loans

Condor Loan or Free Digital Loan: which is better?

Need a loan referral? Today we are going to introduce you to two loans. The Condor loan is a payroll loan with fair rates. The Free Digital loan, on the other hand, is a personal loan with particularities. Continue reading and find out more!

Advertisement

Condor x Livre Digital: find out which one to choose

If you already know and don't know how to choose between the Condor loan or the Free Digital loan, today we're going to help you. Also, if you don't know the two, we'll also introduce you.

That's because choosing an ideal loan can be a difficult task. It is essential to consider interest rates, the contracted modality and also the credit limit. So let's compile all this information.

At first, the Condor loan is consigned. The Free Digital loan is an online personal loan. That is, the two have different proposals for different audiences.

So, read on and find out more about these two loans!

| Condor Loan | Free Digital Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1,69% per month | not informed |

| Deadline to pay | depends on the loan | Within 12 months |

| release period | after hiring | Within 1 business day |

| loan amount | Uninformed | Between R$100 and R$ 6,000 |

| Do you accept negatives? | Yes | Yes |

Condor Loan

First, it is worth noting that the Condor loan is a payroll loan. Therefore, it is exclusive to INSS retirees and pensioners. That is, because of this guarantee, interest rates can be much lower and with longer terms.

This happens because in payroll loans, the installment is automatically deducted from the salary or benefit. In this sense, the bank is confident that the loan will, in fact, be repaid. Therefore, it can offer better conditions.

Therefore, in partnership with Cetelem, Condor launched its payroll loan. This way, your money and your information remain completely safe. Together, it is possible to apply for the loan online, via WhatsApp. Or, if you prefer, you can also apply over the phone or in person in stores.

Finally, it is important to say that the Condor loan is in card format. In this sense, you can both make purchases on the card and make withdrawals.

Free Digital Loan

When we talk about Livre Digital, this is a great option for anyone looking for a loan without bureaucracy. That's because Livre specializes in online credits, that is, in a quick and practical way.

Therefore, the company offers loans from R$100 to R$6,000 for you to pay in up to 12 installments. In addition, with Livre Digital you have your loan with your credit card limit as collateral.

That is, you spend only the limit of your card and then pay the card bill. The payment in installments is the responsibility of the card issuer. In this sense, Livre accepts the following brands: Mastercard, American Express, Elo, Visa and Diners Club.

Finally, the entire contract signing and application process is done online. Therefore, you do not need to attend a notary to recognize a firm. All this can be done directly from your home.

What are the advantages of the Condor loan?

At first, the biggest advantage of the Condor Loan is how easy it is to take out the loan completely online. Furthermore, the process is 100% safe and has even more advantages.

For example, the interest rates are fair, from 1.69% to 1.80% per month. Furthermore, Condor also offers a quick cash release. That is, the amount does not take long to fall into your account.

Furthermore, as we mentioned, the Condor loan is in card format. In this way, he has special conditions of a credit card. For example, the Mastercard brand, which gives access to the Mastercard Surpreenda program.

What are the advantages of the Free Digital loan?

As we have already mentioned, the Livre Digital loan has some advantages. Firstly, we can mention the amount of up to R$6,000 available to be paid in up to 12 installments.

In addition, the money is released into your account within 1 business day after approval. By the way, this approval process is usually quick. Because everything is resolved online, without any bureaucracy.

When we talk about interest rates, Livre Digital has personalized interest rates. These fees may vary based on your financial history and credit analysis.

What are the disadvantages of the Condor loan?

In summary, the main disadvantage of the Condor loan is the fact that it is payroll. However, this is a disadvantage only for those who cannot apply for credit.

This is because the Condor payroll loan is exclusive to INSS retirees and pensioners. Or, in some cases, public servants may also request it.

What are the disadvantages of the Free Digital loan?

At first, a disadvantage of the Livre Digital loan may be the fact that it only has online support. This is because some people end up preferring the traditional service of physical banks.

However, Livre Digital still offers an available service. For customers, the company serves directly via WhatsApp. That is, it is very easy to solve any doubt or problem directly from the cell phone.

Also, if you need a very high amount, the Free Digital loan is not the best recommendation. Therefore, this is a credit for those who need a smaller amount and can pay in up to one year.

Condor loan or Free Digital loan: which one to choose?

Finally, choosing between the Condor loan or the Livre Digital loan depends a lot on your financial reality. That's because the two offer totally different modalities.

That is, if you are retired or pensioner, it is better to hire Condor. If you are looking for a personal loan, Livre Digital is a good option.

Therefore, if you are still in doubt about the best option, let us show you another loan. See now the comparison between the Free loan and the Just loan in the article recommended below.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Bradesco Prime Platinum Card or Sicredi Platinum Card: which is better?

Find out here about the advantages and differences between the Bradesco Prime Platinum card and the Sicredi Platinum card. After that, choose the best option.

Keep Reading

Discover the Alt Bank digital account

Find out in this post how the Alt Bank digital account works and see what advantages it can offer to those who open one.

Keep Reading

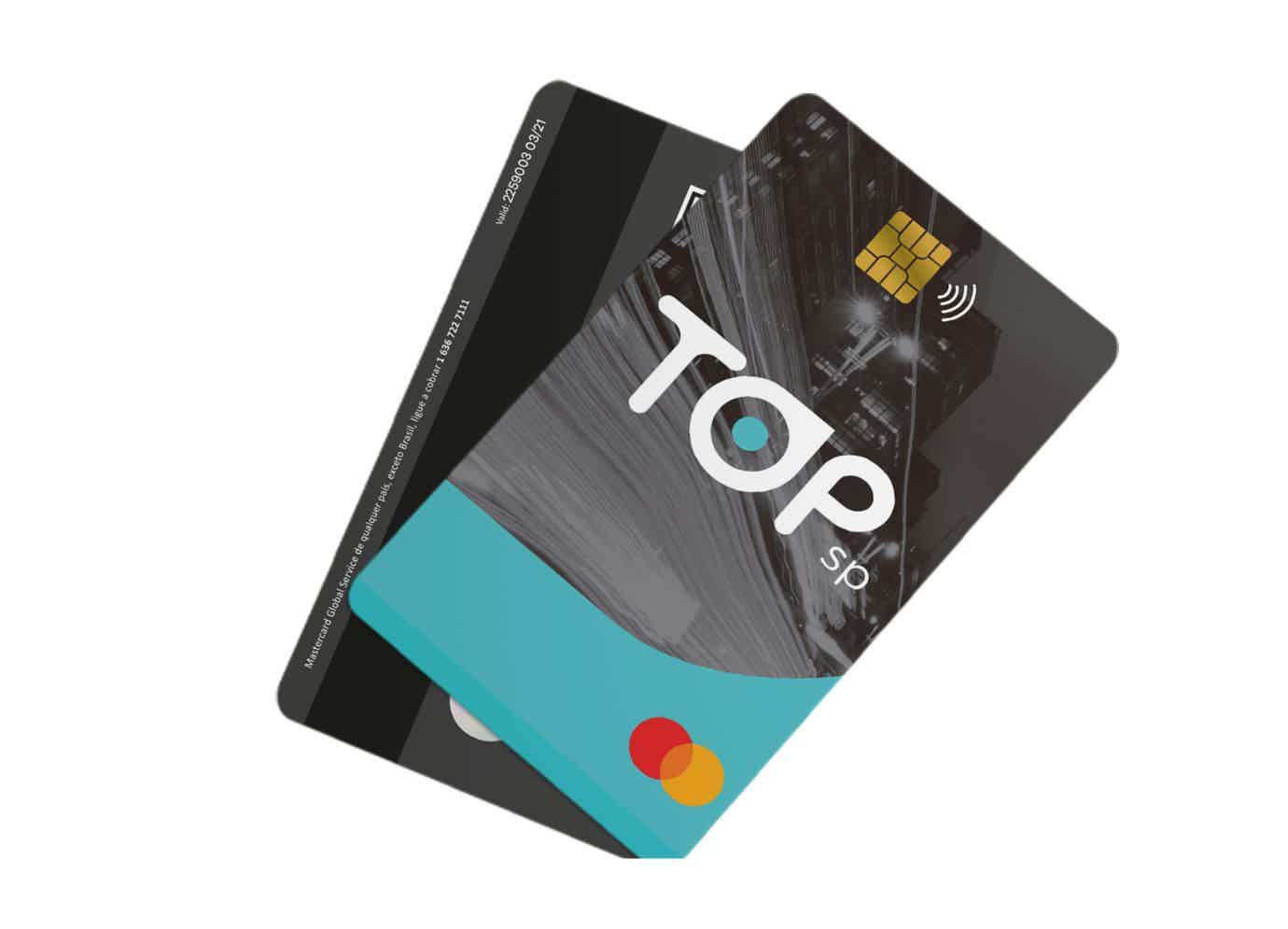

Discover the Top Credit Card

Get to know the features of the Top credit card and see how it helps make your life easier by offering 3 essential features!

Keep ReadingYou may also like

Payroll loan volume breaks record in 2021

The year 2022 promises to have slower economic growth. Due to the record of payroll loans last year, families must focus their budgets on paying off old debts, reducing consumption.

Keep Reading

Superdigital or C6: how to choose yours?

Superdigital or C6 Bank? Both cards have international coverage, the benefits of Mastercard brands and exemption from annual fees. But where do they differ? Find out now!

Keep Reading

Get to know the Ibicard Fácil credit card

Learn more about the Ibicard card with an annual fee of just R$36 reais, national coverage and Mastercard brand benefits.

Keep Reading