Cards

How to apply for the Sofisa card

Do you have a dirty name? The Sofisa Direto card can be a good option. It has international coverage, is prepaid and the requested income is only one minimum wage. Check out!

Advertisement

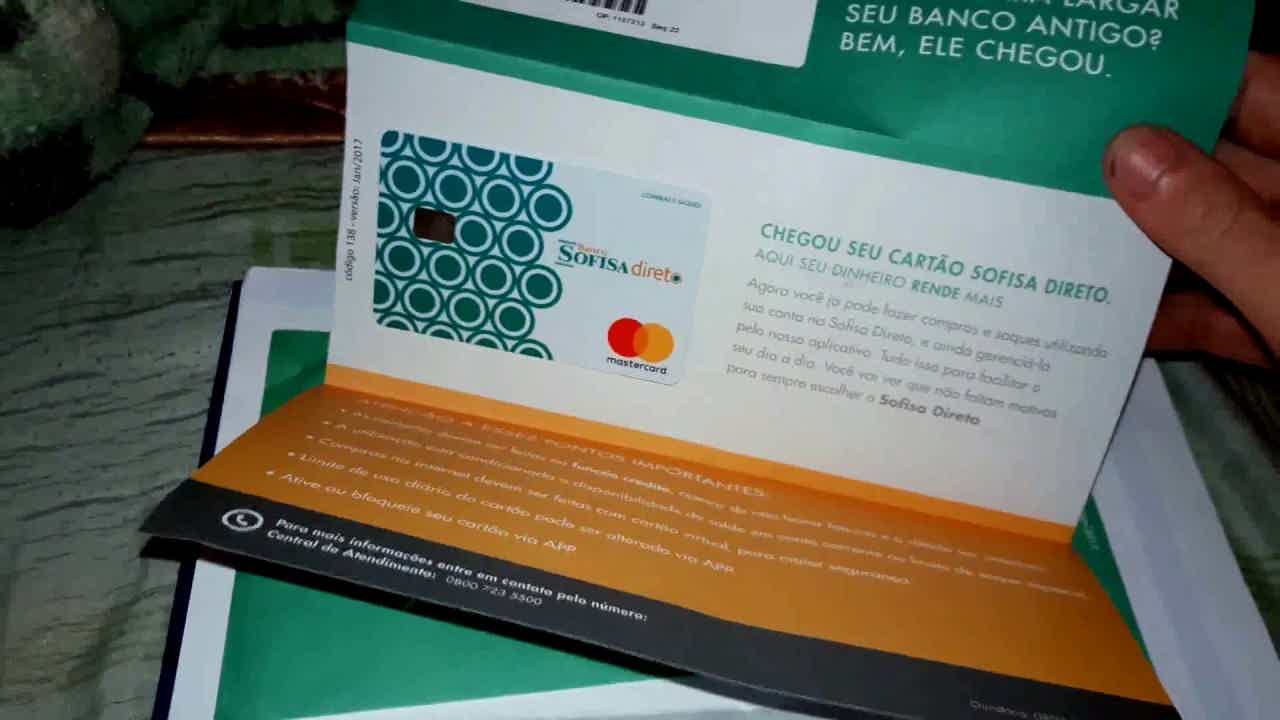

Sofisa card

So, the Sofisa Direto card is a prepaid card model created in partnership with the Mastercard brand, exempt from annuity and administrative fees. In this, it brings practicality, transparency, security and several exclusive offers for Sofisa digital bank customers!

So, today we're going to teach you how to apply for this credit card without having to leave the comfort of your home! Read on!

Order online

Well, to apply for the Sofisa card you need to download the Sofisa digital bank application and make the request through the app. And best of all, everything is very fast and safe!

So, once the application is finalized and approved, your card will arrive within 10 business days.

Request via phone

So, unfortunately, it is not possible to order the Sofisa Direct card over the phone. So, if you have any questions and want to talk to an attendant, just get in touch by the numbers: 0800 727 5042 (SAC) and 3003 7255 (Ombudsman).

Request by app

Well, to order through the app is very simple. You just need to be over 18 years old and have an account at the Sofisa Direto digital bank. After that, have the documents in hand and install the Sofisa app.

On the other hand, if you don't have a bank account, you will need to create an account, and then apply for the Sofisa card! In this, just click on request card in the app, fill in the requested information, and confirm the identity.

So, make a deposit through the app and start using it. After the deposit, you can start shopping wherever you want with your card!

It's easy to apply for your Sofisa Direito card, as long as you are over 18 years old and have a Sofisa Direto bank account. You will only need to have your documents in hand and follow the steps below:

Magazine Luiza card or Sofisa card: which one to choose?

So, both cards have very interesting proposals for Magazine Luiza customers from Banco Sofisa! So, below see a comparison table between them:

| Magalu | Sofisa | |

| Minimum Income | R$ 800.00 | not informed |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Exclusive discounts at Magalu | Mastercard Surprise, fee waiver |

Finally, below is recommended content on how to apply for the Magalu card! So check it out!

How to apply for the Magalu Card

Learn how to apply for the Magalu card, the Magazine Luiza network card, ideal for shopping on Magalu websites and in the app with various discounts! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Know everything about the Next card

In this article, we'll cover absolutely everything about the Next card and you'll find out whether or not it's a good option for you.

Keep Reading

How to subscribe to Believe Who Want? See the process

Find out in this post how to subscribe to Believe Who Wants and thus be able to tell your impressive story for all of Brazil to hear!

Keep Reading

How to be a driver at Lady Driver: check the requirements

Check out in this post how you can be a Lady Driver driver and check out how much you can receive for this app!

Keep ReadingYou may also like

Kids Banco Inter account: learn about the investment account

With the Kids Banco Inter account, you have access to a platform with several investment options, a personalized debit card and several other advantages for anyone who wants to start taking care of their child's financial future right now. Know more!

Keep Reading

Federal Government announces microcredit program for MEI and negatives

According to the Federal Government, Caixa should provide microcredit for MEI and people with negative credits starting in February. The idea is to offer a low-interest loan to strengthen entrepreneurship in the country.

Keep Reading

7 cards for negative public servants 2021

Do you work in a federal, state or municipal agency, are you negative and need a credit card for your day-to-day? So, check which ones are the best for you to apply for. Check out!

Keep Reading