Cards

How to apply for the Kabum card

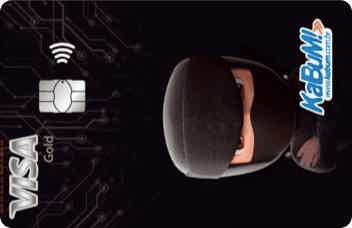

The Kabum card uses approximation payment technology and you can even split your purchases up to 24 times. Find out how to order yours!

Advertisement

Kabum: international coverage and ZERO annuity

Well then, the Kabum card is a great option for anyone looking for a quality product to make their national and international purchases.

In addition, it does not charge an annuity and has incredible advantages, such as the Vai de Visa program, Ourocard benefits and exclusive cashback for customers.

So, check below how to apply for your credit card and enjoy all these advantages!

Order online

So, applying for your card online is very easy and fast.

First, you must access the official Kabum website and register.

In addition, you need to provide the following documents: proof of identity, proof of residence and proof of income.

After completing the request, the bank will analyze your profile to approve the account and define your limit.

Request via phone

Well, the request can only be made through the website. However, if you have any questions about the process, you can contact the Central SAC at (19) 2114 4444 or by email at faleconosco@kabum.com.br.

Request by app

So, although it is not possible to make the request through the application, you can consult your limit directly through the BB App of Banco do Brasil.

Superdigital card or Kabum card: which one to choose?

But if you've come this far and still aren't sure that the Kabum card is the best option, don't worry!

That's why we brought you an exclusive comparison based on the opinion of our readers. Now, you can compare two of the best products on the market and choose which one is best suited for your current financial life. So check it out!

| Superdigital | Kaboom | |

| Minimum Income | not required | On request |

| Annuity | R$ 9.90 per month | ZERO annuity |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Without consultation with SPC and Serasa, Mastercard Surprise | Payment in up to 24 installments, approximation payment |

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

Trending Topics

Itaú Samsung credit card: how it works

See how the Itaú Samsung card works. It is international with the Visa Platinum flag and also has advantages for customers of the brand.

Keep Reading

Get to know the Elo Basic credit card

The basic Elo credit card is ideal for anyone looking for a card with national and international coverage, and a special points program.

Keep Reading

What are the risks of the payroll loan?

Payroll loan risks range from scams to imbalance in monthly income. Check out more in our post and know how to avoid them!

Keep ReadingYou may also like

Personal Inter Cash Personal Loan: What is it and how does it work?

Practical, fast and now at your fingertips. The new personal Inter Cash option has arrived to help you. It is ideal for those who already have an account at Banco Inter and need money in the short term. Read this post and learn more!

Keep Reading

How to apply for the Santander Business Credit Card

Applying for the Santander Business Credit Card is the first step to optimizing your business finances. Discover how to obtain financial flexibility and exclusive benefits for your business.

Keep Reading

How to register for the Social Energy Tariff

See the step-by-step on how to register and receive a discount of up to 65% on your energy bill through the Social Electricity Tariff benefit!

Keep Reading