Contests

How to prepare for IRS exams

Do you want to start a career in this great institution and earn high wages and benefits? So, check out in this post how federal revenue contests work and see information about the selective process that will open in 2022!

Advertisement

Learn more about the federal revenue contest that opened in 2022

Federal Revenue contests are one of the most sought after by the public. From it, it is possible to achieve beyond financial stability, but also build a solid career with good wages and benefits.

And recently, the Federal Revenue launched its new contest for 2022. In this new process, we were able to find vacancies for the positions of tax auditor and tax analyst at the Federal Revenue.

In summary, these are the most desired positions at the institution, but to get them, it is necessary to prepare for the Federal Revenue exam.

Therefore, to help you on this journey, we have separated in the article below the main information about this contest and some tips for you to prepare and study efficiently until the test date!

Will there be a Federal Revenue contest in 2022?

As much as the Federal Revenue contests are very competitive, people are still anxious to know when they will have the next one to be able to have their vacancy in the institution.

Therefore, in June 2022, the Official Gazette of the Union released a new Federal Revenue tender. From it, 699 positions will be offered to participate in the staff of the special secretariat of the Federal Revenue of Brazil.

The positions released were tax auditor and tax analyst. Both are of higher education.

So far, the Revenue has not yet released any further information about the test, such as its edict, the date for registration or the topics that will fall.

But, as this is not the first time that this competition has been held, we were able to base ourselves on the previous ones to prepare the studies.

What to study for the 2022 Federal Revenue contests?

The Federal Revenue contest for the year 2022 will cover two positions that have specific tests. In this way, the subjects that fall into each test also continue to be different.

Therefore, the position of tax auditor at the Federal Revenue usually has questions that cover the following topics:

- Audit;

- Accounting;

- Tax law;

- Portuguese language;

- English or Spanish;

- Tax legislation;

- Customs legislation;

- Constitutional right;

- Administrative law;

- International trade;

- Logical-quantitative reasoning;

- General and public administration.

The positions of tax analyst at the Federal Revenue, on the other hand, have slightly different subjects, namely:

- Portuguese language;

- English or Spanish;

- General contability;

- General Administration;

- Logical-quantitative reasoning;

- Tax and customs legislation;

- Constitutional, tax and administrative law.

Still in the tax analyst test, there are the subjects of tax and customs legislation, which is applied for the position of general analyst. And there is also the subject of applied informatics for the positions that are in the informatics area.

Which job earns the most money?

Those who work in the recipe earn well, but is it possible to achieve greater earnings? Check it out in this article!

How to study for the IRS exam?

As much as the public notice for the Federal Revenue tenders has not yet been released, there is a forecast that it may be released before December of this year. That way, even without the edict, it is still possible for candidates to prepare and start studying for the test.

To help you with this, we have separated in the topics below some tips on how to start studying to increase your chances of passing the test.

Know the structure of the contest

The first step to do well in the Federal Revenue contest is to know in depth how your test is done. That way, you can reduce anxiety and study more efficiently for her.

Therefore, a very important point to know in the Federal Revenue contest is that the tests are separated into three stages. This separation takes place both for analyst positions and for audit positions.

Thus, the first stage of the competition is formed only by the tests. When passing this step, the candidate can go to the second where he accesses the professional training program.

From this program, he will have contact with the activities related to the daily life of the future server. In this way, this stage manages to prepare the candidate for the third stage, which corresponds to the professional training program.

With it, the newly appointed servants will be prepared and will have their knowledge complemented to actually become part of the Federal Revenue and start their work at the institution.

Knowing these steps is essential for you to be more prepared for each one of them. But, it's interesting to focus on one at a time. So, in the beginning, focus on studying for the test. As you pass, you can focus on the second step, and so on.

Take a preparatory course

Another practice that helps the candidate a lot when taking the Federal Revenue exam is to take a preparatory course. Generally, at first, candidates are lost with the subjects they have to study.

This way, this confusion at the beginning can cause him to get lost in his studies and end up paying more attention to items that are not of great importance in the test.

Therefore, by following a preparatory course, the candidate is able to focus on the right things and have a good foundation to continue their studies after the public notice has been launched.

In addition, the preparatory course helps you to deepen your knowledge and focus on the syllabus.

Study the old exams

So that you are really prepared to take this test, it is interesting that you are already used to it.

Therefore, it is essential for you to know how the questions are formulated, how big they are and also to understand what they expect from the candidate.

To have all this knowledge, it's interesting that you start studying and even solving the questions of some old tests. This will make you more familiar with the structure of the test when you take it.

In addition, performing online simulations can also help you get used to the structure of the test and know what it expects from you.

How many hours of study to spend at the IRS?

You have already seen in the previous topics that the Federal Revenue exams have several different themes based on the position. Therefore, it is common to be left with the question of how many hours it would really be necessary to study for the test.

But, the truth is that there is no right time to study. Here, the important thing is not the amount of time you will spend studying, but how much you can absorb from each topic to apply at the time of the test.

That way, if you spend 3 hours a day studying, you might have a better learning result than a person who spends 8 hours a day studying for the exam.

Therefore, it is interesting that you can maintain efficient learning in the time you have available to study. And more important than that is to always have a rested mind and ready to absorb new knowledge.

Only then will it be possible to study efficiently and really enjoy the time you are dedicating to this activity.

What are the positions of the Federal Revenue contests?

In summary, the 2022 Federal Revenue contest covers the positions of tax auditor and tax analyst. Each of the positions has different functions and also different salaries based on their occupations.

Therefore, the position of tax auditor has functions where it is necessary to make decisions about tax administrative processes of consultation, refund or compensation of taxes. He will be responsible for carrying out inspection and activities related to customs control.

On the other hand, the position of tax analyst is responsible for inspecting and unloading imports and exports. In addition, it also takes care of customs transport and performs functions of temporary admission of vehicles and vessels.

What is the salary of an IRS analyst?

The most important part of a contest is to know what is the salary practiced in the positions. Therefore, for the position of Federal Revenue analyst, it is possible to reach the initial remuneration of R$11,684.39.

For this, it is necessary, in addition to taking the exam, to have already completed the higher level in any graduation.

As for audit positions, we were able to find salaries starting at R$21,000.00. In these cases, it is also necessary to have a complete higher education.

How to apply for the Federal Revenue 2022 contest?

Now that you know more about the Federal Revenue exam, what the test is like and the main functions of each position, you must be eager to know how the application process works.

As at the moment no public notice has been released that specifies more about the contest that will take place in 2022, we cannot know for sure how the registration will be carried out.

However, in previous contests, entries were made on the official website of the organizing bank. To do so, candidates needed to fill out a form with the requested data and pay a registration fee.

That way, with that, your registration will be ready and you will be able to dedicate yourself only to your studies to be able to pass the Federal Revenue exam.

However, if you want to know a little more about jobs and the job market, read our recommended content below.

What to do to get a job fast?

Need a job yesterday? Check out this article for top tips for getting one!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Bradesco Signature card

Do you want to know how to apply for the Bradesco Signature card? Read on and find out how to get the card with a great scoring system!

Keep Reading

Discover the Telha Norte credit card

The Telha Norte credit card is ideal for those who are going to renovate or build, offering an additional limit and discounts. Check out!

Keep Reading

Money borrowed on eCred: how does it work?

Serasa eCred is nothing more than an online platform that searches and compares offers for you to borrow money. Want to know more? Check out!

Keep ReadingYou may also like

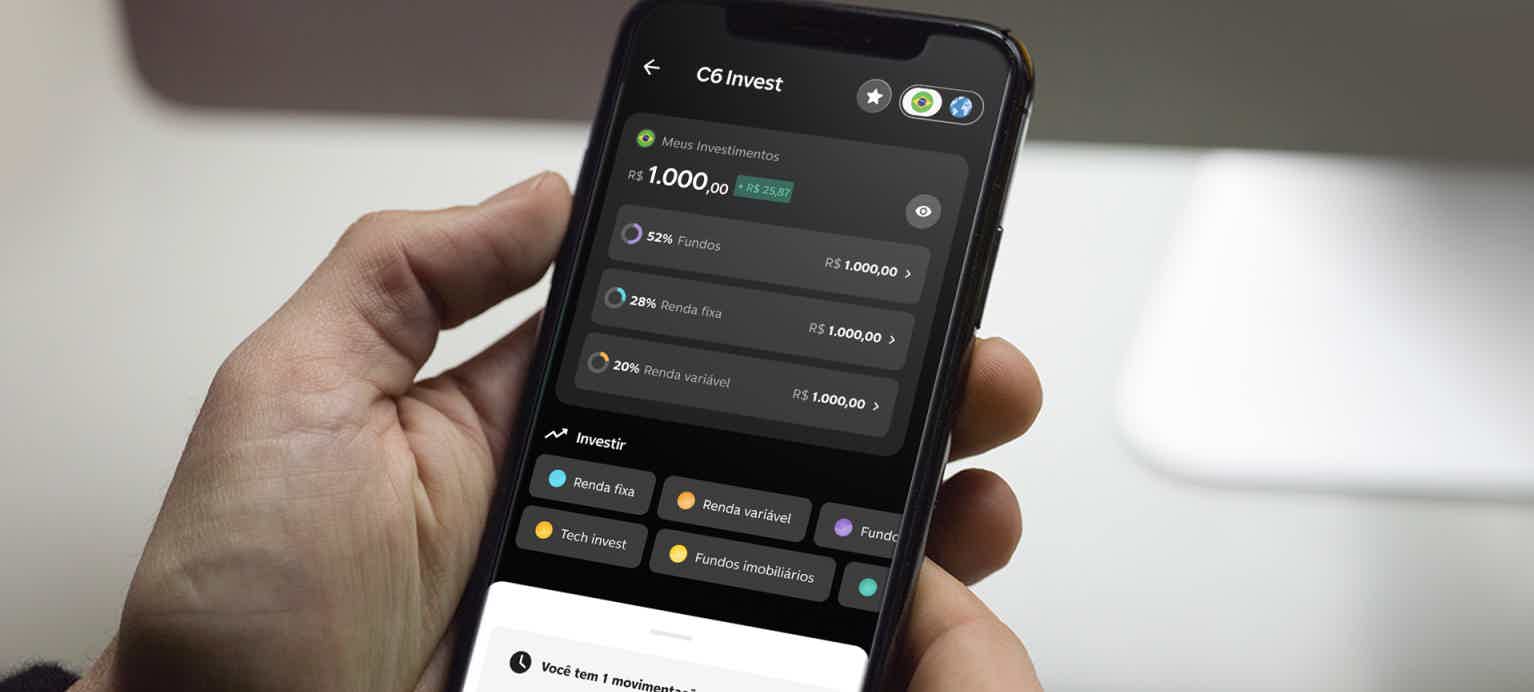

Investments in real estate funds by C6 Bank guarantee up to R$1,200.00 per month in passive income!

Thanks to advances in technology and the creation of investment platforms by digital banks, today it is possible to safely apply your savings to guarantee short-term or long-term profitability. With C6 Invest, you can earn passive income through real estate funds and earn up to R$1,200.00 per month for life. See more here!

Keep Reading

How to apply for the BPI Enjoy card

The BPI Enjoy card is an option full of benefits for those who live in Portugal and want to pay for their purchases more comfortably in installments. To find out how to apply, just continue reading and check it out!

Keep Reading

Cash loan or Agibank loan: which is better?

Would you know how to choose between Caixa loan or Agibank loan? While the first is a personal loan to be applied for at the agency, the second is a payroll loan to be applied for online. See this and other differences below and then make your choice.

Keep Reading