loans

How to apply for the Meu Tudo Consignado loan

Learn how to apply for the Meu Tudo Consignado loan. It is ideal for INSS retirees and pensioners, as well as federal public servants. In addition, you can get a credit with an interest rate from 1.70% per month. Check out!

Advertisement

Meu Tudo Consignado Loan: interest rate from 1.70% per month

Learn how to apply for the Meu Tudo Consignado loan through the financial institution's website or through the application, safely and without any bureaucracy. In it, you have a term of up to 84 months to pay with interest from 1.70% per month. But it is worth noting that only INSS beneficiaries and federal civil servants can apply for this credit.

Interested? So, read on to learn the step-by-step application process. Let's go!

Order online

First, in order to apply for the Meu Tudo Consignado loan, you need to enter the fintech website and do the simulation. To do so, simply enter the desired credit amount and click on “Register now”.

Then fill in the form with all the requested information and send the indicated documents. After that, the proposal will undergo an analysis and after endorsed and approved, the credit will be deposited in the account informed in the register.

Request via phone

So, unfortunately, it is not possible to apply for the Meu Tudo Consignado loan over the phone, but you can clarify all your doubts by calling the institution at the numbers below:

- 4000 1836 (Capitals and metropolitan areas);

- 0800 700 8836 (Other locations).

Request by app

By the way, you can also simulate and take out the loan through the Meu Tudo app, basically following the same steps as the process done on the website.

This is because it is necessary to inform the data, as well as the agreement and follow the steps of contracting the payroll loan. So, if approved, just wait for the amounts to be deposited in the informed account.

BMG loan or Meu Tudo Consignado loan: which one to choose?

First of all, if you have analyzed the features and advantages of the Meu Tudo Consignado loan and realized that it does not meet your needs, no problem. Because there are other financial products on the market with great advantages that can meet your expectations.

Among them we have the BMG loan. So, how about getting to know this credit better? Also, check out the comparison table below and see which one can help you.

| BMG consigned | My Everything Consigned | |

| Minimum Income | Minimum wage | Minimum wage |

| Interest rate | From 1,80% per month | From 1,70% per month |

| Deadline to pay | Up to 96 months | Up to 84 months |

| Where to use the credit | Pay the bills take trip | pay off debts start a business |

| Benefits | There is no consultation with the SPC and SERASA low interest rates | Without consultation with the SPC and SERASA Reduced interest rates |

How to apply for the BMG Emergency Loan

The BMG payroll loan offers credit with an interest rate of 1.80% per month and a repayment period of up to 96 months. Find out how to apply here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

See how to register for free to resell Avon

Understand how to be an Avon reseller and discover all the requirements and documents you need to be able to work with resellers.

Keep Reading

How to find the best forklift operator jobs

Learn how to put together an ideal resume for forklift operator jobs and find the job you're looking for.

Keep Reading

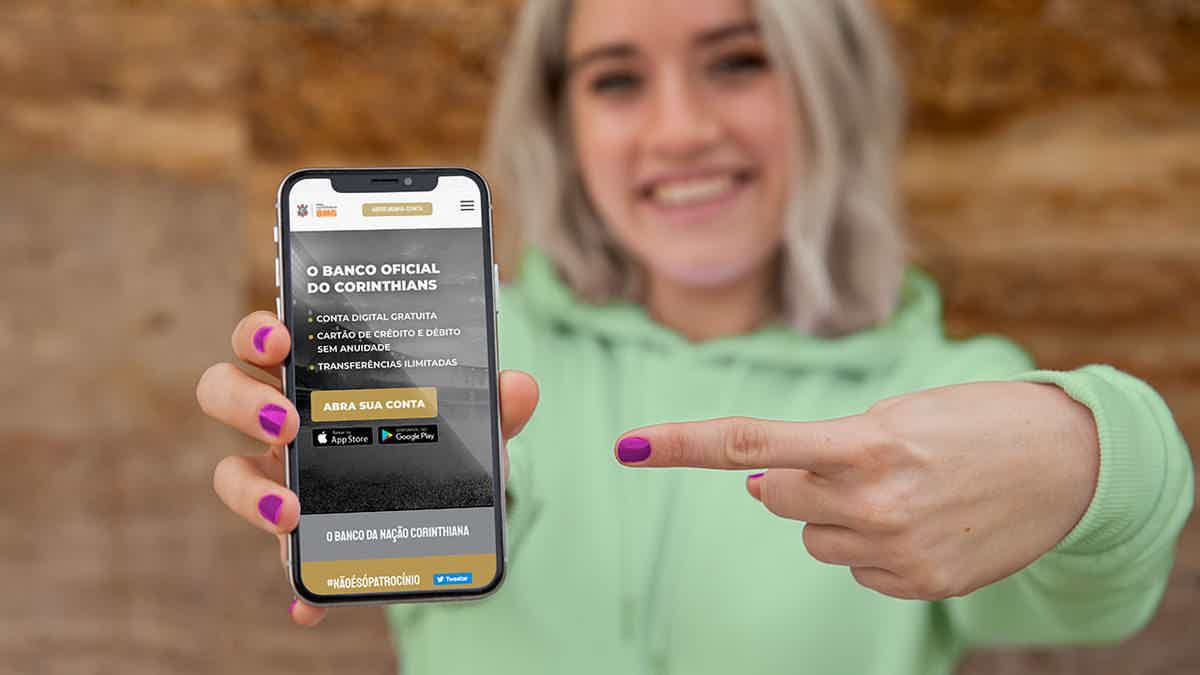

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Keep ReadingYou may also like

Get to know the Bradesco Signature card

In this post we will talk about the Bradesco Signature card. It has several exclusive discounts and access to VIP rooms. Interested? Read on!

Keep Reading

Discover the Cooperforte loan

Discover the Cooperforte loan, exclusive to members and with an interest rate starting at 0.59% per month.

Keep Reading

Credipronto Real Estate Credit or Credihome Real Estate Credit: which is better?

Compare Credipronto's real estate credit with Credihome's real estate credit and choose the one that has the most benefits according to what you need.

Keep Reading