loans

How to apply for a cash loan

Learn how to apply for the Caixa loan. This process is quick and can be done at any Caixa branch. Thus, you have the money in the account more quickly and with attractive interest.

Advertisement

Caixa: application process without bureaucracy

First, let's learn how to apply for a Caixa loan that can be in your account in a few working days, without any bureaucracy and with all the security you need when applying for a loan. So keep reading to learn the process step by step. So let's go!

Order online

Now, let's see how you can apply for a Caixa loan online. So, unfortunately, although Caixa makes several virtual service channels available, it is currently not possible to request them. But you can apply for the loan by going to one of the Caixa agencies.

And, in addition, you need to bring your personal documents, such as CPF, RG, proof of residence, proof of income, among others that the institution requests. Then, you must wait for the credit analysis. Then, in case of approval, the money is released into your account within a few days.

Request via phone

Furthermore, it is not possible to apply for the loan by phone. But you can get in touch with Caixa to ask questions by number: 0800 726 0101.

Request by app

So, the loan request is made directly at the Caixa branch, so it is not possible to apply through the application.

Lendico loan or Caixa loan: which one to choose?

So, if you've come this far and found that the Caixa loan does not meet your needs at the moment. But do not worry! Because we have other similar financial products to introduce you to. Given this, how about getting to know the Lendico loan? In addition, it also offers excellent credit terms to customers. So, see the comparison table below and compare them:

| legendary | Box | |

| Minimum Income | Minimum wage | not informed |

| Interest rate | From 1,99% per month | not informed |

| Deadline to pay | From 12 to 36 months | Up to 48 months |

| Where to use the credit | pay debts | pay debts |

| Benefits | Credibility Security attractive interest | Credibility Security attractive interest |

How to apply for the Lendico loan

Do you want to learn how to apply for the Lendico loan? It has interest rates starting at 1,99% per month, personalized service and several other unique conditions.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

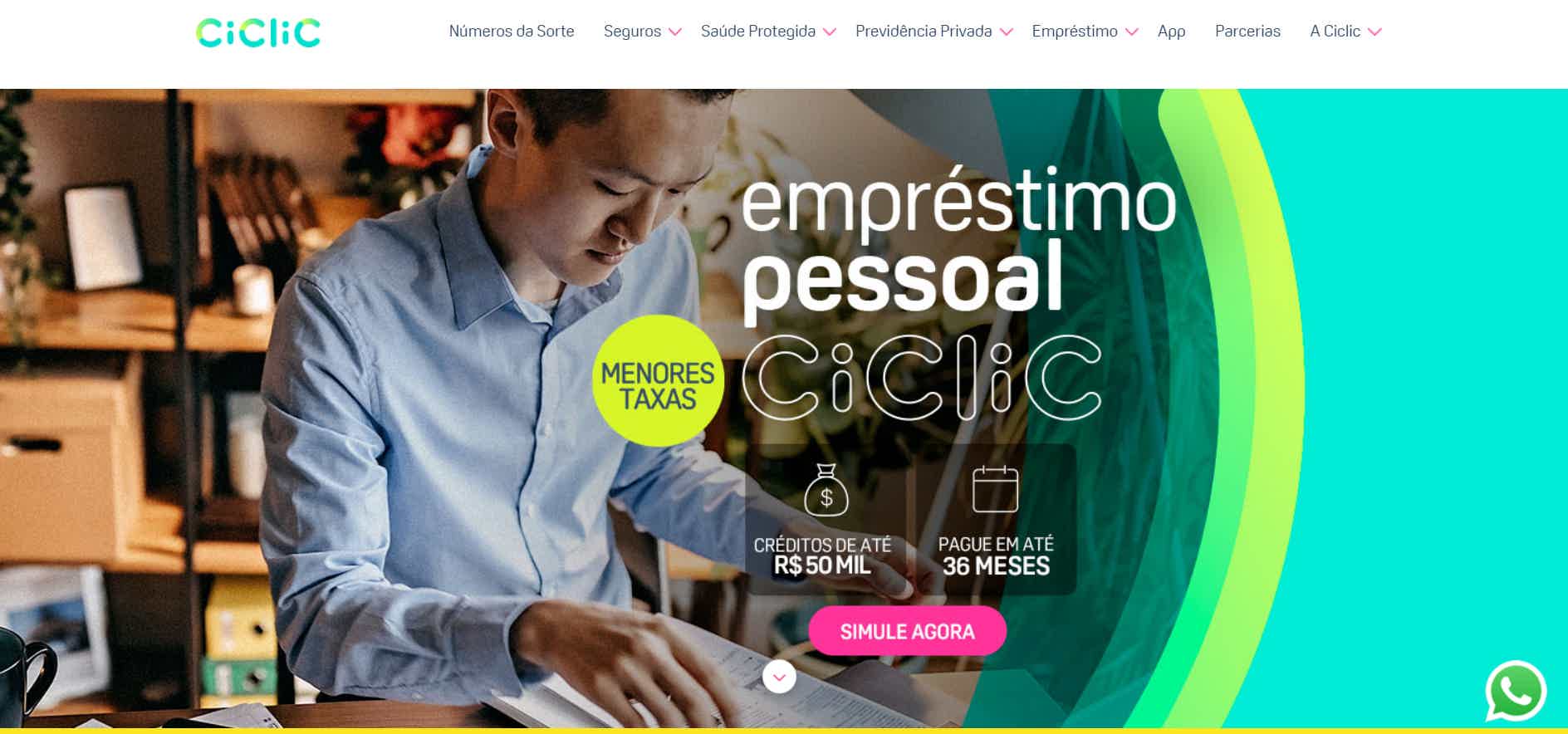

Ciclic personal loan: what is it and how does it work

Get to know the Ciclic loan and see how this credit can help you get out of the red with low interest rates and 36 months to pay.

Keep Reading

PicPay personal loan: what is PicPay?

Do you already know the PicPay personal loan? No? Then read on, as we are going to tell you all about this loan! Check out!

Keep Reading

Condor loan or SuperSim loan: which is better?

Need a loan? How about reading our comparison of Condor and SuperSim credits? So read now and find out more!

Keep ReadingYou may also like

Get to know ActivoBank Personal Credit

Do you want a credit that drives your dreams? Then, discover ActivoBank Personal Credit, which gives up to €15,000 when applying online and €75,000 when applying at the counter. Know more!

Keep Reading

Find out about Caixa construction financing

With Caixa's construction financing, you can borrow up to 80% of the value of the work, pay in up to 420 months and even amortize part of the debt with your FGTS. Learn more in the post below.

Keep Reading

How to do Bradesco debt renegotiation

Renegotiating your debts with Bradesco bank can be an interesting way to get out of the red! This is because not having pending items in your name helps when it comes to recovering your financial health. Interested? Read on!

Keep Reading