loans

How to apply for the Click Cash loan

The Click Cash loan helps you pay off your debts and make your dreams come true. In addition, it offers credit of up to R$10,000 with an interest rate of up to R$14.91 per month. Want to know how to apply? Then read this post and check it out!

Advertisement

Click Cash Loan: fast money without bureaucracy

Without a doubt, the Click Cash loan is ideal for you who are looking for a fast and bureaucracy-free line of credit. In other words, cash in hand and no headaches!

So, check out below how to request yours and make your dreams come true!

Order online

So, it is not yet possible to apply for the Click Cash loan through the website. But you can contact the company through the company's official customer service channels by email atendimento@clickcash.com.br to answer your questions.

Request via phone

It is also not possible to apply for the Click Cash loan over the phone. However, you can contact us via WhatsApp if you want more details about the product.

To do this, just send a message to the number (11) 97502 8273. Service hours are from Monday to Friday, from 9:00 am to 6:00 pm, except holidays.

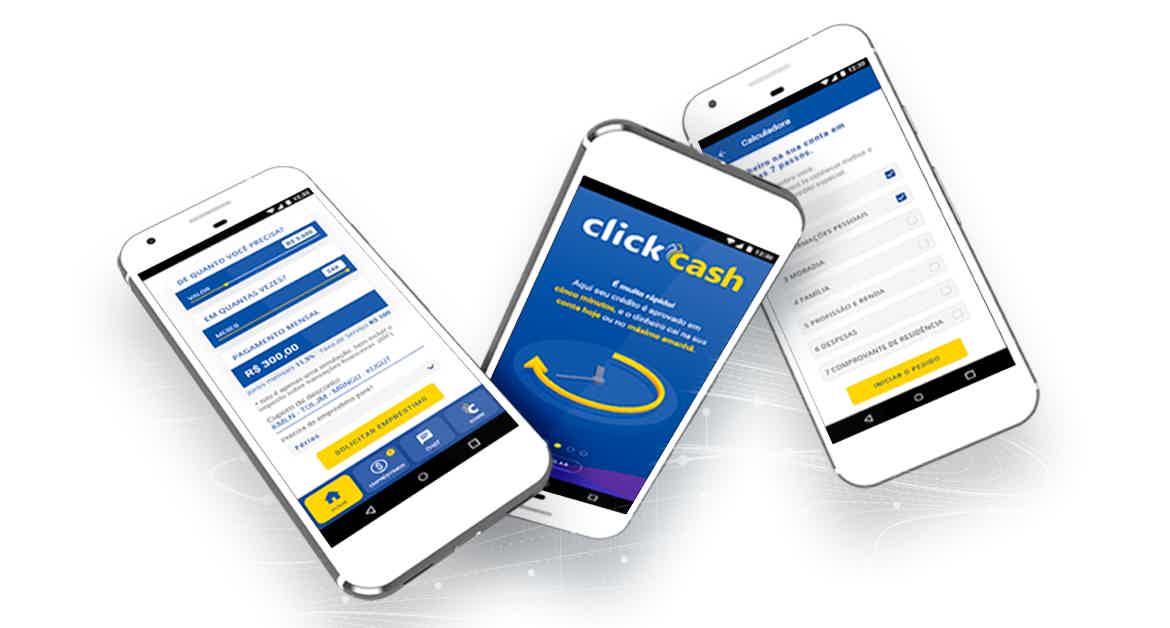

Request by app

Finally, to make the request through the app, simply search for “Click Cash” in the Google Play search bar and download it. It is worth noting that the app is not available on the App Store.

After installation, you must choose the loan amount and the number of installments you wish to pay. Then, fill in the registration information and in a few minutes a credit profile will be created for you.

It is also important to remember that the necessary documents include proof of residence of up to 60 days and an official document with a photo. Likewise, you need to inform the current account that you will use to receive the money.

Finally, if your request is approved, Click Cash sends the contract to your email and the amount is released directly into your account within one business day after signing. Fast, simple and best of all: with zero bureaucracy.

Superdigital Loan or Click Cash Loan: Which One to Choose?

But if even after learning about the Click Cash loan, you still don't know if this is the line of credit for you, we will help you.

With that in mind, we’ve prepared a comparison with a similar product. So, you have all the information you need to make an informed financial decision. Check it out below!

| Superdigital | click cash | |

| Minimum Income | Not Informed | Not Informed |

| Interest rate | Varies according to customer profile | From 4.0% to 14.9% per month |

| Deadline to pay | From 3 to 18 months | From 6 to 24 months |

| Where to use the credit | Debt settlement Reforms Pay the bills | Debt settlement Trips Investments |

| Benefits | Instant release Self-employed are eligible low interest rates | Fast money and no bureaucracy Everything done online 100% First installment in 45 days |

How to apply for the Superdigital loan

Learn everything about how to apply for this loan with amounts of up to R$$25 thousand, low interest rates and up to 18 months to pay off the credit.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Nubank card step by step

The Nubank Card is one of the best cards in Brazil and has an increasing number of customers, in this article you will find out how to apply for it.

Keep Reading

What is Black Friday and how to take advantage of the promotions?

Find out in this post what Black Friday is and find out how you can take advantage of the date's promotions safely and economically!

Keep Reading

Discover the personal loan Next

Learn about the Next personal loan and how it can be of great help in starting your business or paying off that old debt. Check out!

Keep ReadingYou may also like

How to apply for Unibanco Personal Credit

Find out how easy it is to apply for Unibanco Personal Credit and take out a loan that has low interest rates and allows up to 84 fixed installments. Check out!

Keep Reading

Discover the Ibi Digital Loan

The Ibi Digital loan has an online 100% application process and an interest rate starting at 2.97% per month. Learn more about this product in the text below.

Keep Reading

What are the values of the Bradesco health plan?

Find here all the necessary information about the Bradesco health plan to hire it for you, your family or your company.

Keep Reading