loans

How to apply for a Good for Credit personal loan

Are you in doubt about how to apply for a Good for Credit personal loan? See below how to apply for your credit in a simple and practical way.

Advertisement

Good Loan for Credit

The Good for Credit personal loan is another option for those who need quick cash at low rates. Its main feature is the ease of payment in up to 36 installments with economic interest rates. In addition, to have access, the client must receive a minimum income of 1 minimum wage.

In addition, it is possible to simulate the loan, without commitment, on the Bom para Crédito website. If the loan is approved, you receive the previously agreed amount you need, plus interest. So are you interested? Read on to learn more about this practical solution to getting the credit you need.

Step by step to apply for a personal loan Good for Credit

To apply for the Bom para Crédito personal loan, the customer must be over 18 years old and have an active CPF. In addition, banks and finance companies require personal documents such as a valid ID and proof of income and residence.

So, after having these documents in hand, you are ready to apply for your loan. So, check out the step-by-step process below to apply.

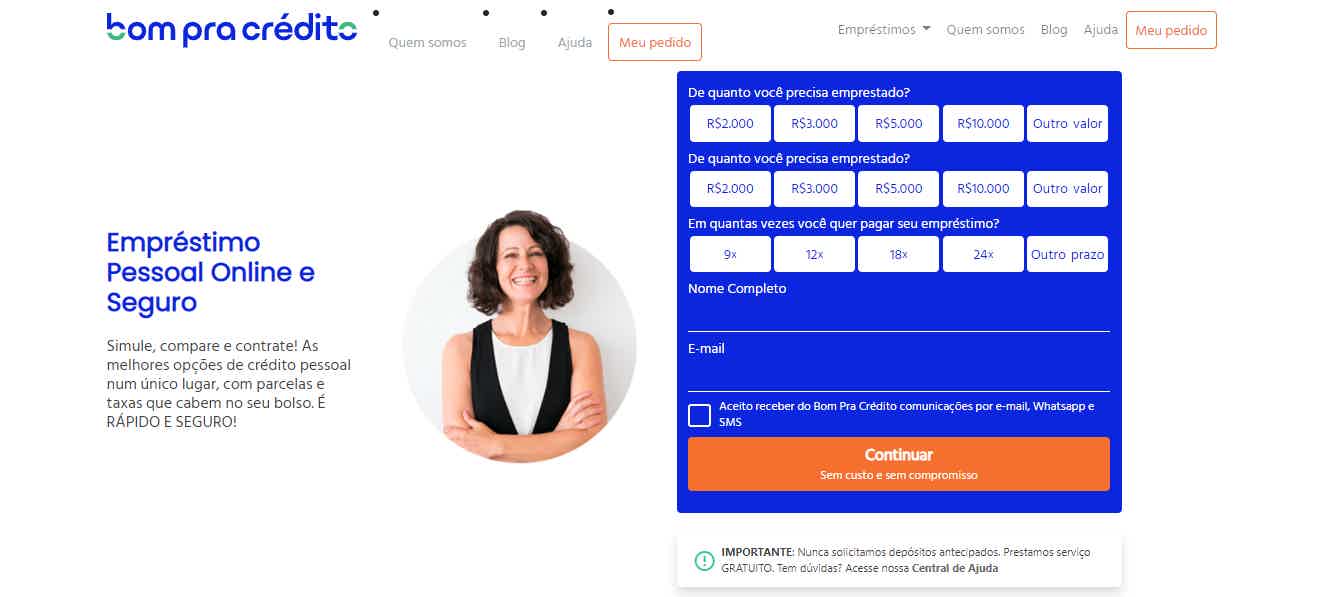

Order online

So, the personal loan application process at Bom para Crédito is simple. Well, customers can do the simulation directly on the website, without having to travel to one of the company's points. After all, just follow the step by step below and analyze which loan is right for you. Check out:

- First, register on the Bom para Crédito platform;

- Then follow the simulation of the proposals on the website;

- Soon after, choose the best loan option for you;

- Finally, take out the loan confirming the rates and bank details.

Then, after requesting and receiving the approval of your personal loan, the money will be deposited in the bank account informed in the registration.

Request via phone

It is still not possible to apply for the Good for Credit personal loan by phone. However, customers can obtain more information about this type of credit, as well as clarify doubts through the following contact number: (11) 4003-8225.

In addition, if you prefer, you can also talk to the team via email: atendimento@bompracredito.com.br. Thus, it is possible to receive quick service, as well as clarify doubts about your credit application.

download app

Bom para Crédito does not have its own application for applying for loans and other financial services. Therefore, customers interested in applying for a loan must do the simulation and apply on the official website of Bom para Crédito.

So, as we mentioned earlier, the application process on the site is simple, easy and secure. That way, in a short time, you can get a response from the finance company and send money to your account.

Superdigital loan or personal loan Good for Credit?

The Good for Credit personal loan offers a low interest rate and up to 36 installments to pay. This, without a doubt, is a great benefit for those who need quick cash, but do not want to get into debt with a personal loan.

However, he does not grant loans to negatives. So, if your name is dirty in the market, it is worth knowing about other options such as the Superdigital loan. In addition to accepting negatives, it has an economic rate, as well as good installment terms. Want to check out these loans better? So, check below what are the advantages of each loan and apply for yours.

| Superdigital loan | Personal Loan Good for Credit | |

| Values | R$5 to R$25 thousand | From R$ 500.00 |

| Installment | Up to 18x | From 3 to 36 installments |

| minimum income | Consult | Minimum wage |

| accept negative | Yes | No |

| interest rates | From 1.6% am | From 0.75% am |

How to apply for the Superdigital credit card

If you have doubts about how to apply for the Superdigital credit card, after this text you will definitely not have any more!

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Loan by check: how does it work?

Want to borrow a value but don't know how to do it? Know that it is possible to borrow with a check. See how it works and its advantages

Keep Reading

Loan on electricity bill: how does it work?

Did you know that it is possible to borrow money from your electricity bill easily and quickly? See right now how this modality works.

Keep Reading

Avatar Maker Apps: Create fun cartoons

Explore avatar maker apps and personalize your online identity in a fun and unique way. Know more!

Keep ReadingYou may also like

Find out about the Santander Foreign Currency current account

Need to make transfers in a currency other than the Euro and are paying a lot of fees to do so? So, take the opportunity to find out about the Santander Foreign Currency account in the post below and stop paying the exchange rate. Learn more below.

Keep Reading

Binance releases option to buy cryptocurrency with your credit card

Innovating yet again, Binance, the global cryptocurrency exchange, now also accepts debit and credit cards for purchasing cryptocurrencies. In addition, it announces six more coins for the Brazilian market to acquire with the brokerage. See more about it and understand.

Keep Reading

Discover the best car models for resale in 2021

Check out our list below and find out which are the best car models for resale in 2021.

Keep Reading