Cards

How to apply for the Gamerscard

Find out how to apply for the Gamerscard in a simple and hassle-free way. This process is 100% online and can be done in just a few minutes. Learn more right below.

Advertisement

Gamerscard credit card

The Gamerscard is a prepaid credit card developed in partnership with Acesso Soluções de Pagamento SA In addition, it is a Mastercard card and can be used in more than 30 million establishments in Brazil and abroad.

This card was produced exclusively for gamers with the aim of facilitating money deposits on the various gaming platforms, as well as making payments. Especially those most famous among players, such as Poker, Counter Strike, among others.

In addition, card users can participate in online tournaments with prizes for winners. As well as earning points in the GamersPoint loyalty program. So, see below how to apply for your card.

Step by step to apply for Gamerscard card

The Gamerscard card became known for the advantages it offers users who love to participate in game tournaments, but also need to keep their finances up to date. In addition, with it, you can easily purchase new game items and even use the prepaid card as you prefer. Undoubtedly, a credit card for gamers on duty.

However, before applying for your credit card, you must be over 15 years old and have a valid CPF. Thus, if you meet this requirement, you will be able to apply for the Gamerscard card as follows:

Order online

So, applying for the card online is very simple. After all, just go to the Gamerscard website and follow these steps:

- To start, click on “ask for your card” and then on “continue”;

- Then fill in the form with your personal data and the address where the card should be sent;

- Afterwards, check the plan and payment method you prefer;

- Finally, when the payment is confirmed, the card will be issued.

Upon receiving your card, you will have to unlock it so that you can top up and use this product to make purchases and pay whenever you need it.

Request via phone

Therefore, it is not possible to apply for the Gamerscard over the phone. However, if you have any questions about the card, you can contact us through the company's Contact Us page or call 11 3004 1300.

download app

As the company does not have an application, it is also not possible to request the Gamerscard card in this way. Card users can track transactions and recharge the card through the website, as well as request its issuance.

Méliuz card or Gamerscard?

So, both the Méliuz card and the Gamerscard card are interesting options and have innovative proposals for customers. Yeah, they allow you to shop safely and comfortably, but without harming your personal finances with it.

Given the benefits offered by these cards, it can be difficult to choose which option is best for you. Therefore, we have made a comparison of the main information of these cards for you. Check out:

| Méliuz card | Gamerscard card | |

| Minimum Income | R$1,045.00 | not required |

| Annuity | Free | Free |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Cashback Annuity Exemption Redemption of earned amounts back directly into the bank account | Mobile Recharges Transfer balances from partner sites directly to your card benefits club |

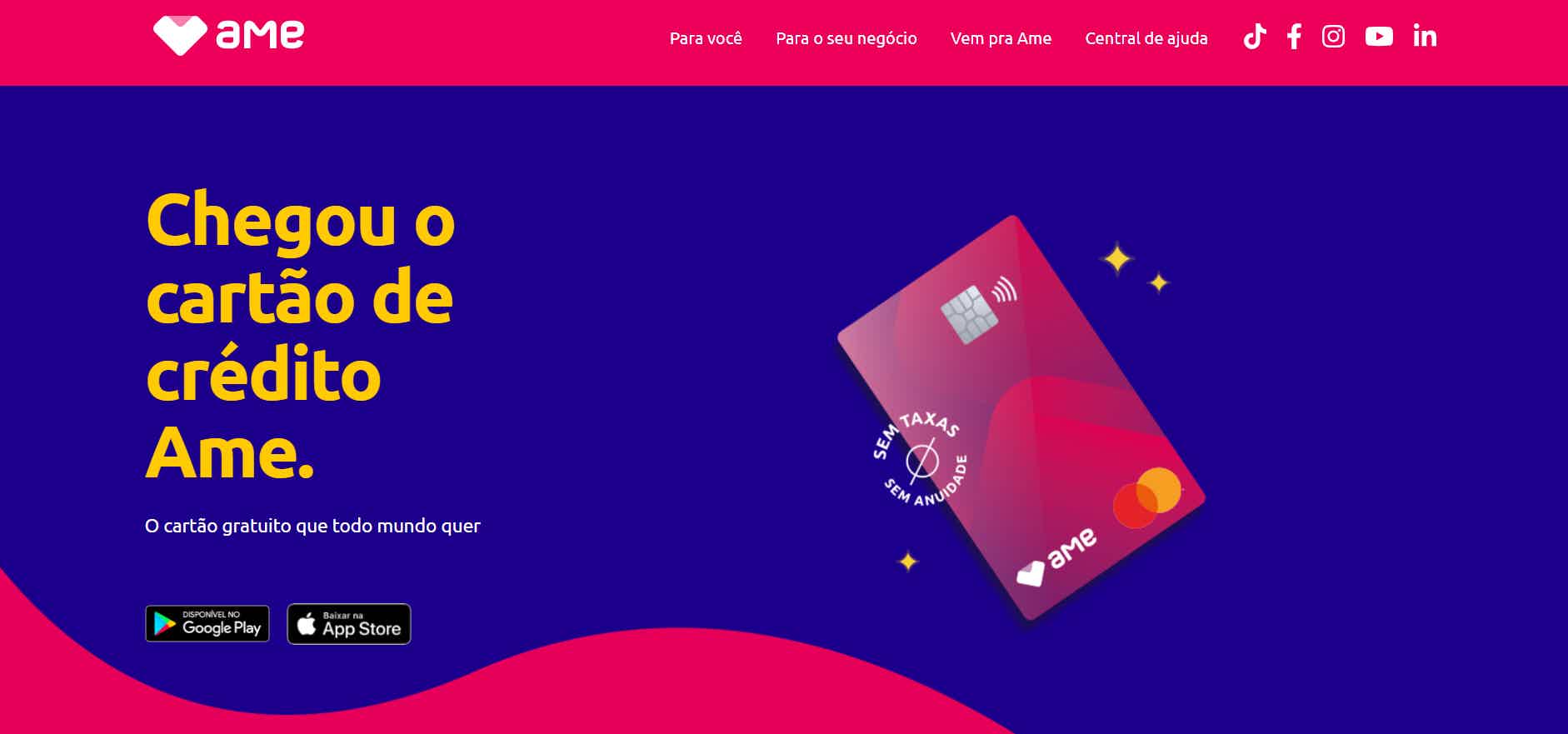

How to apply for AME card

The AME card offers exclusive benefits, in addition to cashback and international coverage with the Mastercard brand. See here how to apply!

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Ali Credit payroll loan: what is Ali Credit?

Ali Credit is a digital 100% platform for applying for payroll loans in two ways! See below and clear your doubts.

Keep Reading

How to apply for the C6 Bank credit card

Find out now in this detailed article how to apply step by step for your c6 bank card without complications and 100% online.

Keep Reading

Sou Barato Visa credit card: what is the Sou Barato Visa?

Do you already know the I'm cheap visa card? No? So keep reading because we'll tell you all about this card! Check out!

Keep ReadingYou may also like

Discover the HelloTalk online English course

If you like researching information before making a final decision, this post about English courses will be another addition to your research! Let's go?

Keep Reading

Discover the Bx Blue Payroll Loan

Bx Blue Consigned Loan is a great option for negatives, civil servants and INSS beneficiaries. Come find out more about!

Keep Reading

Discover the Postalis loan

Getting our financial life in order should be one of our priorities. In this way, if we need any help, even with financial resources, the Postalis loan is a good opportunity, with interest and values exclusive to each client. Want to know more about this complete loan option? Come with us!

Keep Reading