Cards

How to apply for the Supera Card

Do you want to know how to apply for the Supera card that is being successful? See now the step by step to help you.

Advertisement

Super card

Request the card overcome has been preferred by many people. This product has been drawing attention from the public and the financial market. The excellent conditions of use certainly have an influence on all this success.

However, despite being famous, many users do not know how to order this tool. Thus, it is common for these people to believe that this is a difficult process and full of bureaucracy. However, they couldn't be more wrong.

In the meantime, the purpose of this article is to show you how to get your card overcome. Therefore, here, you will find out about all the alternatives to make this request. Finally, all you have to do is choose which one you found easier.

Step by step to apply for the Supera Card

No. You have more than one option in this regard. However, most people prefer to use the website to apply for the Supera card. In this way, this happens because this is undoubtedly the most practical and fastest alternative. Therefore, the next topics will tell you more about this.

Applying online

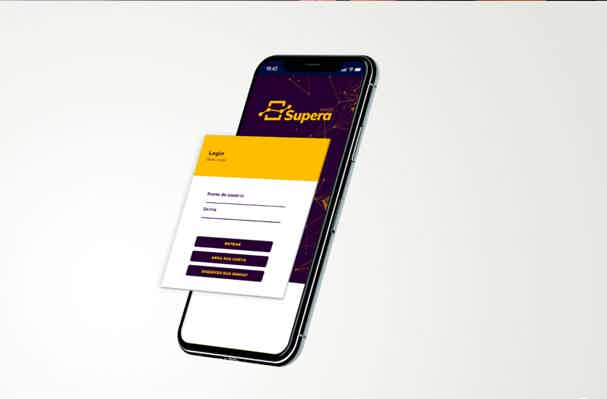

To order this product, you must have opened your digital account. In this sense, only after this process is the card available. That way, done that, just access the company's website or app. Then, log in with your CPF or CNPJ and registered password.

Once this is done, go to the “cards” tab and click on “request card”. Thus, you will be directed to a page where some information is requested. So don't worry, it's basic personal data.

After filling out everything that was requested, just finish the operation. Then, the bank will create your product and have it delivered to the address you described.

Request via phone

A downside to applying for the card overcome is that you can't do it over the phone. In this way, everything must always be done through internet banking or the application.

However, if you have any problems or questions, you can contact the company in two ways. So, see what they are below.

- Telephone: (11) 3199-5250

- E-mail: sac@bancosupera.com.br.

download app

Remember that you can move your digital account through the bank application. Therefore, the first thing to do is download the tool. In this sense, just go to the Apple Store or Google Play and download it.

With the app running on your device, the possibilities are endless. For example, you can issue a bank slip, make transfers and so on.

PagBank Card or Supera Card?

There is another option similar to the Supera card, which is the PagBank card. Both have very interesting features. However, they differ in some ways. So, just look at the table we prepared on these two credit tools to see if it's worth applying for the Supera card.

| Characteristics | PagBank | overcome |

| Minimum Income | not informed | not informed |

| Annuity | Free | Free |

| Flag | Visa | Link |

| Roof | International | National |

| Benefits | Digital account, cashback, savings income | All benefits associated with the card brand |

Finally, you already know everything about how to apply for your card overcome. Now it is your turn. So, don't delay another minute and order yours now. In other words, take another step towards your financial autonomy.

How to apply for PagBank Card

If you liked the options and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Lanistar Card Limit: what is the value

Want a card that promises to innovate the market? So, see the Lanista card limit that can gather up to 8 lines of credit. Check out!

Keep Reading

Discover the PicPay credit card

Meet the PicPay credit card! With it, customers have the advantage of getting rid of the annuity and paying zero fees. Check out!

Keep Reading

Access credit card: the best of life for negatives

Considered one of the best in the prepaid market, the Acesso credit card is the best in life for negative credit cards. Learn more about it!

Keep ReadingYou may also like

Obtain financial independence by reselling O Boticário products

Do you want to know how to be an O Boticário reseller to guarantee commission on all sales and pursue your professional success and financial independence? So, check out this material that we have separated for you and learn how to register.

Keep Reading

How to apply for the card Today

The Hoje card offers exclusive interest-free installments at taQi and VouLevar stores and websites. In addition, it has international coverage and the benefits of the Visa flag. Find out here how to apply for the card and enjoy all its benefits.

Keep Reading

How to open a EuroBic Senior account

Do you want a simple current account to manage your financial life? If so, take the opportunity to check out how to join the EuroBic Senior account and do not pay a maintenance fee (subject to special conditions). Find out everything you need in the post below.

Keep Reading