Cards

How to apply for the Crefisa card

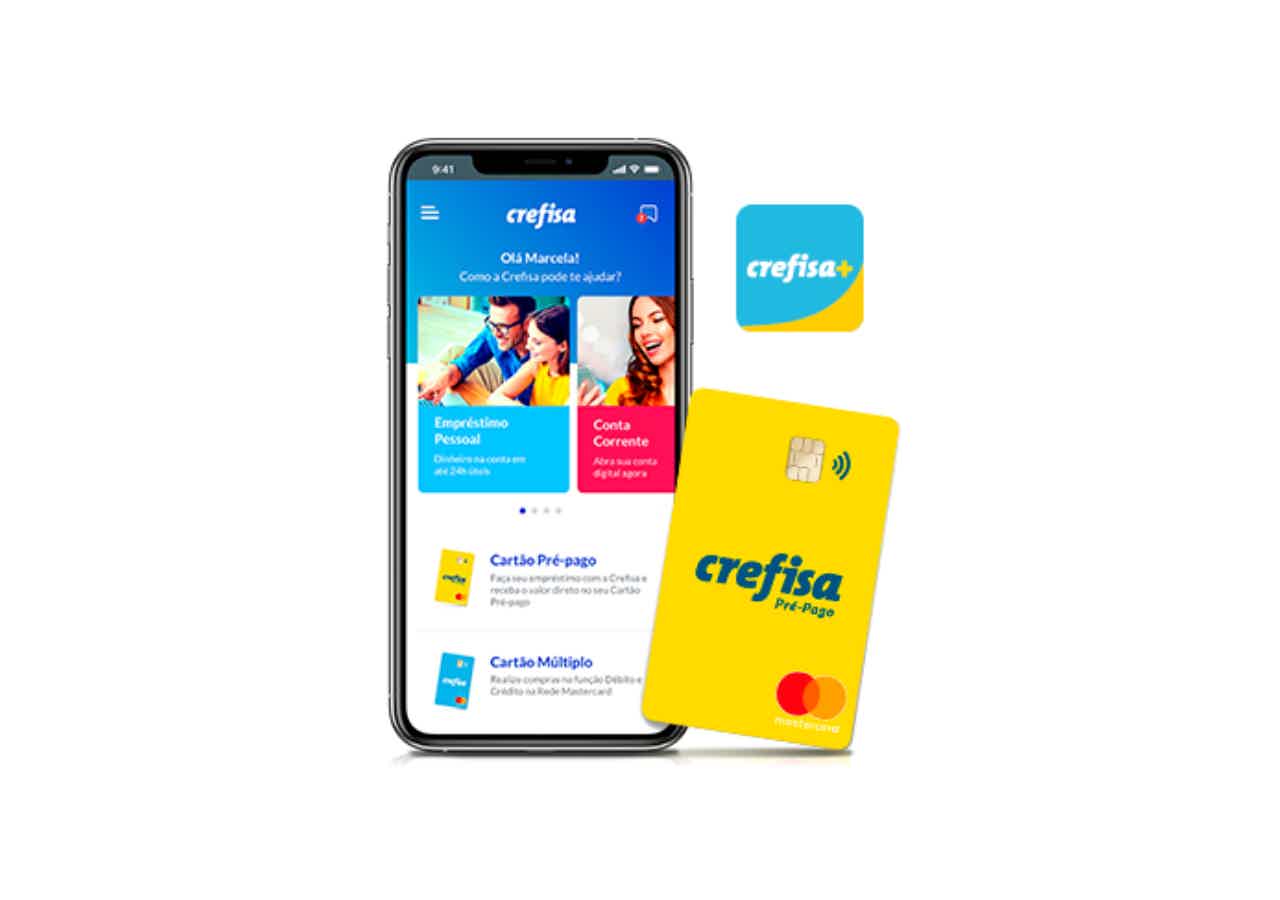

The Crefisa card is another option for making purchases with convenience. Check out this article on how to order yours!

Advertisement

Crefisa credit card

The Crefisa card was developed for people who need a less bureaucratic line of credit with reduced interest rates. In addition, the features offered by the finance company allow you to use your money with ease. That way, you can control your purchases with peace of mind, as well as avoid debt.

However, it is important to know that it does not work like a traditional credit card, so there is no payment in installments and no invoices, for example. In this way, purchases are made using credit, but payment is in cash, based on your balance.

Therefore, check below how to request your Crefisa card in a simple way.

Step by step to apply for Crefisa card

Step by step to apply for Crefisa card

So, asking for the Crefisa card is easy even for someone who is not a customer of the financial institution. After all, to have a prepaid card, you just need to request a loan at any of the company's service points. However, you must be over 18 years old and meet the loan requirements.

Thus, it is necessary to go to the agency with documents such as RG or CNH, bank statement, proof of address and INSS card. However, applying for a Crefisa credit card is much simpler. So, check out what the main means are below.

Order online

To apply for a Crefisa credit card online, simply access the financial institution's website and look for the button “Cartão Crefisa” and “Order your card” on the page. Then, follow these steps:

- To get started, click on “Open your account” or “Make your loan”;

- Then fill in the registration form with your personal and financial data;

- Finally, submit the request for data analysis.

In this way, you will receive an email response from a Crefisa representative. However, if your request is approved, your card at the residential address informed in the register. Therefore, it is important to send the data correctly to avoid errors in issuing and delivering the card.

Request via phone

Although it is not possible to request the Crefisa card over the phone, it is possible to contact the relationship center for more information about the cards and other company services. So, in that case, you need to call the following contact numbers:

- Capitals and metropolitan regions: 3003 3372

- Other locations: 0800 273 3372

So, as the service is 24 hours a day, you can contact Crefisa at any time. In addition, a good tip is to have identification documents such as CPF in hand, in this way it is possible to speed up the service.

download app

Crefisa + is Crefisa's free application and is available in Android and iOS versions. So, with it you can open your digital account, apply for the Crefisa card, as well as carry out other simple transactions. This undoubtedly offers greater practicality to manage expenses.

Superdigital card or Crefisa card?

The Crefisa card is undoubtedly a great solution for digital account customers. However, if you need to have a conventional credit card to pay your purchases in installments and have more time to pay the bill, it is worth getting to know the Superdigital credit card. After all, it meets all these requirements and works with a credit limit.

Furthermore, it is a Banco Santander card with no annual fee and international coverage and also offers other attractive advantages. Therefore, to decide which is the best option, check out the comparison between these two cards below.

| Superdigital | Crefisa | |

| Minimum Income | Free | Free |

| Annuity | does not have | does not have |

| Flag | MasterCard | MasterCard |

| Roof | International | National |

| Benefits | cell phone recharge Application to manage movements Withdrawals at the 24-hour Bank Network ATMs | Withdrawal on the 24-hour Bank Network Debit card for shopping Card transfer to other current accounts through the Crefisa Portal |

Or if you are already sure that this card is for you, apply for the card now by downloading the Superdigital application and opening your account in less than 10 minutes.

Find out how to apply for the Superdigital card

Our team separated the step by step to teach you how to apply for this card

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

FIES Program: clear your doubts

The FIES program was created to help students pay for their college tuition when they graduate. See the details in this article!

Keep Reading

How to query dirty name

Do you think you are restricted but don't know for sure how your CPF is? See how to do the dirty name consultation and know where to negotiate

Keep Reading

Which digital account yields more than savings?

Want to know which digital account yields more than savings? In today's article we will show you some options. Keep reading!

Keep ReadingYou may also like

Discover the CGD Extract Emigrante current account

The CGD Extracto Emigrante current account is a complete option for those who want more benefits in their financial life, with an online 100% request and credit card. To find out more, just continue reading and check it out!

Keep Reading

How to apply for the Pão de Açúcar card? Check it out here!

Having a Pão de Açúcar card to call your own is easier than you might think. After all, the process can be done completely online, or if you prefer, through any of the Pão de Açúcar supermarket chain stores.

Keep Reading

6 main questions about the Leroy card

The Celebre card is ideal for those who want to consume at Leroy Merlin chains! In addition to guaranteeing exclusive discounts on the network, it allows the first payment within 45 days. Check out!

Keep Reading