loans

How to apply for the Creditas loan

With the Creditas loan, you have three types of credit to choose the one that best fits your financial life. Check how to apply!

Advertisement

Credits: request 100% online with agility and speed

Undoubtedly, the Creditas loan is a good option for anyone in need of extra money to make their dreams come true.

So, check out how to apply for your credit so you can become the protagonist of your financial life. Let's go!

Order online

Well, the loan application is made online 100%. Therefore, it is much more practical, faster and safer.

So, all you have to do is access the official Creditas website and simulate one of the three types offered: property guarantee, car guarantee and payroll deduction.

After that, you must provide the necessary information and wait for your profile to be analyzed. Ready!

Once the loan is approved, you must sign the contract for the money to be released into your account.

Request via phone

So, although it is not possible to place the order over the phone, you can contact us and ask any questions about the process at the following numbers:

- (11) 3164 1402 (São Paulo – capital);

- 4003 1586 (other capitals and metropolitan regions);

- 0800 721 8547 (other locations).

Request by app

Finally, you can also simulate your loan directly through the app, which is available on Google Play and the App Store. The process is the same as described in the online application.

Good loan for credit or credit loan: which one to choose?

So, if you've come this far, but are still in doubt about the best credit option, don't worry!

Therefore, we have prepared a special comparison based on the opinion of our readers so that you can find out about another loan option.

Thus, you can make the best decision for your financial life with all the information at hand. So check it out!

| good for credit | Credits | |

| Minimum Income | Minimum wage | On request |

| Interest rate | From 1,59% per month | From 0.99% per month |

| Deadline to pay | Up to 36 months | Maximum 240 months, depending on the modality |

| Where to use the credit | Renovate your home, invest in studies | Travel, start a business |

| Benefits | Fast credit on the account, more than 30 financial partners | Low rates, three loan options |

How to apply for a Good Credit Loan

Are you in doubt about how to apply for a Good for Credit personal loan? See below how to apply for your credit in a simple and practical way.

Trending Topics

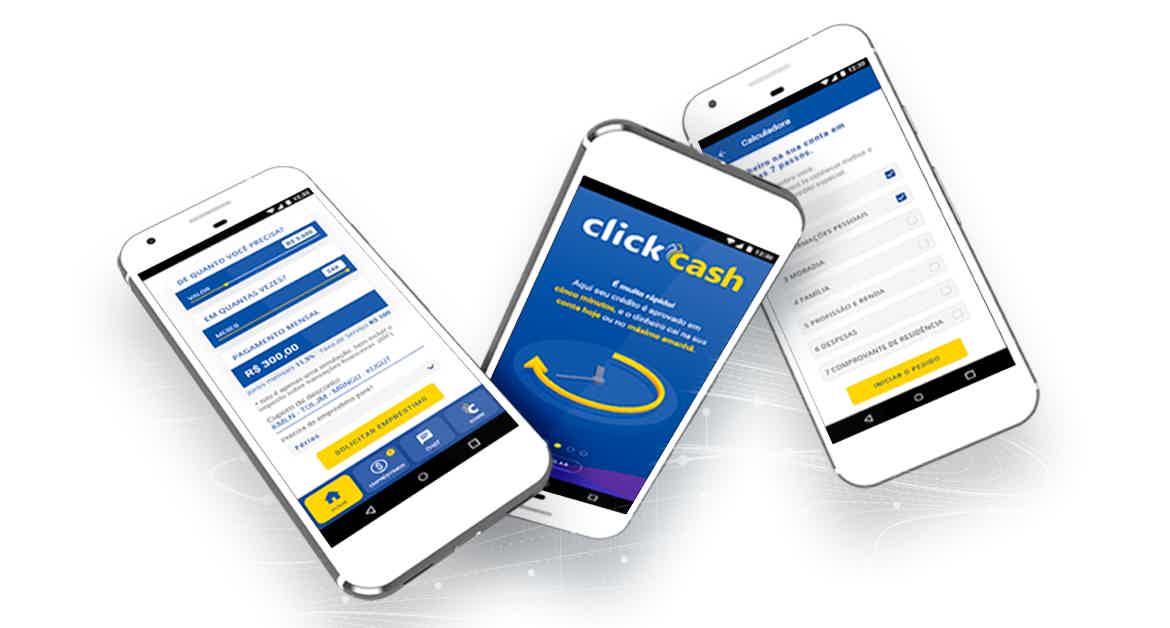

How to apply for the Click Cash loan

The Click Cash loan helps you pay your debts and make your dreams come true. Want to know how to apply? So, read this post and check it out!

Keep Reading

How much is the Casas Bahia card annuity?

Do you know how much the annuity card Casas Bahia is? Read this post and check out all about the fees charged, as well as the main benefits.

Keep ReadingYou may also like

How to open a PagBank account

With PagBank's digital account, you can make unlimited transfers, have a card with no annual fee and even invest in the bank's CDBs to see your money yield more. See here how to open your account!

Keep Reading

How to open a current account at Valor BPI

At BPI, you can subscribe to the Valor current account, pay a monthly fee and access the main banking products at no additional cost. See below for how to join.

Keep Reading

Find out about credit for works by Novo Banco

To renovate the home and make it look like new, nothing better than having the help of a credit for works with a high amount and an extended repayment period. This is exactly what Novo Banco credit for works offers. Learn more below.

Keep Reading