loans

How to apply for the Lendico microentrepreneur loan

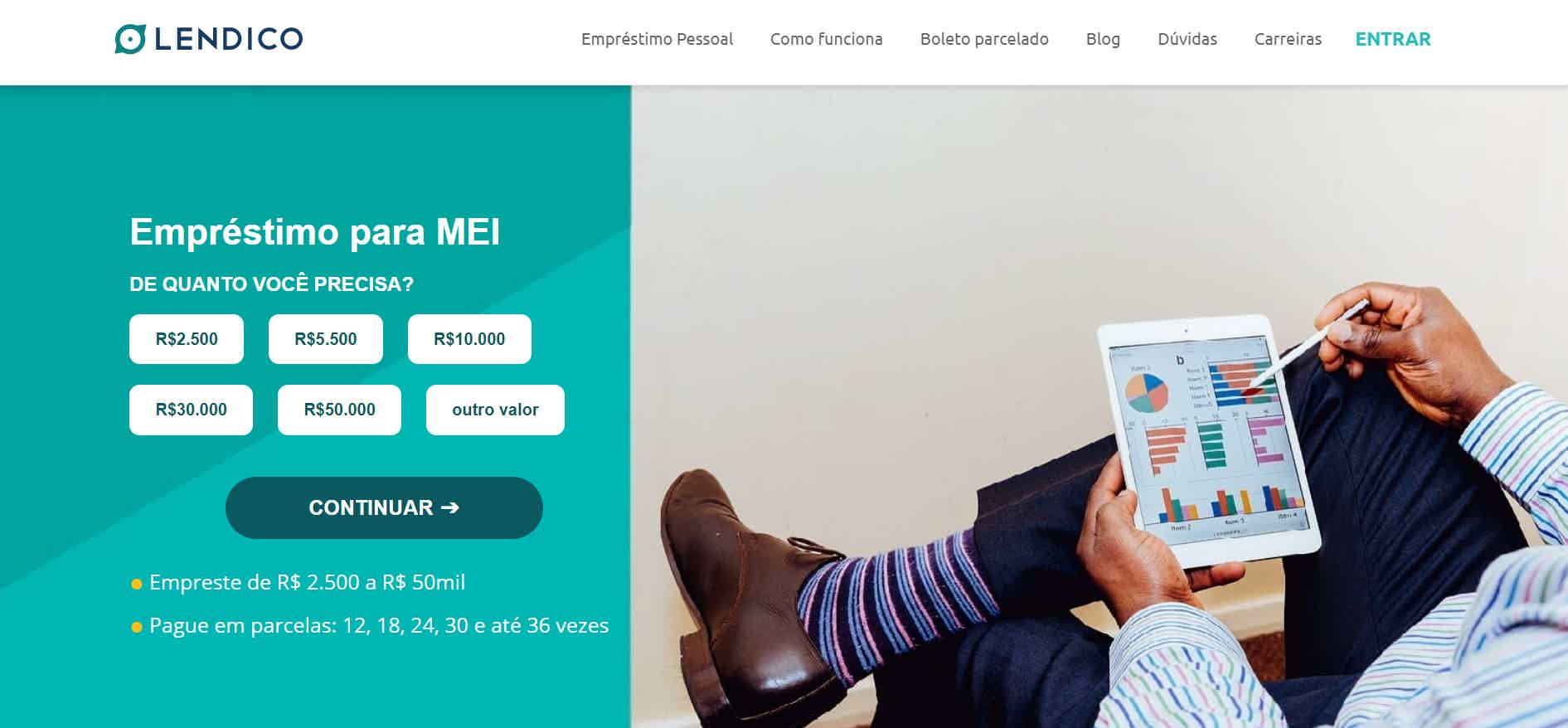

The Lendico micro-entrepreneur loan checks your CPF and your MEI income at the time of credit approval. It is ideal for those who want to invest in business. See here how to order yours.

Advertisement

Lendico: quick loan with low interest rates

First, if you have a business, the Lendico micro-entrepreneur loan may be essential for you. In this sense, Lendico offers advantages, such as reduced interest rates and fully online service. That is, everything to facilitate credit for those who are MEI.

So, are you interested and want to apply for your loan right now? Keep reading and check out the step-by-step process. Let's go!

Order online

Well, the Lendico loan is very practical and you can make the simulation and request entirely online and safely. To do so, simply access Lendico's official website and select the personal loan tab.

As this line of credit does not use the CNPJ number, you must fill out the form as if it were a personal loan. However, the difference will be when presenting proof of income. Thus, you can include your income as MEI. By the way, it is important to say that this process can increase your chances of approval.

So, the pre-analysis process takes about a few minutes. Meanwhile, the complete review of submitted documentation may take up to 2 business days. Thus, if you are approved, you must sign the contract and wait for the amount to be released, which can be on the same day or on the next business day.

Request via phone

In this sense, it is not possible to apply for the Lendico micro-entrepreneur loan over the phone. However, if you have any questions, you can contact the finance company by phone: (11) 3230-3332.

Request by app

So, the entire Lendico loan application process must be done online. That is, there is no application that you can use to make the request.

However, you can use your smartphone to access the official website and apply for your loan.

microentrepreneur loan finmatch or Lendico microentrepreneur loan: which one to choose?

Well, are you still in doubt if the Lendico loan is right for you? So, check out this suggestion that we leave below. See their main features and compare them:

| finmatch MEI | legendary MEI | |

| Minimum Income | Above R$ 4,000.00 per month | not informed |

| Interest rate | From 2,49% to 14,59% per month | From 1,98% per month |

| Deadline to pay | Up to 36 months | Up to 36 months |

| Where to use the credit | As you wish | As you wish |

| Benefits | Procedure 100% online Extended payment period | Procedure 100% online Reduced interest rates |

How to apply for the Finmatch MEI loan

Applying for your Finmatch MEI loan is much easier than you might think! Read our text and understand more about this request process.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Postalis loan

Find out here how you can apply for a Postalis loan to renegotiate your financial debts and enjoy its benefits.

Keep Reading

Serasa eCred loan: the best for negatives

The Serasa eCred Loan brings together, on a platform, several online personal credit options with different financial institutions. Meet!

Keep Reading

DigioGrana loan: how it works

The DigioGrana loan may be ideal for you, as it has interest rates starting at 2,97% per month and payment in up to 24 months. Check out!

Keep ReadingYou may also like

How to Apply for Just Loan

Need urgent cash? Just's online personal loan can be a good alternative. Since it has an interest rate from 1.60% per month. Check out!

Keep Reading

Can minors apply for a payroll loan?

To take out loans, there are some rules and observations that must be followed. To find out if there are ways for minors or guardians to get a payroll loan, continue reading with us!

Keep Reading

12 advantages Credicard Beta

Do you already know the Credicard Beta card? Count on several insurances and benefits, in addition to several discounts at stores such as Ponto Frio and Magazine Luiza.

Keep Reading