loans

How to apply for the Zema loan

Do you want to learn how to apply for the Zema loan with extended terms, quick release and reduced interest rates? Then continue reading to learn the step by step!

Advertisement

Zema Loan

So, the Zema loan is a type of credit that has special conditions in relation to other loans. That's because, it works with low interest rates, longer payment terms, as well as almost immediate release of the loan!

Thus, it brings the security and data protection you need, comfort and agility in a process that takes place 100% online! So, today we are going to teach you how to apply for this loan without having to leave the comfort of your home! Well, read on!

Order online

So, the process of taking out the Zema loan is 100% online. To do so, just access the official website of Zema Financeira, fill in the form and simulate the loan!

Then, Zema will do a credit analysis and if accepted, the amounts will be released into your account within 24 hours with all the security and protection you need!

Request via phone

So, it is not possible to apply for the Zema loan over the phone. However, you can contact us through the numbers for questions: Phone: 0800 095 6702.

Request by app

Unfortunately, Zema still does not have an application to apply for the loan. That's because, the whole process is done by the company's official website! Therefore, go to the official website to access all the information about the loan!

Geru loan or Zema loan: which one to choose?

So, the two loans have very interesting proposals for Zema and Geru customers, as well as security and comfort for the customers of these banks! So, below see a comparison table between them:

| Geru | Zema | |

| Value | 2 thousand to 50 thousand reais | Up to R$15 thousand reais |

| Installment | from 12 to 36 installments | Up to 24 months |

| Interest rate | 2% to 8.4% per month | From 3.7% per month |

| accept negative | No | No |

| release period | up to 2 business days | 24 hours |

Finally, below is recommended content on how to apply for the Geru loan! Check out!

How to apply for a Geru loan

Learn how to apply for the Geru loan and other useful information about this loan, so you can get out of the red or pay for that dream trip!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for Vamos Parcelar

Check here how to request the installment of Vamos Parcelar and settle your residential bills, slips or debts with the DETRAN within 48 hours!

Keep Reading

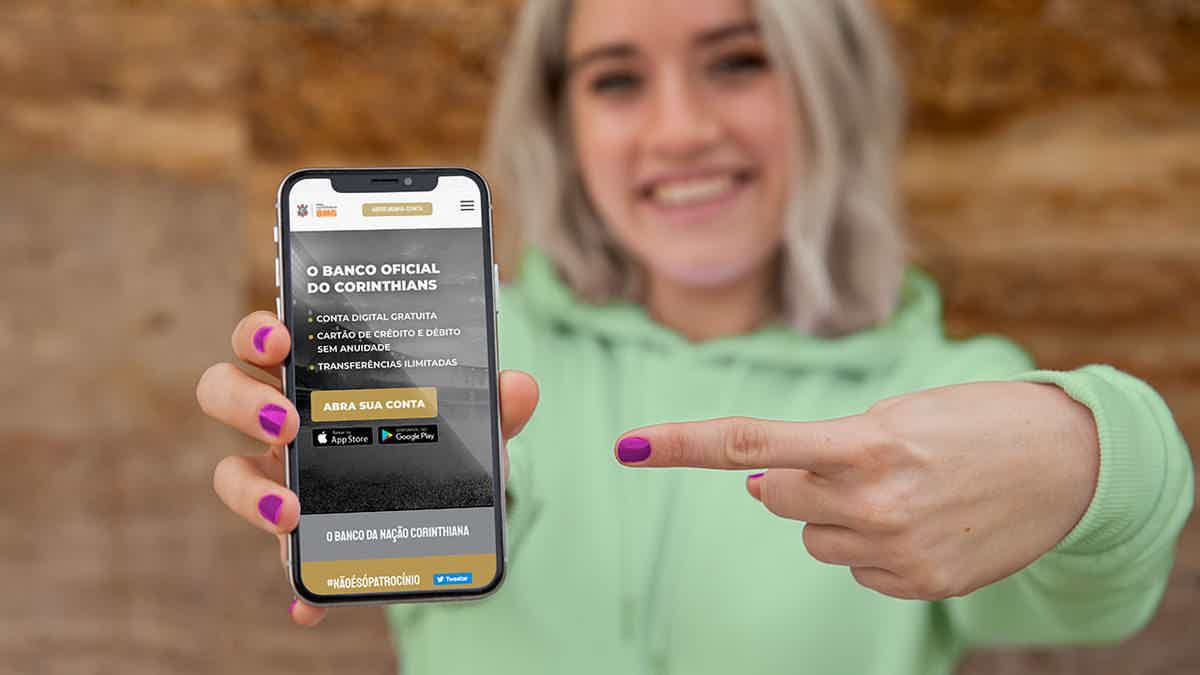

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

How to apply for the Family Allowance

Do you want to find out how to apply for the Family Allowance? In this article, we will explain how it works and the step by step to register!

Keep ReadingYou may also like

Discover the Leader Credit Card

Get to know the Leader card, with national coverage, the benefits of the Visa brand and a minimum wage requirement.

Keep Reading

Nubank or Agibank account: which is the best digital account?

If you are looking for digital accounts to manage your money in an uncomplicated and online 100% way, the Nubank or Agibank account may be the solution for your financial life. Were you curious to know a little more about each of them? Come with us!

Keep Reading

Learn how to make money on Instagram

Did you know that Instagram can be a great ally to increase your monthly income? Check out this post how to make money on Instagram!

Keep Reading