Cards

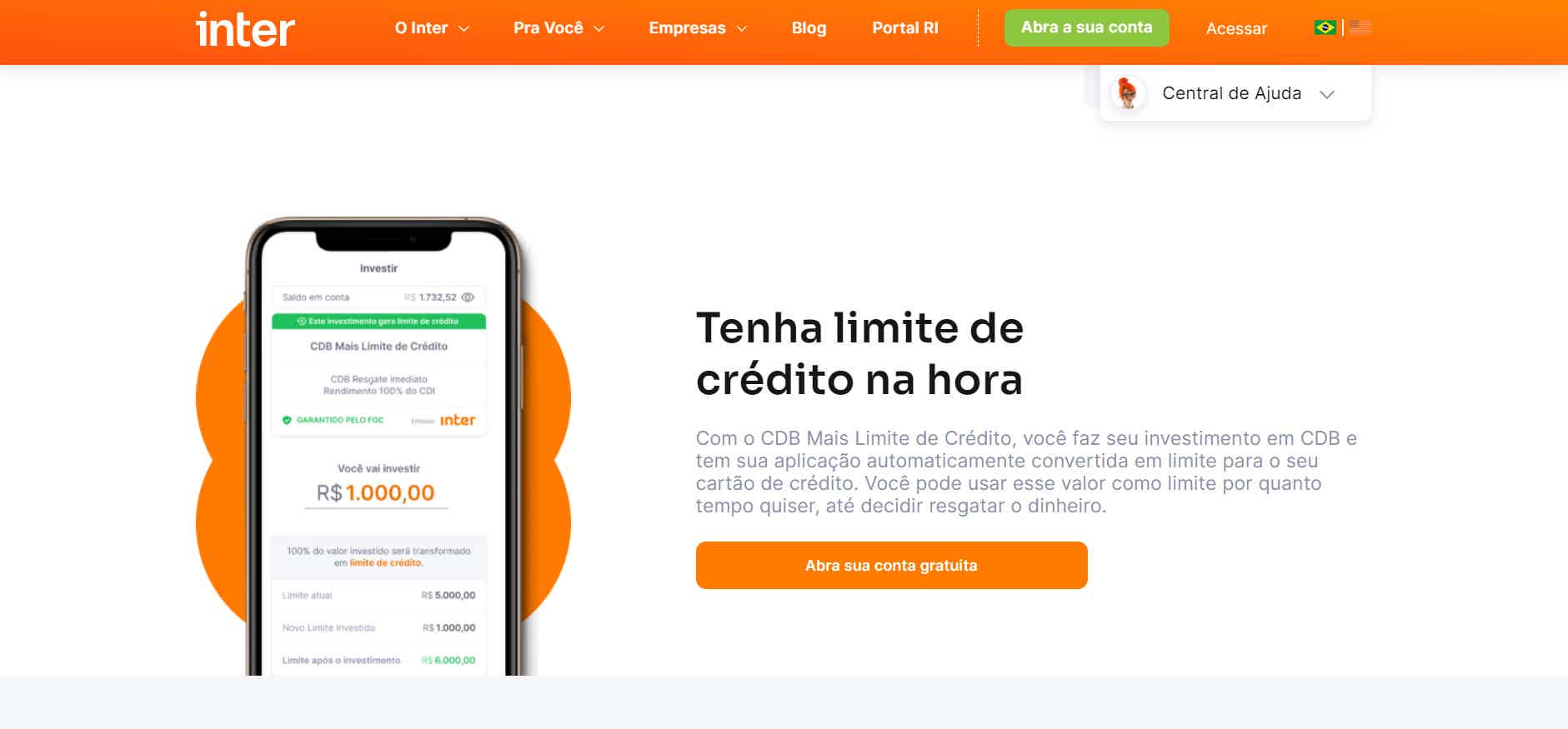

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Investido card without any bureaucracy in the comfort of your home. Through it, amounts from R$100 can be converted into a credit limit for negative people.

Advertisement

Inter Limite Invested: 100% request online

The Inter Limite Investido card is a very relevant option for people who cannot get immediate approval for the Inter bank financial product. In addition, with it you can create a financial reserve with low values, without having to leave the comfort of your home, that is, doing everything through the bank's website. So, read on to find out how to get this card step by step.

Order online

The first step to apply for the card is to open a digital bank account. To do this, simply access the website or app and place your order. After this process, you receive the debit card from the account at your home.

Next, there are two ways to apply for a credit card with Invested Limit, either through the cards area or Inter Invest.

Then, through the cards area, you must access it and click on “See credit options”. Then click on “Invest”. After that, fill in the amounts you want to apply and click on “Invest” again. Ah, the minimum value is R$100.

On the other hand, you can also apply through Inter Invest. So, click on “Investments”. Then click on “Invest” and then on “Fixed Income”. Then, look for the option “CDB Plus Credit Limit” fill in the invested amounts and click on “Invest”.

After this process, the credit function is enabled on your card. Therefore, the online process is very simple, just follow the step by step.

Request via phone

Also, unfortunately, it is not possible to apply for the card over the phone. But you can contact the Inter bank to ask questions through the numbers:

- 3003 4070 (capitals and metropolitan areas);

- 0800 940 0007 (other locations).

Request by app

You can also apply for the Inter Limite Investido card through the app. To do this, just download it from Google Play or the App Store and open your account. Then follow the same steps described above.

Inter Payroll Card or Inter Limite Invested Card: which one to choose?

First, if you got this far and found that the Inter Limite Investido card does not meet your needs at the moment. Rest assured! Because we have other similar financial products to introduce you to. In the face of this, how about getting to know the Inter Consigned card? In addition, it also offers excellent credit terms to customers. So, see the comparison table below and compare them:

| Inter Payroll Card | Invested Inter Limit Card | |

| Minimum Income | Minimum wage | not informed |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Cashback accept negatives flag benefits | Cashback accept negatives flag benefits |

How to apply for the Inter payroll card

Discover the Inter payroll card, with no annual fee and great benefits. And you can easily order online or over the phone! Look here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out about the Housewife Aid benefit

Do you know the Housewife Aid benefit? It assists low-income people who do housework at home. Check out!

Keep Reading

7 digital accounts for negatives

Digital accounts for negatives have great functions and make life easier for those with CPF restrictions. Check out our list of 7 of them!

Keep Reading

KeyCash loan: how it works

KeyCash loan can be a great option to stabilize your business. Check out its main features and advantages here!

Keep ReadingYou may also like

How to apply for the C&A card

Do you want an annual fee-free credit card that offers a 50% discount at the cinema? So, find out how to apply for the CEA card.

Keep Reading

Living on rental income: practical tips for 2021

If you already have or are thinking about acquiring a property to live on rental income, then you need to check out our practical tips! Here you will learn about the pros and cons of this type of investment and also the best practices for success. Know more!

Keep Reading

Discover the Monese debit card

The Monese debit card is a simple means of payment and is associated with all the digital bank's account plans. See here how it works and if it's worth doing yours.

Keep Reading