Cards

How to apply for the Santander SX card

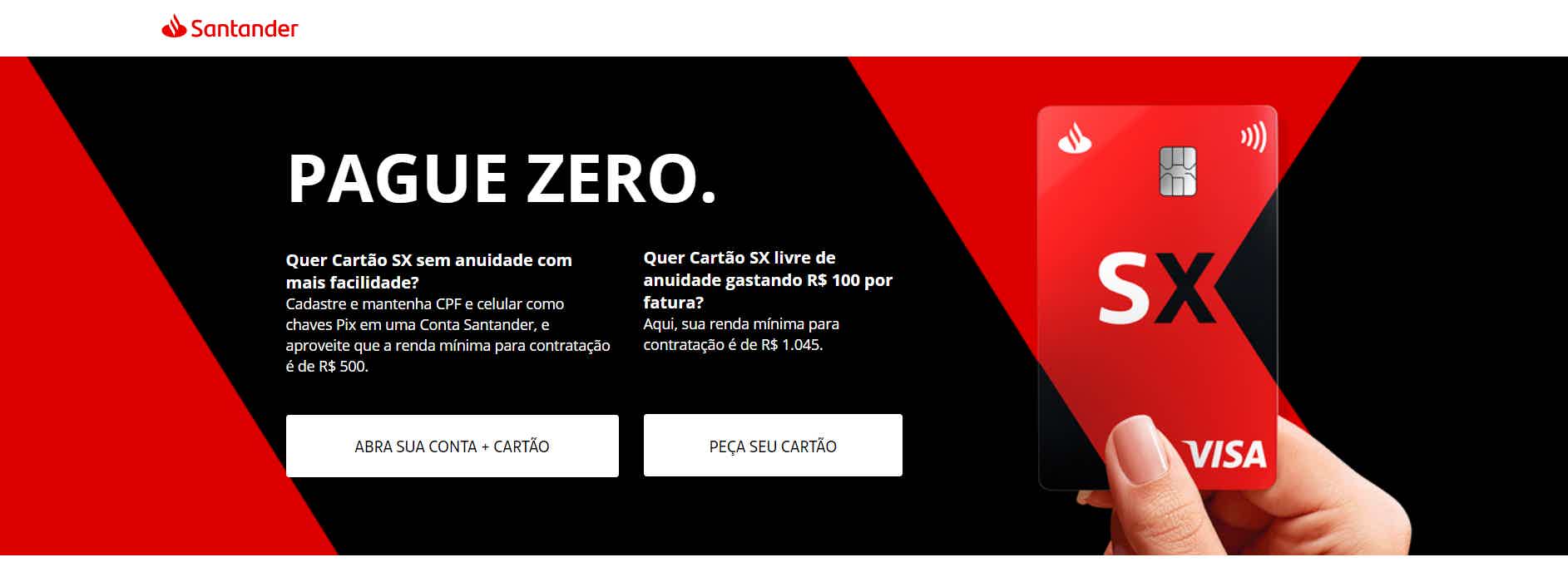

Find out how to apply for your Santander SX card online and enjoy its advantages, such as discounts with partners, exclusive installments, the possibility of waiving the annuity and much more!

Advertisement

SX card: online 100% application

The SX card does not require a Santander bank account, but it offers a good option to have a permanent free annuity. To do this, just become a Santander account holder and register your data as the card's PIX key. In addition, this card offers many benefits, such as discounts with Esfera partners and exclusive installment payments.

Want to know how to order yours? So, stay with us!

Step by step to apply

To order the SX, the process is very simple. We have listed here the step-by-step process so that, in a few minutes, you can consider yourself the owner of the new Santander card.

Order online

It is important to start by saying that Proof of income is required, R$ 500.00 for account holders and R$ 1,045.00 for non-account holders.

If everything is fine, just place an order through the bank's website. Then click on the option “ask card”, to proceed with the process. After that, fill in your personal information such as full name, social security number, etc.

Then just sit back and wait! The bank will analyze your consumer profile and send you a response regarding the request. If the order is validated, the card is already issued and sent directly to your home.

It is worth mentioning that the card with the Mastercard brand must be requested in person at a bank branch.

Request via phone

You can also apply for the card over the phone, just call the following numbers:

- 4004 3535 (capitals and metropolitan areas);

- 0800 702 3535 (other locations).

The service is available from Monday to Friday, from 9 am to 9 pm, and on Saturdays, from 10 am to 4 pm.

download app

Because there is the exclusive SX app for both IOS and Android, which is free and allows you to manage your card online. So, just go to your phone's app store, download and use.

Santander SX or Pan?

But if you've come this far but still aren't convinced that the Santander SX card is for you, no problem. Because our team has compared all available cards, and based on feedback from our readers, has chosen an additional recommendation for you. Check this option below and compare with the SX card.

| Santander SX Card | pan card consigned | |

| Minimum Income | R$ 500.00 for account holders R$ 1,045.00 for non-account holders | Minimum wage |

| Annuity | R$ 399.00 or 12x R$ 33.25 Exempt if you spend R$ 100.00 on the monthly bill or if you join the PIX system | Exempt |

| Flag | Visa or Mastercard | Visa |

| Roof | International | International |

| Benefits | Discounts with Esfera partners Benefits associated with the flag | easy approval Go Visa Program |

How to apply for the Pan payroll card

Do you want to know how to apply for the Pan credit card and make your purchases and payments easier? So, watch the step-by-step right now.

Trending Topics

Online Cashme loan: with credit of up to 15 million

See in this article how the Cashme loan online works and learn about the special conditions you can access with it!

Keep Reading

Is Santander SX credit or debit?

Find out if the Santander SX card is credit or debit and how it works in practice. For this, check out its features and advantages here!

Keep Reading

Check out how to get a CNH without paying anything

Understand how CNH Social works, the value of the benefit, all the requirements you need to enroll, all in one place!

Keep ReadingYou may also like

10 advantages of the BMG bank credit card

Discover now 10 advantages of the BMG credit card!

Keep Reading

How to open a Montepio Ordenado account

At Montepio, when you open your current account to receive your salary, you can access essential banking services while being able to advance salaries by up to 100% of the amount you receive from your employer. Check then how to open your account.

Keep Reading

Investing abroad: what you need to know

Investing abroad is not something for the rich and not as difficult as it seems. See here how to invest outside Brazil, the advantages of doing so and if, after all, it is worth it. Learn more later.

Keep Reading