loans

How to apply for the BMS loan

Do you want to learn how to apply for a BMS loan with reduced terms and almost immediate approval? Then continue reading to learn the step by step!

Advertisement

BMS loan

So, the BMS loan is a type of credit that has special conditions in relation to other loans. That's because, it works with reduced deadlines and values, but it has almost immediate approval within 24 hours after signing the contract!

Thus, it brings the security, agility and comfort you need in a process that takes place 100% online! So, today we are going to teach you how to apply for this loan without having to leave your house! Well, read on!

Order online

Then the process is done 100% online! To do this, just access the SerasaeCred website and do a free simulation! Then, just inform the CPF number and if you are already registered, just inform the password. If you haven't already, just register!

So, just complete the credit profile and wait for the offers made available according to your profile! So it's a very simple and intuitive process!

Request via phone

So, you cannot apply for the BMS loan over the phone. However, you can get in touch using the numbers to answer questions: Phone: (11) 3181.1444 .

Request by app

Unfortunately, BMS still does not have an application to apply for the loan. That's because the whole process is done through the SerasaeCred website! Therefore, go to the official website to access all the information about the loan!

BMG loan or BMS loan: which one to choose?

So, the two loans have very interesting proposals for the clients of BMG and BMS banks, as well as, with security and agility for the clients of these banks! So, below see a comparison table between them:

| BMG | BMS | |

| Value | Uninformed | Up to R$3000 thousand reais |

| Installment | Up to 84 months | Up to 8 months |

| Interest rate | 1.80% per month | Uninformed |

| accept negative | Yes | No |

| release period | up to 24 hours | up to 24 hours |

Finally, below is recommended content on how to apply for the BMG loan! Check out!

How to apply for the BMG Emergency Loan

Applying for your BMG Emergency Loan is much easier than you might think! Read our text and understand more about this request process.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Is the Caixa Mulher card safe?

Find out if the Caixa Mulher card is safe. In this article we will tell you all the benefits and advantages of this card. Read and find out!

Keep Reading

How to apply for the Cetelem payroll card

With the Cetelem payroll card, you can shop without worrying about the annual fee and you can even get discounts. See here how to apply.

Keep Reading

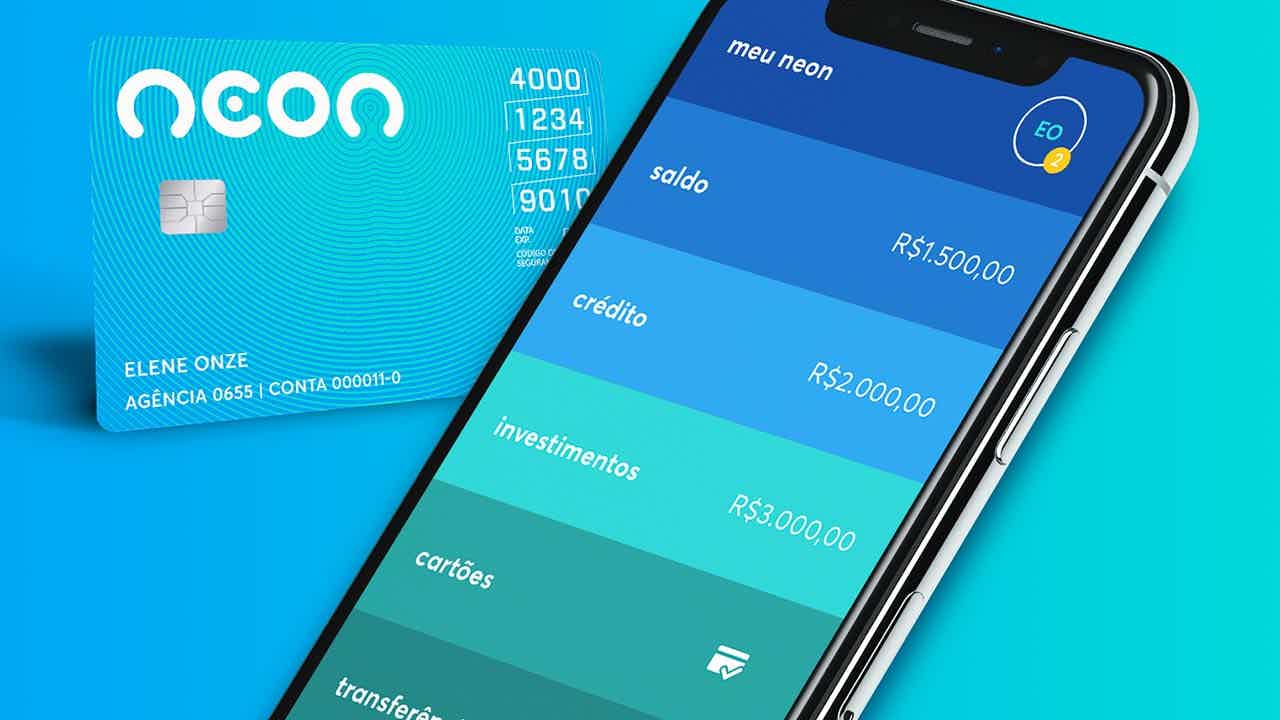

How to apply for the Neon card step by step

Find out in this article how to apply for the neon card in a simple and uncomplicated way, and the process is 100% online.

Keep ReadingYou may also like

The best online loan options

Discover the best online loan options now. Find out which option best suits your needs and find out how to apply.

Keep Reading

Discover the WiZink Flex credit card

The WiZink Flex credit card offers many advantages. Among them we can mention the personal credit of up to 90% of the credit limit, which, in turn, can be paid in up to 96 months. Do you want to know more about him? So read this post and check it out!

Keep Reading

How do I sign up for Disney Plus?

The whole family can enjoy quality content by subscribing to Disney+. In addition, movies and series can be viewed on the smart TV by linking your smartphone to the device. Do you want to know how to do this process and how to register for streaming? Come with us!

Keep Reading