit protection bodies, such as the source of your database information. So, check out its main features below and understand how they can influence your consumer profile!

Keep Reading

How to open a Mercado Pago account

The Mercado Pago account is the option you are looking for to improve your finances and have more security in your transactions. To see how to ask and how it can help you, see more information in the topic below.

Keep Reading

How to register for Happy Child

This program can help you in many ways and in different areas in children's lives, from schooling to access to quality education. See how to apply in this article.

Keep Reading