Cards

How to apply for the Next Visa International credit card

There's no denying it: anyone who knows the facilities and benefits of the Next Visa International card is very tempted to apply for it. So don't waste any more time and order yours soon!

Advertisement

Next Visa

Benefits are what the Next Visa International credit card does not lack. Among them, we have up to two months of subscription to Disney+ in the annual plan just for making the purchase with it. Too good, isn't it? No wonder, asking for it is a temptation that only, but the product justifies this feeling. So, it's time to do your will and say with your mouth full that you are a Next customer!

How to apply for the Next Visa International credit card?

As we know, Next is a digital bank created by Bradesco. For this reason, all your banking services are carried out online, with no need to go to the branch to solve your life - so much so because we don't even have a branch when it comes to a financial institution of this type!

So, as it should be, the application for your Next Visa International credit card is made online 100%. In fact, the entire process is in the palm of your hand, all you need is a cell phone and the bank's application to request your card.

But what are the requirements to have a Next card? The first of all is to meet some basic requirements, such as being at least 18 years old, presenting an identity number and a valid CPF. It's inside? Then you need to download the bank application and open a digital account, which is free, thus becoming a Next account holder.

After registering, you will be just a few steps away from being one more lucky person who fell in the grace of the Next credit card. You only need to wait three to seven business days for the bank to confirm whether you are eligible to receive a card or not. In order for a verdict to be given, the financial institution will assess your credit situation and outstanding debts.

But don't be scared by this protocol! As we already mentioned in our text about the 3 credit cards with the most chances of approval, the Next Visa International credit card is very easy to acquire. Be patient, everything will work out!

Conclusion about next card

Among all the cards in the digital banking market, the Next card is, without a doubt, one of the best in the market. However, pay attention to one detail: do not confuse the Next Visa International credit card with the Platinum, okay? The latter, in addition to charging an annuity, is not so simple to acquire, especially if you have a low score on SERASA.

Having made the observation, then it's time to acquire your Next card and be happy with the benefits it will provide you. Then stop by to thank us for the tip given, ok?

recommended alternative

If you've made it this far, but still aren't convinced that the Next card is what you're looking for, no problem. Our team has compared all available cards, and based on feedback from our readers, has chosen an additional recommendation for you. Check this option below and compare it with the Next card. I'm sure you'll know which option to choose.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

See how to get over 1500 reais salary working with customer service

Check now how much a clerk earns, discover all the functions and skills that this professional needs to develop.

Keep Reading

Discover the Visa Prepaid Credit Card

prepaid Visa credit card can be a great solution for anyone who wants to organize their finances or who is in debt. Click and find out!

Keep Reading

How to apply for the Livraria Cultura card

The Livraria Cultura card offers a system of points to exchange products and advantages in purchases. Request yours without bureaucracy here!

Keep ReadingYou may also like

How to apply for the cash card

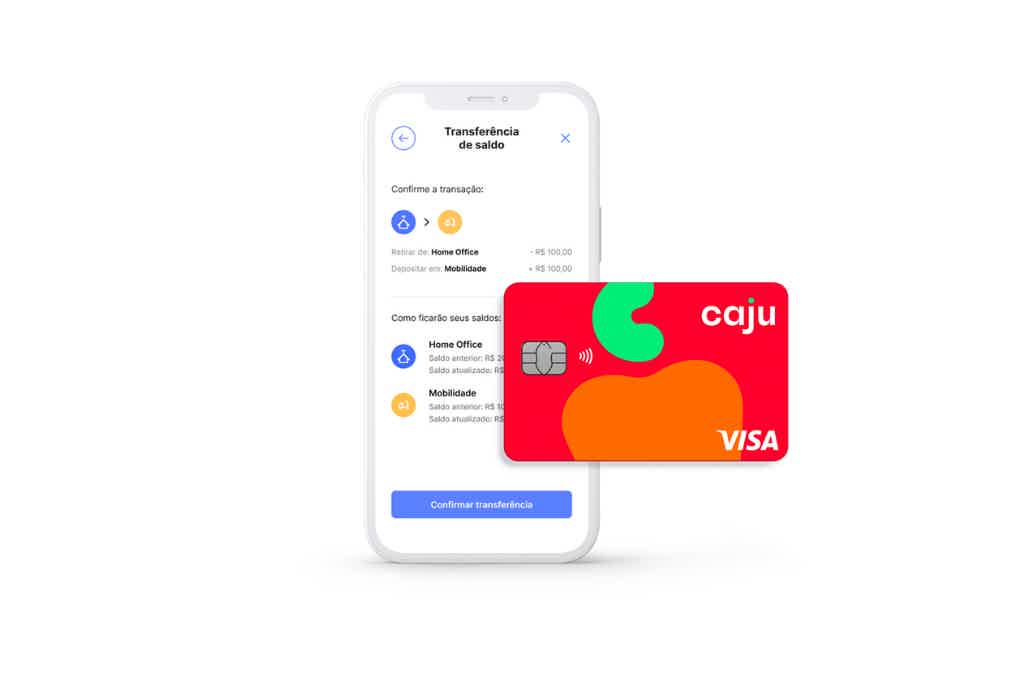

The Caju card is national with the Visa flag, so it is a complete option to unify the benefits of your employees. Plus, it's free and accepted in thousands of places. To find out how to apply, just continue reading below!

Keep Reading

How to Apply for a Citi Premier Card

If you want a credit card with a points program to take advantage of on your travels, look no further. Continue reading and find out about the Citi Premier card, as well as how to apply for it.

Keep Reading

Get to know Bankinter Personal Credit

Do you want a credit that allows you to open new doors in your life, open a business or travel? So, discover Bankinter Personal Credit in which you have 84 months to pay up to €30,000 at competitive interest rates. Check out!

Keep Reading