Cards

How to apply for the PagSeguro Prepaid Card

Do you already know how to apply for the secure pag prepaid card? So watch the step by step now and order yours now without leaving home.

Advertisement

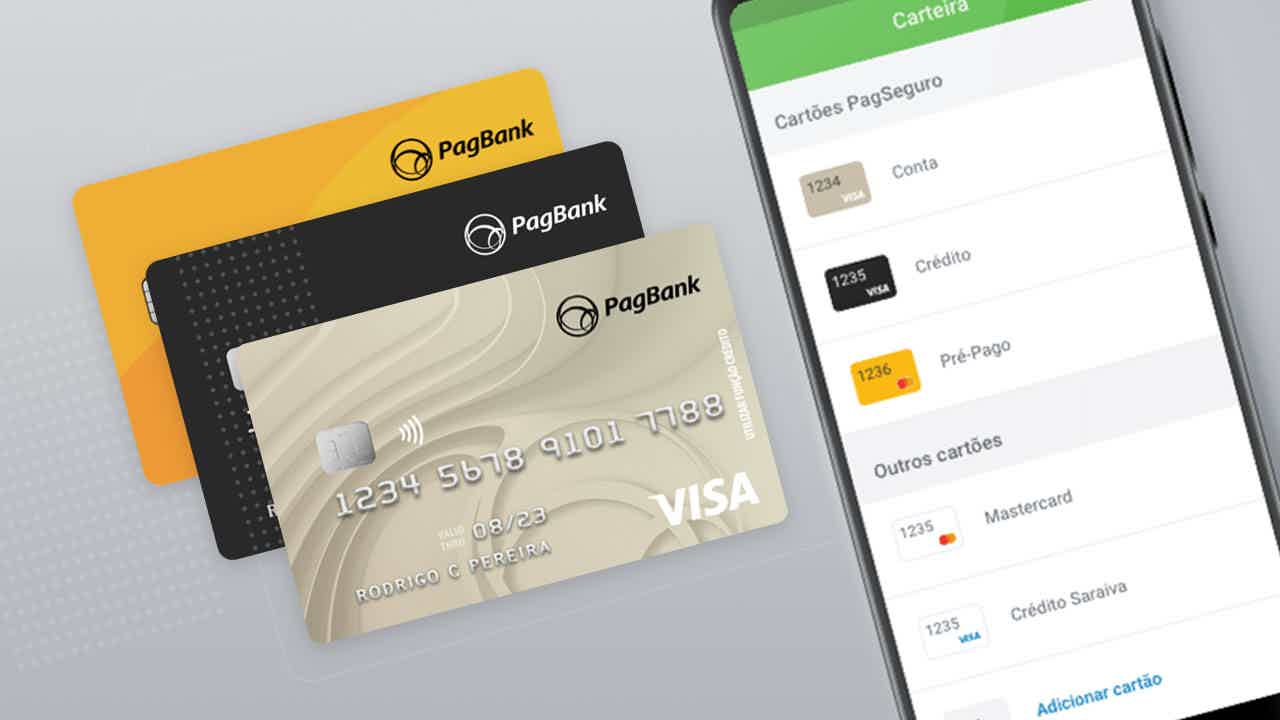

PagSeguro Prepaid Card

If you are negative, but want to regain the purchasing power of before, with all the facilities that a credit card allows you, choose PagSeguro prepaid. In addition, you do not run the risk of returning to the default list, as the prepaid PagSeguro only works with the limit you decide to charge.

If you are interested, find out how to apply for the card here. So, let's show you step by step how to order your prepaid PagSeguro right now. So countiNue with us and check it out!

Step by step to apply for PagSeguro Prepaid Card

Therefore, the PagSeguro prepaid card has several uses, it can be used for financial control, paying employees and even for your child's allowance. So, learn how to apply now!

So the step by step is very simple and now you will know how to do it from the request, unlocking, until the moment you have the card in your hands. So there are three simple steps of everything you need to know to have the PagBank Prepaid Card.

- Request your Card

So go to the PagBank website and register or login and ask for your card! Then it will be delivered within 15 working days.

- unlock your card

Because after the arrival of your card, through the website or the App, you can unblock it without any problems. However, for this you will receive your password by SMS.

- recharge your card

Therefore, top up your PagSeguro prepaid for the first time by accessing “load your card” through the PagBank App. But you can also choose the value you want and that's it! So now you can do your shopping.

Order online

So the request is also made through the PagBank website, whenever you want, without having to leave your home or face queues.

Therefore, to apply it is necessary to access the website and create an account. Then you will be directed to a page where you will need to enter the necessary data and a valid address for sending the card.

Request via phone

Here you will find all the necessary telephone numbers to clear all your doubts about prepaid PagSeguro directly with an attendant.

Call center (for questions, suggestions and technical support)

- 4003 1775 – Capitals and metropolitan regions

- 0800 728 2174 – Other locations, except cell phones

Customer service 24 hours a day, 7 days a week.

Ombudsman (exclusive channel for complaints)

- 0800 728 2167

Available from Monday to Friday from 9am to 6pm (except holidays).

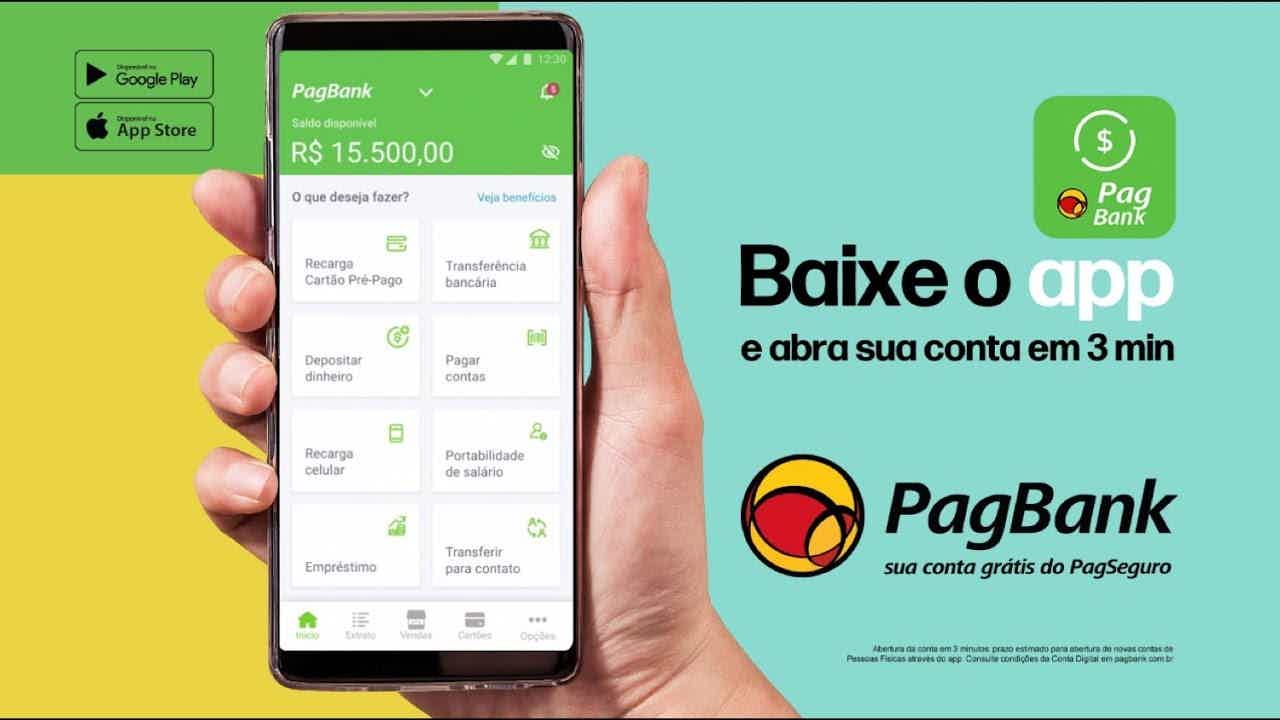

download app

Therefore, the PagSeguro prepaid request can also be made through the App that is available for Android and iOS devices. Then check your app store and download the App.

So with the PagBank Application you have access to everything a bank can offer, without paying extra fees and fees.

Access Card or PagSeguro Card?

For you to make the best choice, it's always good to be able to compare products, isn't it? So now let's make a brief comparison between the Acesso and PagSeguro prepaid cards. Follow the table below:

| Access | PagSeguro | |

| Minimum Income | not required | not required |

| Annuity | R$ 5.95 | Free |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Mastercard Surprise | Mastercard Surprise |

Now that you know how to apply, access and order yours soon!

Request the Access Card

See now how to apply for the Access prepaid card with a simple, quick, easy and safe step by step.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Condor loan

Get to know the Condor loan, a secure line of credit, with digital 100% contracting and the lowest rates on the market. Learn more here.

Keep Reading

Extra Card or Walmart Card: which is better?

Undeniably, choosing the Extra card or the Walmart card is difficult: both are Itaucard and offer discounts on products. So look at the differences.

Keep Reading

Is Digital Account worth it?

Those who have a digital account have all the practicality and agility, manage banking services and transfers through the app and more. Find out here!

Keep ReadingYou may also like

How to apply for the Smiles Bradesco Visa Platinum Card

Want to travel more comfortably and earn more miles? Discover the Smiles Bradesco Visa Platinum card in the text below!

Keep Reading

Stratus Rewards Visa White Credit Card: How It Works

Do you know the world's first white credit card? And do you know how exclusive it is? No? So, follow here for more details and discover one of the most exclusive cards in the world.

Keep Reading

How does the credit card bill work? Understand this document!

If you want to take advantage of the main benefits of your cards for your finances, it is essential to understand how the credit card bill works. To learn more, just continue reading the article and check it out!

Keep Reading