Cards

How to apply for the prepaid Ourocard Card

Want a card with no annual fee, no abusive fees and exclusive discounts? So, get to know the prepaid Ourocard.

Advertisement

prepaid Ourocard card

Having a prepaid Ourocard card with a value that you set yourself can be very useful. Whether for emergencies, entrusting someone else with the task of making your payments or even for your child's allowance.

Furthermore, BB does not consult the credit protection bodies (SPC and Serasa) to grant you the Ourocard. That is, if you are negative, do not worry that your request will certainly be approved. Because despite the debts, you are still a consumer.

The card is rechargeable, so you can control the balance with whatever amount you want, paying by bank slip or making online transfers in the BB App itself. The prepaid card guarantees that the user controls the balance with maximum security, comfort and with the guarantee of Banco do Brasil.

Did you like it? So, here you can find out how to hire this Banco do Brasil card.

Step by step to apply

In addition to all the advantages you get with a prepaid card, by acquiring the Ourocard prepaid card, you will be contracting one of the best banks nationwide, with an excellent and well-evaluated service.

Therefore, you can order your card online, without having to leave your home. Check out the complete step-by-step process for applying here:

Order online

You can then make the request through the official website of Banco do Brasil. However, it is worth remembering that the card is only available to people who are Banco do Brasil account holders. BB customers must follow these steps:

After entering the BB website, click on the option “order yours now” located on the upper right and fill in the forms with the information that will be requested.

Request via phone

You can also solve other doubts about the Ourocard prepaid card over the phone, without leaving your home. Then, contact BB from the following telephone numbers:

It is indicated to carry out all possible banking processes online, due to the Covid-19 pandemic. Therefore, before thinking about going to a branch, contact Banco do Brasil through its service channels:

- BB Relationship Center: 4004 0001 / 0800 729 0001

- SAC: 0800 729 07222

- Hearing/speech impaired: 0800 729 0088

- WhatsApp: 61 4004 0001

- BB Ombudsman: 0800 729 5678

download app

All recharges of your prepaid card can be done through the Banco do Brasil application, available for Android, iOS and Windows devices.

Pag Bank Card or Ourocard?

Still in doubt? Here we make a simple comparison of PagBank cards and prepaid Ourocard cards. Check it out below:

| PagBank | Ourocard | |

| Minimum Income | It is not necessary | not required |

| Annuity | Free | Free |

| Flag | MasterCard | Visa |

| Roof | International | National |

| Benefits | Mastercard Surprise | No abusive fees, Discounts on Shows and other events. |

Now that you know about another credit card option, which is PagBank, learn how to request it by clicking the button below.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Writing for contests: tips for getting the best performance

Check out all the steps to put together a perfect contest essay. Check out the criteria and 8 very important tips.

Keep Reading

How to negotiate Caixa debts?

Are you hanging and don't know what else to do? See now the best tips on how to negotiate Caixa debts and get out of the red now.

Keep Reading

How to apply for the Brasil Você Prepaid Card

If you already know the benefits and facilities of the Brazil card, then see how to apply for it without leaving home. It's easy and fast

Keep ReadingYou may also like

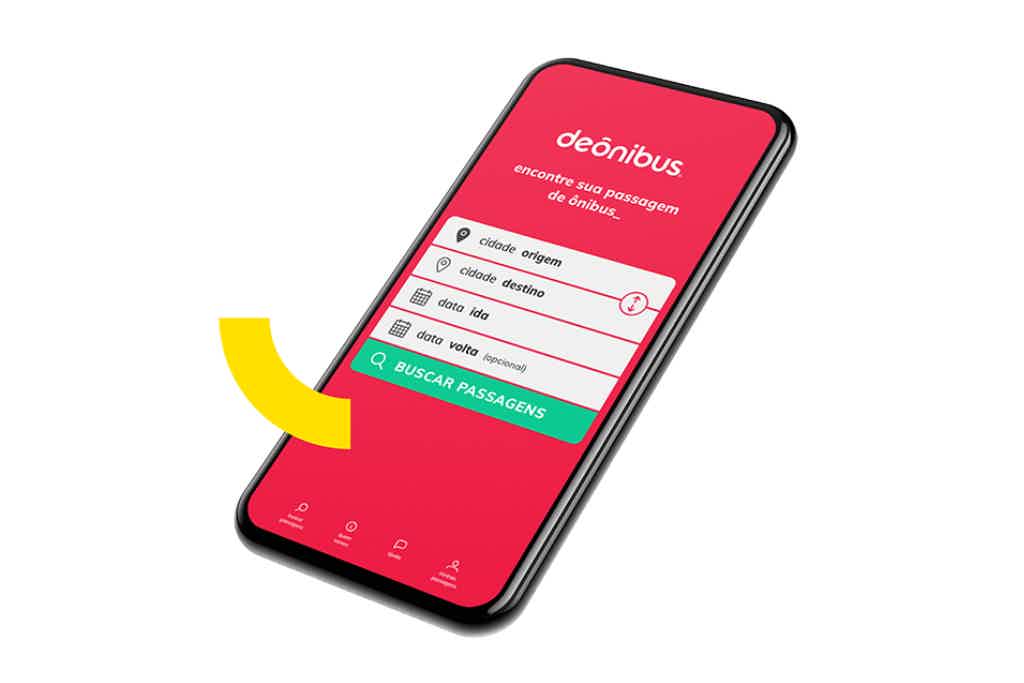

By Bus App: see how to save on travel

Do you want to save on tickets for your bus trips? Then the ByBus application can help you. To learn more about the app and see if it's worth using it, just continue reading ahead. Look!

Keep Reading

Meet the Necton brokerage

Necton does not charge a charge for pension funds and has even zeroed the custody fee for government bonds. Want to meet her? Then read on.

Keep Reading

How to increase Nubank limit 2021

Who doesn't want to have the dreamed purple card, right? And when it comes to the Nubank card, a frequent question is how to increase the limit? If you want to know the answer, read this post and discover the step-by-step process to get a higher limit for your purchases.

Keep Reading