Cards

How to apply for PagBank Card

If you liked the options and advantages of the Pagbank card, find out right now how to apply without bureaucracy.

Advertisement

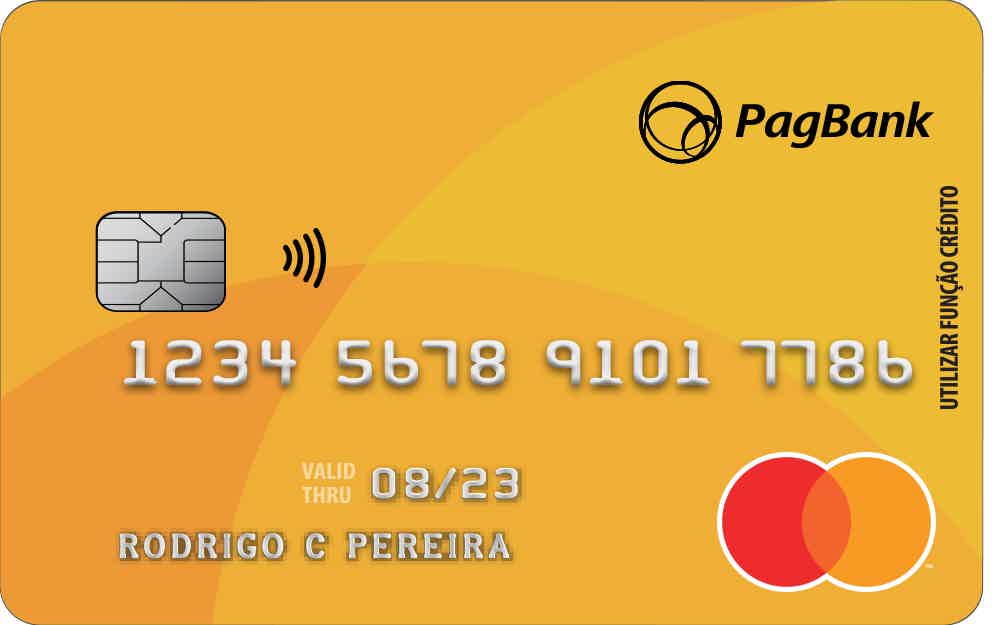

PagBank card

The PagBank card has several advantages and features. Given this, it's time to find out how to apply and start enjoying all the benefits it offers you.

Here, therefore, you will find out all the detailed step-by-step on how to apply for your new card. So, stay with us and check it all out.

Step by step to apply for PagBank Card

In addition to not consulting the Credit Protection Bodies (Serasa and SPC) for the request, the card can then be useful for your financial control. So load it only with what money you can spend. So you don't run the risk of extrapolating in expenses, reducing the chances of getting out of control financially and getting a dirty name.

The step by step is very simple and now you will know how to do it from the request, unlocking, until the moment you have the card in your hands. There are therefore three simple steps of everything you need to know to have the PagBank Card.

1. Request your: So, go to the bank's website, register or login to the account and ask for your card. It will therefore be delivered within a period of up to 15 working days.

2. unlock your card: With the card in hand, through the website or the application, you can unlock your card. After unlocking you will receive your password by SMS.

3. Reload your card: In the App, go to “Reload Card'” and top up with the desired amount. Ready! Now you can do your shopping.

Order online

The application for the Pagbank card is made through the bank's website, without you having to leave your home.

To apply, you must access the website and create an account. You will be directed to a page where you will need to enter the necessary data to create an account.

Request via phone

Here you can check all the necessary telephone numbers to solve all your doubts about the pagbank card directly with the attendants.

Call center (for questions, suggestions and technical support)

- 4003 1775 – Capitals and metropolitan areas

- 0800 728 2174 – Other locations, except cell phones

Customer service 24 hours a day, 7 days a week.

Ombudsman (exclusive channel for complaints)

- 0800 728 2167

Available from Monday to Friday, from 9am to 6pm (except holidays).

download app

The request can also be made through the App that is available for Android and iOS devices. Check your app store and download the App.

Recarga Pay Card or PagBank Card?

If you still have doubts about hiring the PagBank card or not, we have created a table comparing it to the Recarga Pay card.

| Pay top up | PagBank | |

| Minimum Income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | National | International |

| Benefits | Cashback | Mastercard Surprise |

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the C6 Acqua card

Have you heard about the C6 Acqua card? It is a great option for those looking for a card with advantages and also helps the environment. Check out!

Keep Reading

How to order the Ton card machine

Check out in this post a step by step for you to request the Ton card machine online without having to leave your home!

Keep ReadingYou may also like

How to apply for City Furniture card

Do you want to buy your furniture and decorations with discounts, safely and without worrying? So, check here how to apply for the City Furniture card and take advantage of the discounts and special conditions for store customers.

Keep Reading

Discover the BBVA Salary current account

With annual fee-free cards, overdraft facilities and a discount on the monthly commission, the BBVA Ordenado current account makes your salary more profitable. See how it works here!

Keep Reading

Ali Credit personal loan: what is Ali Credit?

Can you imagine getting a credit to pay in up to 96 months with an interest rate of up to 3,99% am? This is possible through the Ali Crédito private payroll loan. Read this post and learn more!

Keep Reading