Financial education

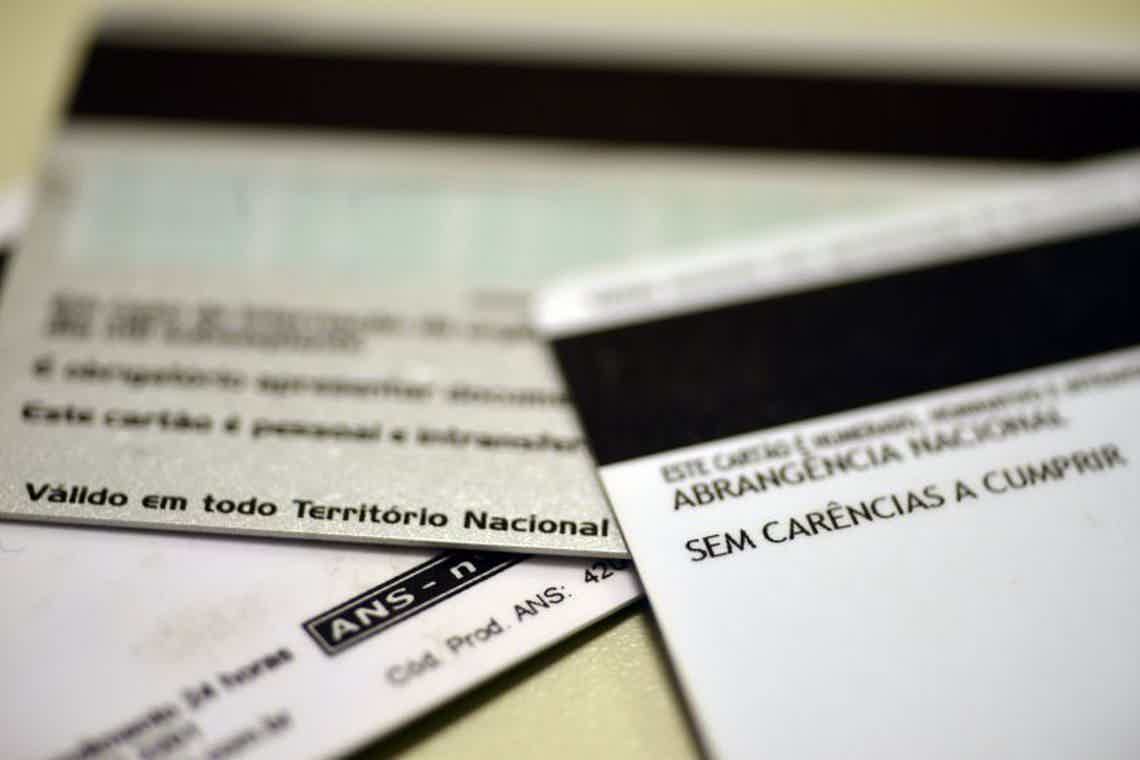

How to have a health plan with a dirty name?

Do you want to hire a health plan but don't even know where to start, and to make matters worse, you have a dirty name? Don't worry, we'll help you with that!

Advertisement

Discover health plan options

In Brazil, health is part of the rights included in the Federal Constitution, but the number of people who use the unified health system is huge, which makes quality and efficient care impossible, hence the need to have a health plan, but how to have a health plan with a dirty name?

This is because, despite being a right guaranteed to citizens, it is not possible to take care of all of us, and hence the importance of having a health plan.

The fact is that, proportionally to the citizens who need the SUS, there are those who, despite being able to afford the plan, because they have the negative name.

So how to resolve this issue? That's what we'll talk about, and we'll even quote about the best health plans and how they work.

Why is it important to have a health plan?

As we said, Brazil has public health care services, considered one of the best in the world.

However, there is a huge number of Brazilians who need this service, and for a large demand, we have a reduced number of doctors.

That is, even though the services are provided with quality and efficiency, it is still not enough.

That is, it becomes necessary, for people who have financial conditions, to pay for a particular plan.

This is because, through a private health plan, the citizen will have the same health services but will be sure of the service.

It is sad to say that, today, public health care cannot give us this certainty, especially in the midst of the pandemic we are experiencing.

The fact is that health plans bring security, peace of mind, comfort and the certainty of support when you need it.

And, in addition, in addition to providing a vast network of accredited hospitals, they also take care of disease prevention and other treatments, as well as discounts on medicines.

Therefore, having a health plan is not a luxury, but, it can be said that in certain circumstances, a necessity.

Do I need to have a clean name to hire a health plan?

Initially, it is not necessary to have a name free of impediments to have a health plan.

This is because health plans accept anyone to register for the plan, which may be individual or family.

Or even, have the name negatived by credit protection agencies such as SPC and SERASA.

This is because insurers cannot use the interested party's old debts to bar access to the plan.

However, insurers are not obliged to maintain a relationship with customers if payments are not made.

That is, after hiring, if there are delays beyond what is accepted in the contract for that plan, the insurer has the right to request the cancellation of the health plan.

Therefore, insurers cannot use policyholders' old debts to deny requests.

What documents are required to purchase a health plan?

To purchase a health plan, you will need the following documents:

Health plan holder:

- Personal documents with photo (CPF and RG);

- Proof of address.

Health plan dependents:

- Personal documents with photo (CPF and RG);

- Proof of address;

- Wedding certificate. (spouses).

It is important to mention that other documents may be requested by insurers.

7 health plan options with a dirty name

There are several health plan options on the market, below we will mention the best known ones. Check out:

PagBank Saúde

PagBank Saúde is among the best health plans on the market in Brazil.

This is because the network has a wide variety of accredited doctors, and offers customers consultations with reduced prices and exams with discounts of up to 70%.

Another advantage of the plan is that policyholders can buy drugs with a 20% discount at major pharmacies, and still compete for premiums.

To make the plans, the initial values are R$14.90 per month, with up to four dependents and no grace period or limit to use.

And, in addition, if you want to hire PagBank, you can opt for an annual plan, where you will have 15% off the total amount, which would give you two monthly fees less!

unimed

Unimed's health plan is the most popular in Brazil. This is because it has several advantages and affordable prices, in addition to being responsible for 31% in the health plan market.

One of Unimed's most famous services is the Unimed Medical Guide, where customers can access all accredited professionals in the network.

Another advantage is that in cases where the doctor is unable to attend to the patient within the deadline established by the National Health Agency, the network has a wide variety of doctors, allowing customers not to be helpless.

Thus, Unimed still brings security to customers, as all its professionals also need to be accredited through the union or professional association.

Therefore, it is no wonder that Unimed is one of the largest health plan networks in Brazil, as it also offers discounts, partnerships, and various other benefits to customers.

Agemed

Agemed is another health plan option, which is among the best on the market, however, it maintains its focus on business plans.

Another differential of this plan is the wide variety of health plans, of which the following stand out:

- Plans that have fixed monthly fees with user co-payment, as well as;

- Plans with fixed monthly fee with co-payment of beneficiaries in 20%, 30% or 50% that will be limited to predetermined amounts.

And, in addition, the plan has complete coverage for outpatient and hospital care, as well as clinical, surgical, obstetric and urgent and emergency care procedures.

Another advantage of this plan is the accredited network of pharmacies, which are available to customers, with various discounts.

Therefore, the insurer seeks to offer the best services to customers at the best values.

Amil Saúde

Amil is a network that is among the ones that have the best health plan offers, from the simplest to the most complete.

And, in addition, the plan also has a large network of accredited regional and national doctors.

Another advantage is Amil Resgate, the only Brazilian hospital transport service recognized by the Joint Commission International.

Therefore, Amil is an excellent health plan option for people with a dirty name, as it has several forms of values.

Bradesco Saúde

Bradesco Saúde is part of Bradesco Seguros, and works only with business plans, being considered one of the largest companies in Brazil.

One of the biggest advantages is the accredited network of hospitals and laboratories, with the best doctors in the market.

And, in addition, the plan also provides the option of reimbursement for covered medical and hospital procedures performed outside the network.

To hire the plan, the values vary greatly, from R$318.20, being a great option for businessmen.

safe harbor

Porto Seguro is a company that provides various types of insurance, including health, being recognized as one of the largest in Brazil.

This is because it works with contractors who seek quality, safety, transparency and efficiency in the provision of the company's services.

Another feature is that the insurer works with business-type contracts, and also provides reimbursement and coverage, as in Bradesco's plan.

And, to top it all off, it also provides services such as acupuncture and chemotherapy, making it even more differentiated in this area.

Therefore, it makes sense to be among the best companies on the market, and prices start at R$255.41, with several other advantages.

South America Health

To close our list of health plans, we will talk about Sul América, one of the oldest insurers in Brazil.

This insurer provides quality services, however, its plans are reduced compared to other insurers.

And, in addition, the insurer requires that the beneficiary has a CNPJ, that is, a legal entity registration.

The fact is that all plans, despite being reduced, have national coverage, reimbursement, travel insurance and other extras.

Therefore, we could not cite another plan but one of the oldest and most respected in the field of health plans.

What to consider when choosing a health plan with a dirty name?

When choosing the best health plan option with a dirty name, several points need to be taken into account.

Value

When hiring a health plan, one of the first points to be observed is the amounts charged.

This is because there are numerous options for plans, from the most economical to the most complete, which cover advantages in different ways.

That is, it is recommended that you do a detailed research of the best plans on the market, to find out which one is the best cost-benefit.

However, one must be careful and not focus only on values, as there may be pitfalls along the way.

Remember to consider other equally important issues, such as how long the insurer has been on the market.

Geographic coverage

Another issue to consider when choosing the best health plan, one that will meet your needs, is coverage.

This is because there are several health plans in the country, however, not all have national coverage.

That is, if you travel to another state, for example, and need medical care and the plan does not cover it, you will need to consult the public or private service.

So, try to do research that demonstrates the coverage of health plans.

What the plan contemplates

And to close, of course we would need to mention the services offered by health plans.

When choosing, knowing which are the partnerships, services, professionals, hospitals associated with that plan is essential.

This is because health plans are used in the most important moments of our lives, and it is not possible to make a choice without knowing precisely the treatments and bonds of that health plan.

Therefore, to have or not to have a dirty name cannot and should not be a reason not to take out a health plan, look among those with the greatest advantages, follow our tips, and you will make the best choice!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

5 loan options now on account 2021

It has become much easier to get a loan now on the account. So check out our top 5 list and apply for credit today!

Keep Reading

How to increase the value of the Brazil Aid?

Do you want to know if you are entitled to increase the value of the Brazil Aid? We will help you answer this and other questions in this article. Check out!

Keep Reading

How to apply for Pride Bank Prepaid

See how you can apply for Pride Bank Prepaid, Pride Bank digital bank card, the world's first LGBT digital bank!

Keep ReadingYou may also like

How to apply for Decolar Santander Visa Platinum

Find out how to apply for the Decolar Santander Platinum card, which offers 2 points for every dollar spent, international coverage and several other benefits.

Keep Reading

How to apply for the Superdigital Internacional card

The Superdigital Internacional card offers many advantages for those who like to travel. Want to know how to order it? So, read on and check it out!

Keep Reading

Discover the Bradesco DIN prepaid card

Get to know the Bradesco DIN card, which does not charge an annuity, requires a minimum age of just 14 years and does not consult the SPC or Serasa. Learn more below!

Keep Reading