Cards

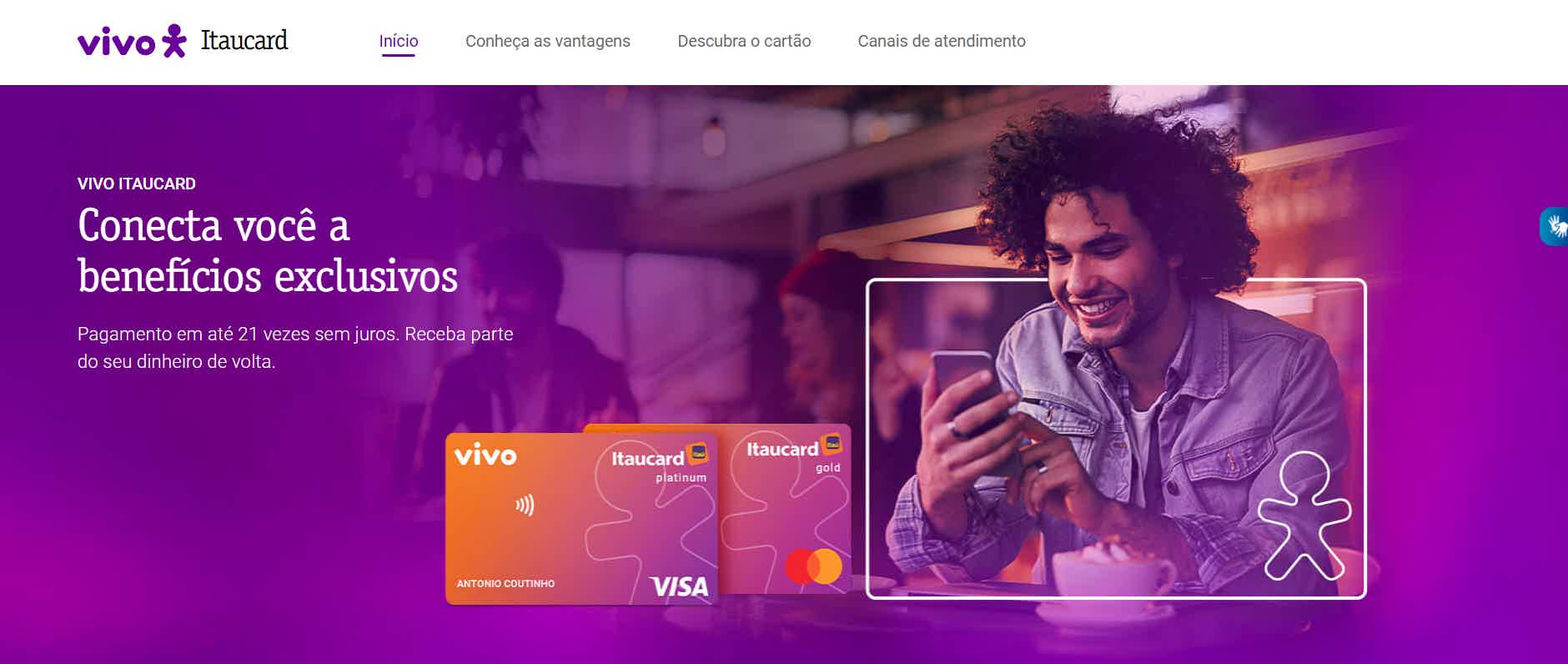

How to apply for Vivo Itaucard Cashback Platinum Visa card

Learn how to request your Vivo Itaucard Cashback Platinum Visa card and take advantage of special discounts and installments at Vivo stores. In addition, you also have the possibility of waiving the annual fee, as well as an incredible cashback program.

Advertisement

Vivo Itaucard Cashback Platinum Visa Card: request 100% online

If you are looking for a card that helps you with your finances, offers you discounts and also exempts you from the annual fee, the Vivo Itaucard Cashback Platinum Visa card is what you are looking for. So, continue reading and learn the step-by-step process for applying.

Order online

So, to request this credit card signed between Itaú and Vivo, you need to access the official Itaú bank website. Next, you must choose the Vivo Itaucard Cashback Platinum Visa card and fill out the request form.

Therefore, you must fill in your personal data, such as CPF, ID, proof of residence and proof of income for a minimum value of R$800.00 and then wait for the bank's credit analysis, which may take a few days.

Furthermore, the card has a simple and quick application and you can have access to several advantages such as 50% discount at cinemas.

Request via phone

Well, unfortunately you cannot request the card over the phone, because to request it you need to go to the institution's website.

However, you can contact the Itaú Customer Service Center to answer all your questions via the numbers:

- 4004 4828 (capitals and metropolitan areas);

- 0800 970 4828 (other locations).

Likewise, you can also go in person to one of the Itaú bank branches to find out more information.

Request by app

So, you can't request the card through the app, but you can access the Itaucard app to have access to all your credit card information through the Itaú app.

You can also make contactless payments, transfers and various other transactions. Therefore, Itaú offers the best services and products for the institution's customers.

Santander SX card or Vivo Itaucard Cashback Platinum Visa card: which one to choose?

So, if after knowing a little about the card you still have questions, don't worry, because today we have brought a comparison of the Santander SX card with the Vivo Itaucard Cashback Platinum Visa card. Take a look below and see which one is the best option for you.

| Santander SX Card | Vivo Itaucard Cashback Platinum Visa Card | |

| Minimum Income | R$ 500.00 for account holders R$ 1,045.00 for non-account holders | R$800.00 |

| Annuity | 12x of R$ 33.25 | 12x of R$ 30.00 |

| Flag | Visa/Mastercard | Visa |

| Roof | International | International |

| Benefits | International Card Go with Visa/Mastercard Surprise Possibility of exemption from annuity | international card Possibility of exemption from annuity Go from Visa 50% of cinema discounts Cashback Program |

How to apply for the Santander SX card

The Santander SX card is international and has several advantages, such as the possibility of exemption from the annuity. Find out how to order yours here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Work at General Mills: check out available opportunities

Work at General Mills: check available opportunities. Let's take a look at the opportunities today.

Keep Reading

How to work with delivery application? see the options

Learn in this post how to work with a delivery app and discover 6 platforms that allow you to work as a delivery person!

Keep Reading

Dream agent: discover this opportunity to earn money

MRV offers the chance to be a dream agent, as a promoter or partner broker. See how it works in this article!

Keep ReadingYou may also like

Why join the Mr Finance WhatsApp group?

By joining Mr Finance's WhatsApp group you will find out firsthand about the content we make about finance, credit cards, investments and much more. To participate, you pay nothing. Learn more later.

Keep Reading

New payroll margin rises to 40% and integrates BPC and Auxílio Brasil beneficiaries

With IN 131, INSS retirees and pensioners can commit up to 40% of income with the payroll loan. BPC and Auxílio Brasil beneficiaries can also apply for the credit line. Understand.

Keep Reading

How to open account at Ativa Investimentos brokerage

Check out how you can create your account at the Ativa Investimentos brokerage and take advantage of the custody and brokerage fee exemption on various types of investments. Learn more below.

Keep Reading