loans

How to apply for a bank loan

The Nubank loan has fixed installments of up to 24 months and low interest rates. Check out how to order yours today!

Advertisement

Nubank: payment within 90 days after hiring

If you are looking for credit without bureaucracy and a quick application, the Nubank loan can be a good option.

So, in addition to having reduced interest and installments in up to 2 years, you can also do the entire process online. So, check out how to apply for your loan today!

Order online

Well, the request is made online 100%, directly through the Nubank digital account.

First, you must access your account and check if the option is enabled. If so, click to run the simulation and discover all the conditions available to you.

So, just check the information and check if the values are in order. If you agree with the conditions, you can confirm. After that, if everything is correct with your analysis, the money goes directly into Nubank's digital account. Simple, isn't it?

Request via phone

Although it is not possible to make the request by phone, you can ask all your questions about the process at the following number: 0800 608 6236.

Also, if you prefer, send an email to meajuda@nubank.com.br.

Request by app

So, the request is made directly through your digital account in the Nubank app.

So all you have to do is download the app, which is available on Google Play and the App Store. Then, carry out the simulation step by step and confirm the loan.

Agibank loan or Nubank loan: which one to choose?

But if you've come this far and are still in doubt about the best loan choice for your financial life, don't worry!

Therefore, we have prepared a special comparison between the Nubank loan and the Agibank loan. Thus, you have one more option to make the best decision according to your needs. So, check it out below!

| Agibank | Nubank | |

| Minimum Income | On request | On request |

| Interest rate | Variable | Variable |

| Deadline to pay | Up to 84 months | Up to 24 months |

| Where to use the credit | Renovating the house, financial unforeseen | Take a trip, start a business |

| Benefits | No SPC or Serasa consultation, payroll deduction | Online hiring, reduced interest rates |

How to apply for the Agibank loan

If you already understood what the Agibank loan for negatives is and you were delighted with its advantages, the time has come to find out how to apply for it. So check it out here!

Trending Topics

Discover the Telha Norte credit card

The Telha Norte credit card is ideal for those who are going to renovate or build, offering an additional limit and discounts. Check out!

Keep Reading

Bradesco loan or Santander loan: which is better?

Do you know which is the best Bradesco loan or Santander loan? No? So, read this post and see the analysis we did. Check out!

Keep Reading

How to apply for the Next Visa International credit card

Are you interested in the benefits and now want to know how to apply for your Next Visa International credit card? So find out now!

Keep ReadingYou may also like

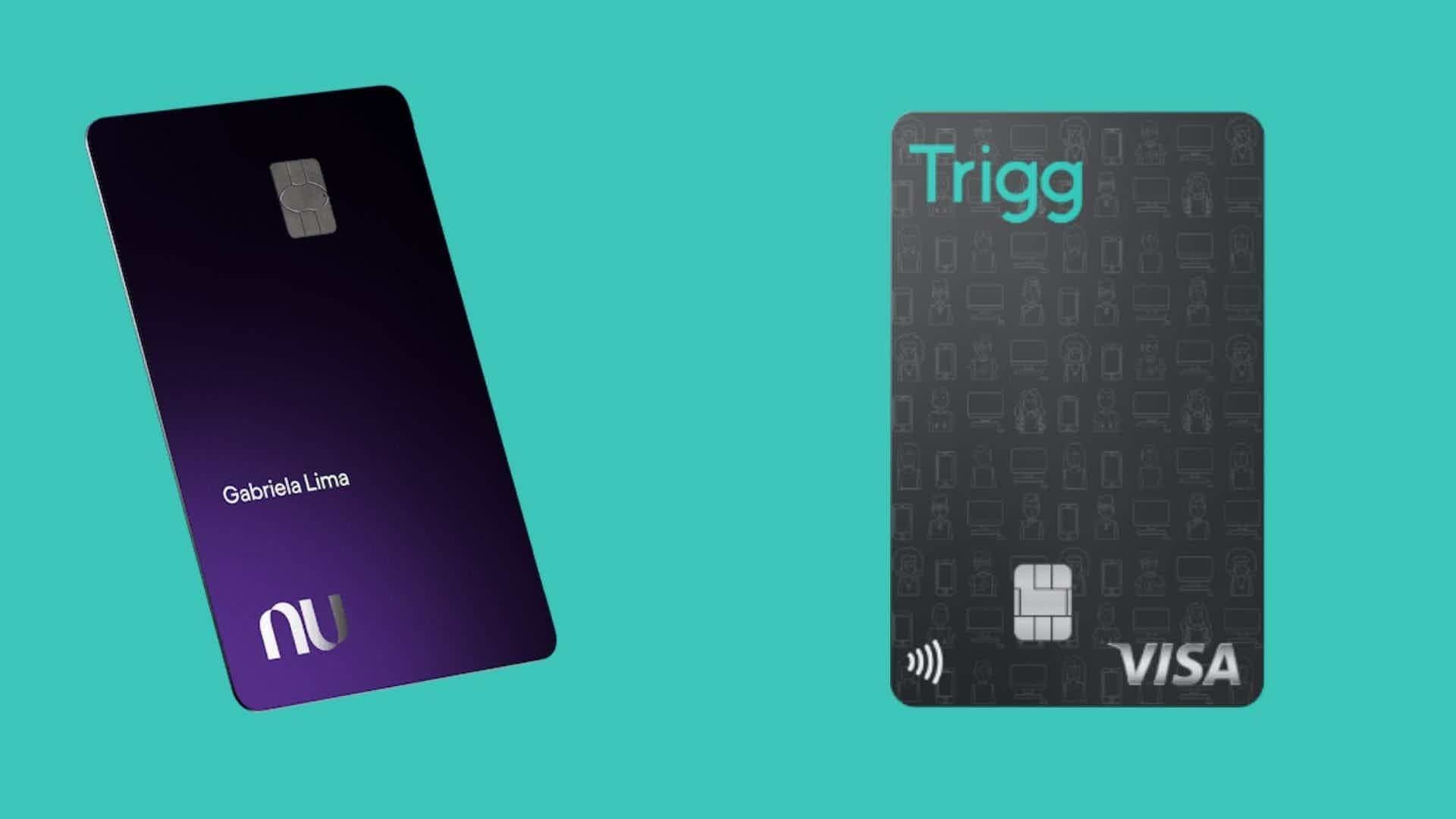

Trigg Card or Nubank Ultraviolet Card: which one to choose?

In addition to perks, many credit cards also offer style. The Trigg card or the Nubank Ultravioleta card may be the choice for those looking for these two things. Check out more about them here and choose yours!

Keep Reading

PIS/PASEP 2022: those who did not receive the benefit can file an appeal

Those who fulfilled the requirements demanded by the Ministry of work in 2020 and still were not entitled to pay the Abono Salarial this year can file an administrative appeal for non-payment. Learn more below!

Keep Reading

Understand why Naiara Azevedo from BBB 22 has already become a meme on the internet

Naiara Azevedo has been on Big Brother Brasil 2022 edition for just a few days, and has already managed to awaken the public's rancidity. With controversial behavior and unpleasant comments, the sertaneja is already the target of memes.

Keep Reading