Cards

How to apply for the Ibicard Fácil card

We will show you how you can apply for the Ibicard Fácil credit card and other tips on how this card works. Check out!

Advertisement

Ibicard Easy

At the outset, let's mention that the Ibicard Fácil card is ideal for people with a dirty name and who want to have a card option that guarantees them security and comfort, as well as helps them control expenses and even financial investments.

Well, Ibicard Fácil is a card that, despite having an annual fee, has relatively low rates compared to other cards and offers several benefits for users who want to acquire this card.

Therefore, today we are going to show you how you can apply for this card, as well as show all the advantages of purchasing this product!

Order online

Well, it is not possible to apply for an easy Ibicard online. This is because the request is only made in person. That's because, for that, you must go to one of the Ibi stores, take your personal documents such as RG, CPF and proof of income and then place your order for the card.

Request via phone

Initially, unfortunately, there is no way to apply for Ibicard Fácil over the phone. However, if you have any questions about the card, you can contact them via the following telephone numbers: SAC 0800 721 1506, and also, SAC Deficient Hearing 0800 721 1508 and, in addition, through the ombudsman 0800 722 2073.

download app

Well, the Ibicard Fácil card has an application where you can access all card movements, as well as view credit card invoices. However, it is not possible to apply for the card through the application. That's because, as we've already mentioned, it's only possible in person.

So, the Ibicard Fácil application is the Ibicard APP. That is, you can make the card and then have access to the app to find out about your movements, financial investments, as well as other data about your Ibicard credit card.

Superdigital or Easy Ibicard Card?

| Superdigital Card | Easy Ibicard Card | |

| Minimum Income | MINIMUM WAGE | FREE |

| Annuity | FREE | 10 x of R$3.60 (total R$36.00) |

| Flag | VISA | MASTERCARD |

| Roof | INTERNATIONAL | INTERNATIONAL |

| Benefits | free digital account zero annuity Digimais Reward international coverage | Up to 40 days to start paying bills Installments of purchases up to 12 installments Invoices by email Discounts for exams in accredited laboratories Free add-on cards Exemption from proof of income Payment of bills in up to 3 interest-free installments |

That is, both options have pros and cons, for example, one of the cards requires proof of a minimum income of one minimum wage, however, the other card does not require proof of income. That's because, there is no credit analysis.

So, the Ibicard option may be a better option for people with a dirty name, as they won't need to prove income and will still have an ally for purchases and bill payment.

Therefore, to know which is the best credit card option, you need to compare the pros and cons of the two options to see which one best suits your needs.

How to apply for the Digimais card

The Digimais card is great for people with a dirty name and also provides several other advantages. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the PicPay loan

Do you want to learn how to apply for a Picpay personal loan with a quick and secure release? Then continue reading to learn the step by step!

Keep Reading

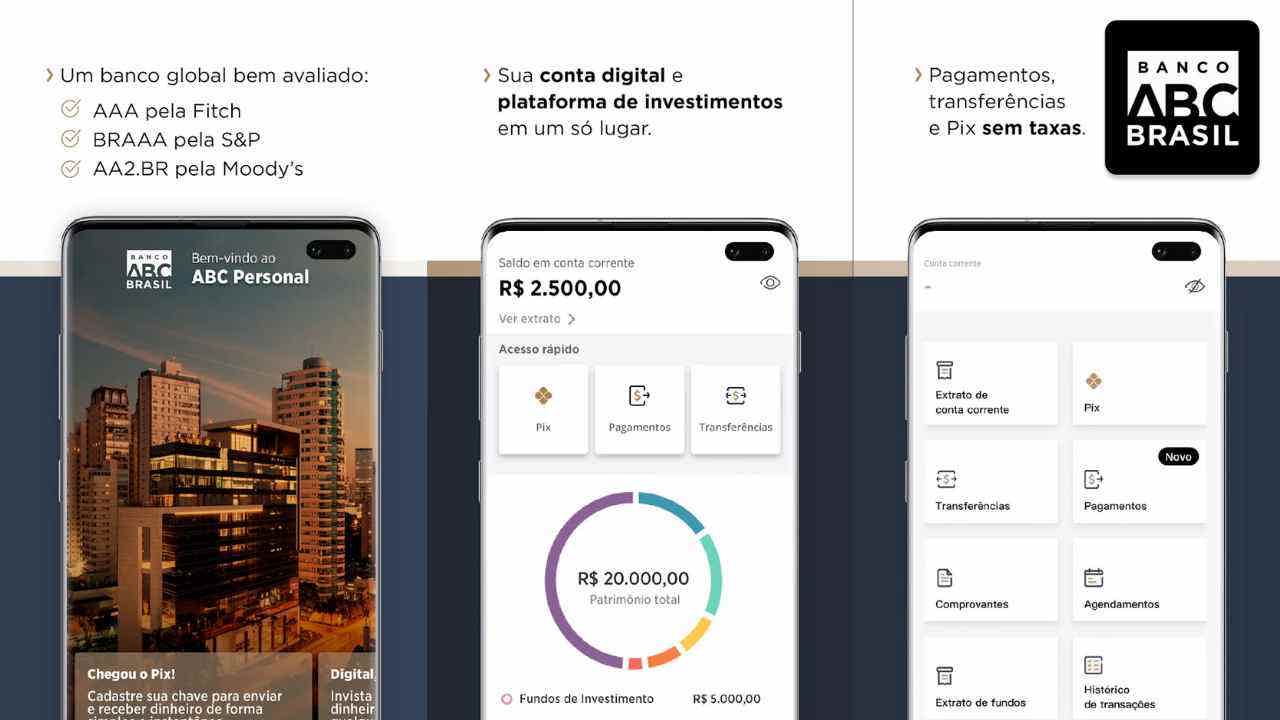

How to open an ABC Personal account

Learn how to open your ABC Personal account without leaving home. As well as take advantage of the opportunity to invest in fixed income funds without paying fees.

Keep Reading

All about Bolsa Família's 13th salary

Learn all about the 13th salary of the Bolsa Família, and find out if you are entitled to the benefit and how to know if you will receive it this year 2021!

Keep ReadingYou may also like

Check out the main questions about Brazil Aid

Auxílio Brasil came to replace Bolsa Família. Although with the new rules more families are being assisted, there are still many questions about who is entitled and what are the rules to participate.

Keep Reading

Novo Banco Mortgage Credit: what is it?

Want to conquer your own address? So, check out the advantages of Novo Banco Mortgage Credit and finance up to 90% of the property. Check out!

Keep Reading

Check out details about the new Porto Seguro digital account

With the aim of providing more resources in one place, Porto Seguro should launch its own digital account later this year. With exclusive advantages for Porto Seguro Bank users, the company promises interesting features! Know more.

Keep Reading