loans

How to apply for the Finamax loan

Do you want to learn how to apply for the ideal Finamax loan for negatives with reduced terms and interest rates? Then continue reading to learn the step by step!

Advertisement

Finmax Loan

So, the Finamax loan is a type of credit that has special conditions in relation to other loans. That's because, it works with reduced interest rates, longer payment terms, as well as being ideal for negatives.

Thus, it brings the security, comfort and speed you need in a process that takes place completely online! So, today we are going to teach you how to apply for this loan without having to leave the comfort of your home! Well, read on!

Order online

So, the process is done completely online through the official website of Finamax. So, you just need to enter the site, answer some objective questions so that the institution knows your profile and, after that, just wait to find out what conditions will be offered by them.

Then, if you accept the proposal, just send the documentation and wait for the money to be released within 6 hours! In this, the process is very fast and safe!

Request via phone

So, it is not possible to apply for a Finamax loan over the phone. However, you can get in touch using these numbers to answer questions: Phone: 0800 773 773 0.

Request by app

Unfortunately, Finamax still does not have an application to apply for the loan. That's because, the whole process is done by the company's official website! Therefore, go to the official website to access all the information about the loan!

Just loan or Finamax loan: which one to choose?

So, the two loans have very interesting proposals for Finamax and Just customers, as well as, with security and comfort for the customers of these banks! So, below see a comparison table between them:

| Just | finamax | |

| Value | Up to R$35 thousand reais | Depends on credit analysis |

| Installment | Up to 24 installments | Up to 18 installments |

| Interest rate | From 1,60% per month | From 1,60% per month |

| accept negative | No | No |

| release period | up to 2 business days | 6 hours |

Finally, below is recommended content on how to apply for the Just! Check out!

How to apply for the Just loan

Do you want to learn how to apply for the Just loan with terms and reduced interest rates? Then continue reading to learn the step by step!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to pay off Carrefour card debt

If you want to settle your Carrefour card debt, read this post and see how simple it is to negotiate the amount of your invoice through the Debt Agreement.

Keep Reading

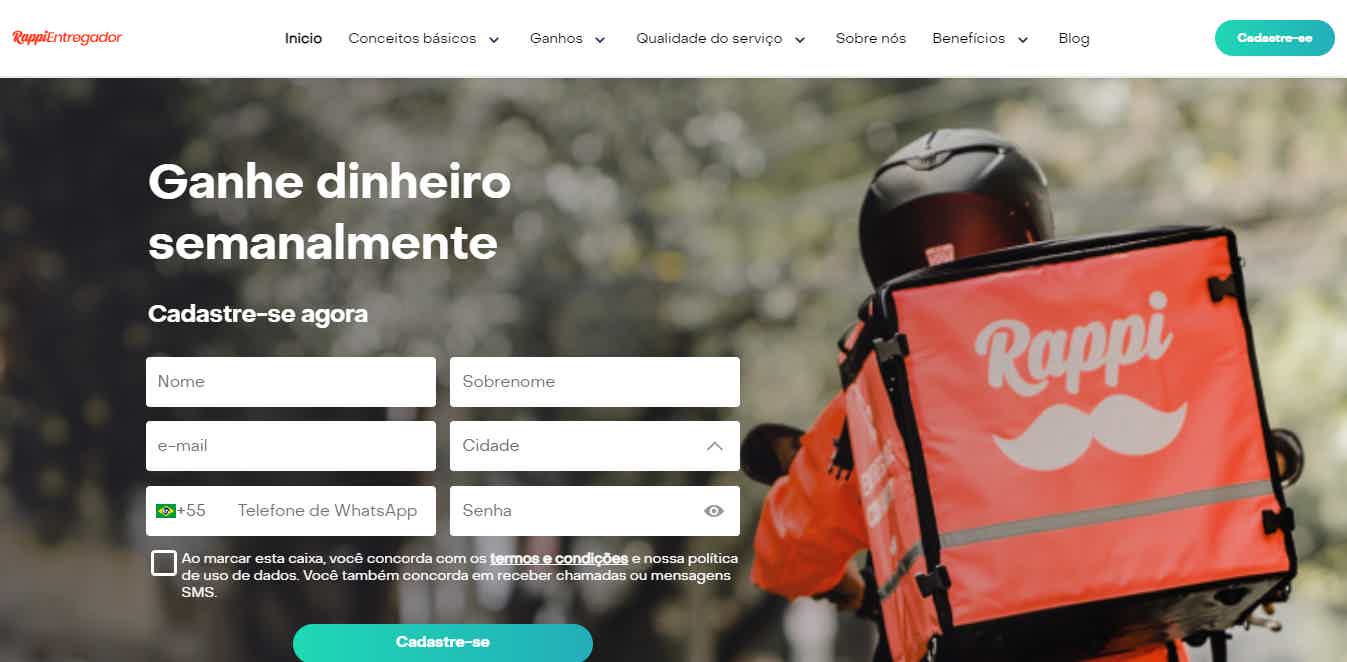

Rappi delivery man: what you need to know

Discover in this post everything about what it's like to be a Rappi delivery man and learn more about the routine and advantages of working with the app!

Keep Reading

How to apply for the Caixa Universitário card

Check out the step-by-step guide on how to apply for the Caixa Universitário card and enjoy its unmissable benefits. Learn more here!

Keep ReadingYou may also like

How to apply for the N26 debit card

The N26 debit card offers all the advantages of a digital account and also the benefits of Mastercard. Find out how to order yours here!

Keep Reading

Find out about the Single Father Allowance benefit

Are you a single parent and received emergency aid in the years 2020 and 2021? The Single Father aid benefit can pay you an amount of up to 3 thousand reais. Find out how this benefit works here.

Keep Reading

What are the interest rates charged in the Casa Verde e Amarela program?

Recently, the Federal Government's housing program underwent a change in the concession rules regarding interest rates. See what they are below!

Keep Reading